Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

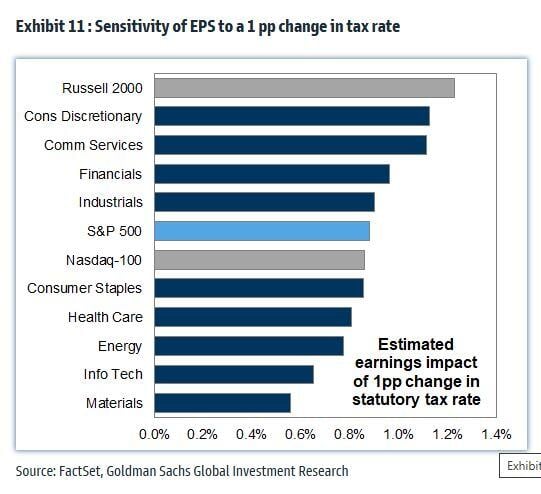

Are you wondering why US smallcaps are surging?

As highlighted by GS: GOP House control could enable corporate tax reform, potentially reducing the tax rate from 21% to 15% and increasing EPS estimates by 4%. Source: Mike Zaccardi, CFA, CMT, MBA, GD

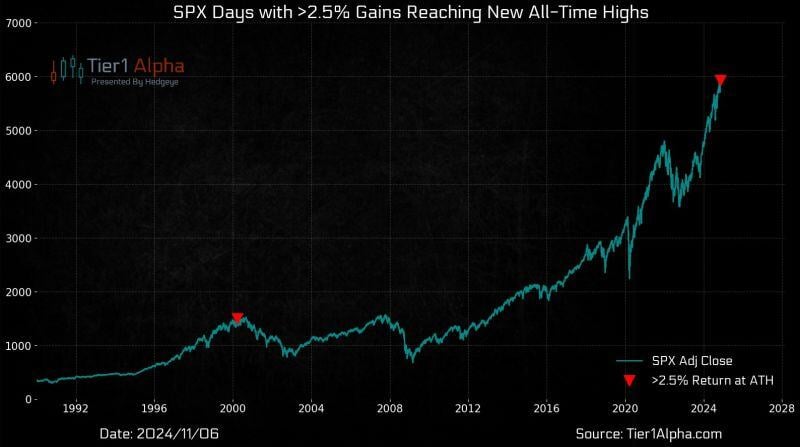

Fun fact: This was only the 5th time since 1960 that $SPX returned more than 2.5% while simultaneously breaking into an all-time high.

The last time this happened was March 21st, 2000. Source: Tier1 Alpha

JUST IN: MicroStrategy breaks $50 BILLION market cap and is now worth more than Ford Motor Company.

Ford has lost ~60% of its market cap since 2022 and holds $26 BILLION in cash, about 65% of its total market cap! The "melting ice cube" of cash holdings, eroded by inflation year after year. This is what Michael Saylor feared for his company when he decided to buy Bitcoin in 2020. MicroStrategy's market cap is UP ~45x since then. Source:

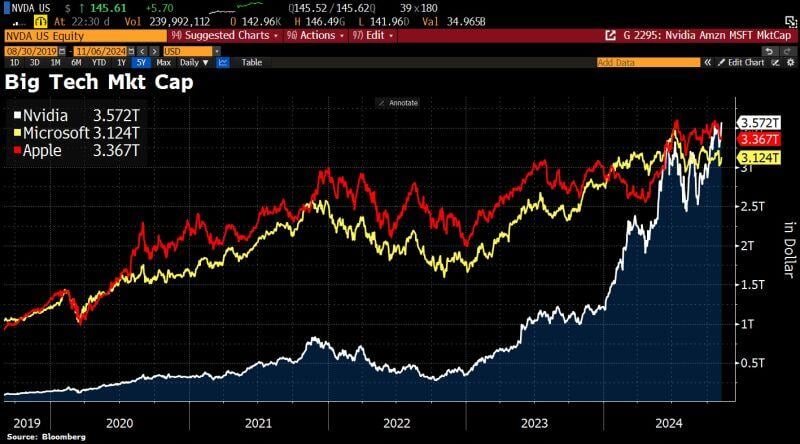

Nvidia is once again the most valuable company in the world.

Surpassing Apple and underscoring just how dominant AI has become on Wall Street. Nvidia's largest customers reported last week and explicitly stated that supply, not demand, remains a constraining factor. Source: HolgerZ, Bloomberg

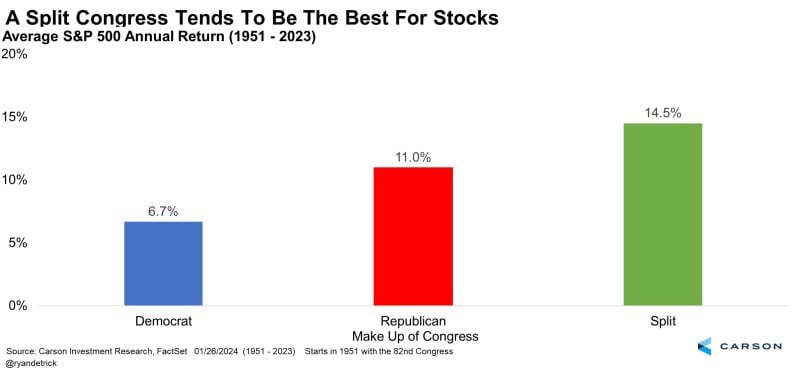

A Split Congress Tends To Be The Best For Stocks

This year will be the 13th year in a row stocks didn't fall when there was a split Congress. Source: Carson, Ryan Detrick, CMT

New York Post Cover

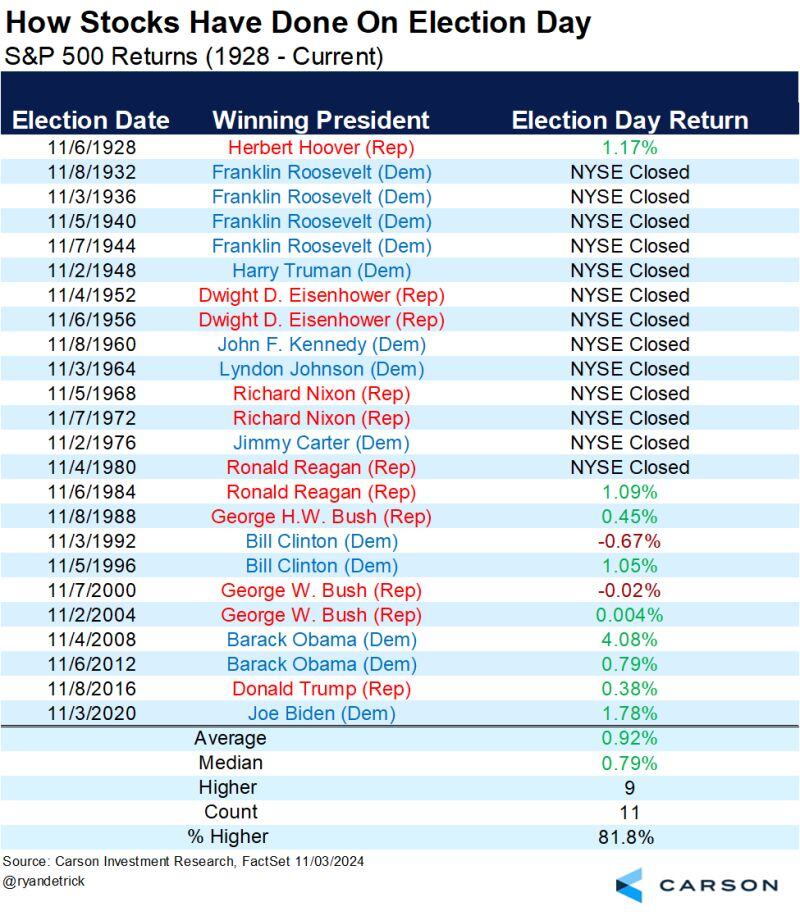

Pretty well overall, but also up the past five elections. Source: Carson, Mike Zaccardi, CFA, CMT, MBA

Some Trump trades really going for the extreme...

Russell futures vs the 10 year trading with a gap not seen in ages. Source: The Market Ear

Goldman has some potential reaction functions:

* Trump w/ Republican Sweep = 25% probability; S&P +3% * Trump w/ Divided Government = 30% probability; S&P +1.5% " Harris w/ Democratic Sweep = 5% probability; S&P -3% * Harris w/ Divided Government = 40% probability; S&P -1.5% Source: Carl Quintanilla on X, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks