Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The S&P 500 $SPY P/E Ratios Heat Map.

Besides Banks and Energy, everything is wildly overvalued. $SPY Source: Jesse Cohen @JesseCohenInv

Speculative tech over large cap tech is making a come-back

Source: The Strazza Letter

🍕 BREAKING: Domino's Pizza stock, $DPZ, soars over 8%

after Warren Buffett discloses new position in the company...

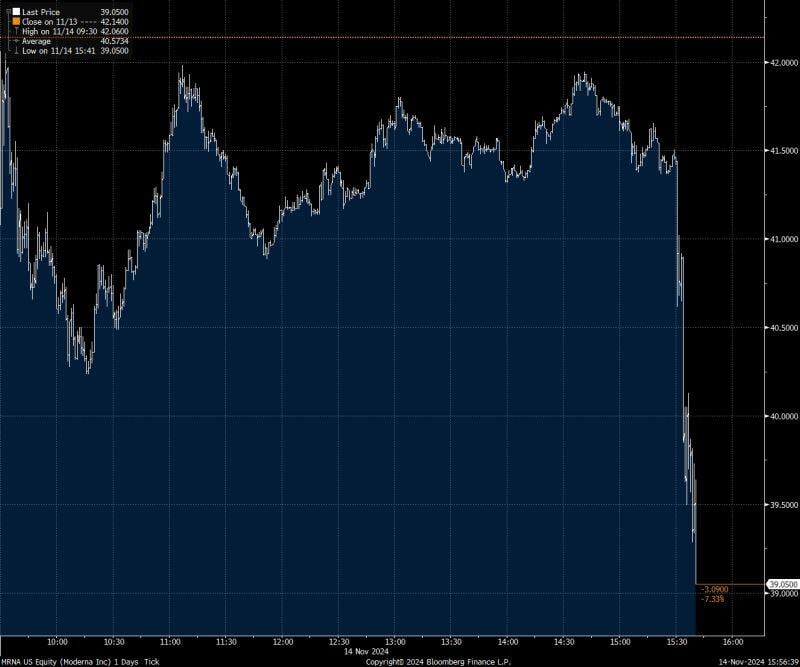

Moderna is getting absolutely smacked (-7%) on the news that Trump is nominated RFK Jr to lead HSS $MRNA

Source: Bloomberg

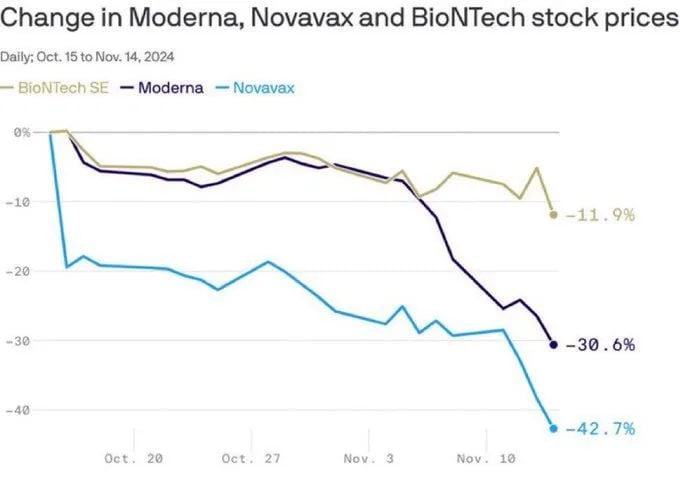

VACCINE STOCKS PLUNGE AS TRUMP TAPS RFK JR. FOR HHS CHIEF

Pharmaceutical stocks are in freefall after Trump named Robert F. Kennedy Jr. as his HHS Secretary nominee. Moderna (-30.6%), Novavax (-42.7%), and BioNTech (-11.9%) have all tumbled since the announcement as investors fear a dramatic shift in U.S. health policy. RFK Jr., who has challenged mainstream medical practices and vowed to streamline the FDA, says he'll refocus health agencies on nutrition and fighting chronic disease. Trump: "For too long, Americans have been crushed by the industrial food complex and drug companies." Source: @Breaking911 NBC, Mario Nawfal @MarioNawfal

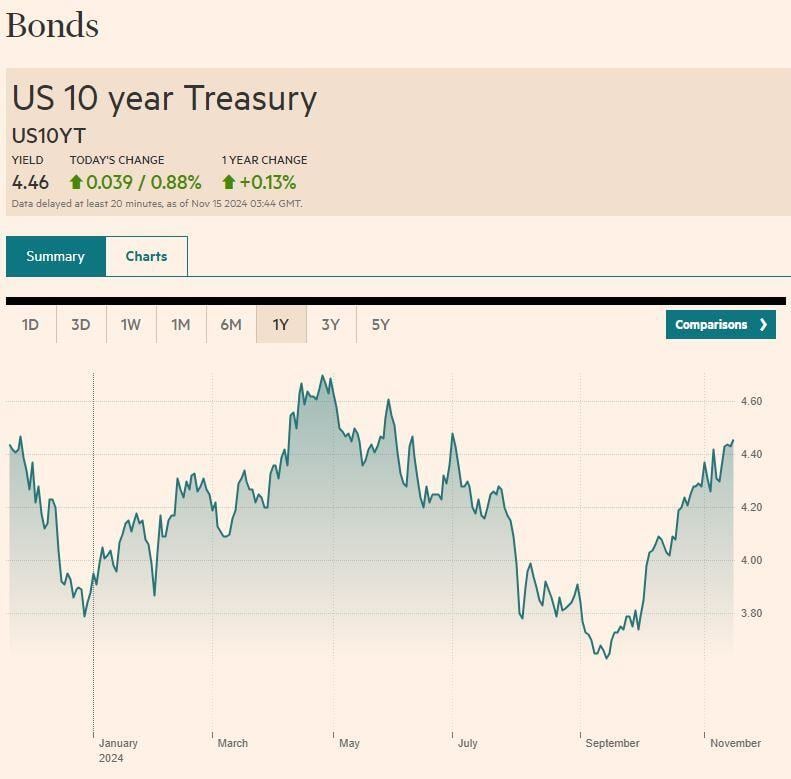

Has J Powell handed Trump a ticking time bomb?

By prematurely cutting rates by 50 bps ahead of the election, even with inflation still running above target, the Fed has set the stage for an inflationary resurgence. The latest October inflation data released yesterday confirmed the trend, with PPI coming in at 2.4%, hotter than the expected 2.3% Meanwhile, core PPI rose to 3.1%, ahead of the expected 3.0% increase The bond market starts to price in this risk, with 10-year Treasury yields up nearly 70 bps since the Fed's began cutting overnight rates in September Rising borrowing costs will become a major headwind for Trump's pro-growth, and likely pro-inflationary, fiscal policies. And it could soon become a major problem for equity investors paying a near record high 28x (TTM) earnings in today's stock market. Source: Porter Stansberry @porterstansb on X, Marketwise,T

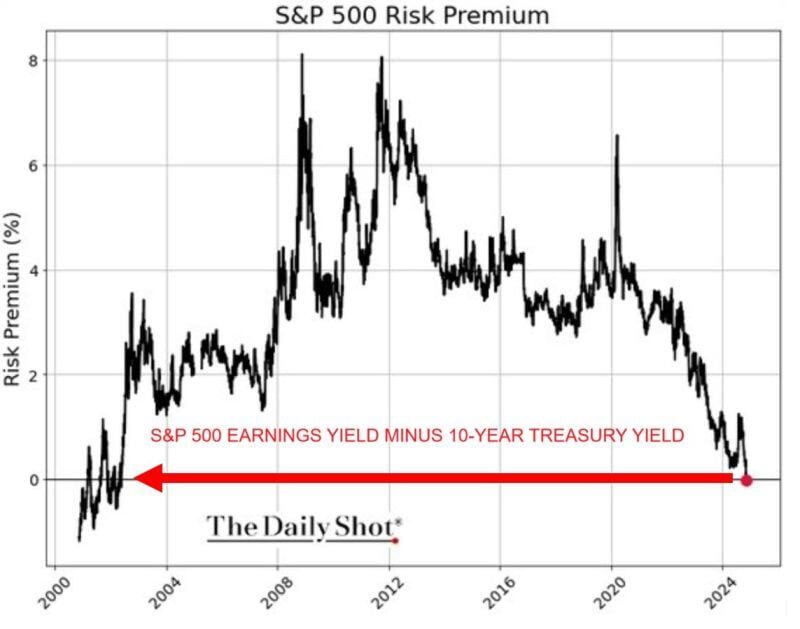

ARE US STOCKS OVERVALUED ⁉

☢ S&P 500 earnings yield FELL below the 10-year Treasury yield for the 1st time in 22 YEARS. ❗In other words, less risky (theoretically) 10-year Treasury is paying MORE than the S&P 500. ⚠This could imply lower than average forward returns for S&P 500. Source: The Daily Shot, Global Markets Investor

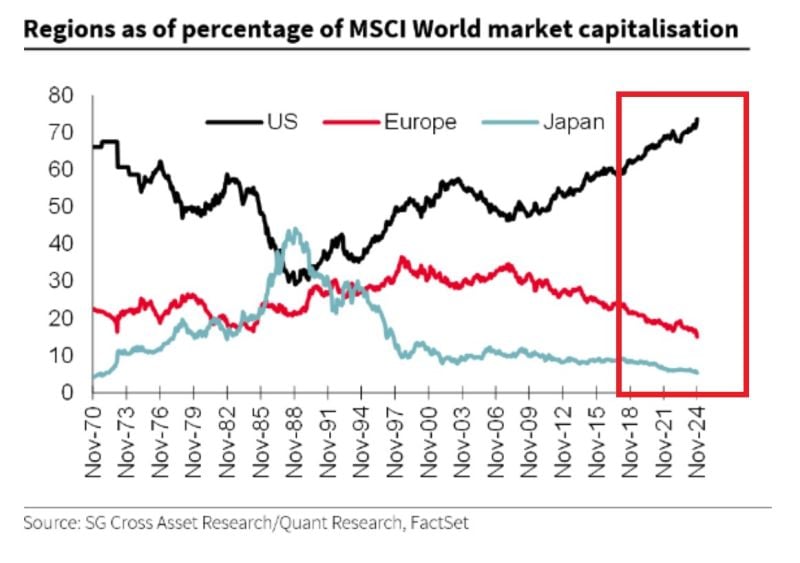

The US accounts for 74% of the MSCI world market capitalization, also a new all-time high.

Source: SG

Investing with intelligence

Our latest research, commentary and market outlooks