Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Will the "Trump trade" start top fade in December?

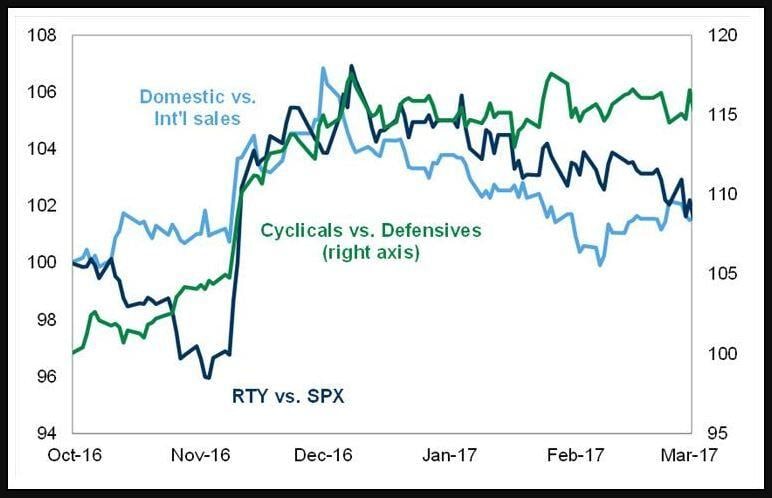

Goldman Sachs' trader John Flood highlighted the 2016 analogs: the 3 trades depicted below (Domestic vs. International sales, Cyclicals vs. Defensives, Small-caps vs. Large-caps) skyrocketed in November 2016 but ALL started to fade in December 2016, going nowhere in Q1 2017. Could we see something similar in December and Q1 2025 ? Source: www.zerohedge.com, Goldman Sachs

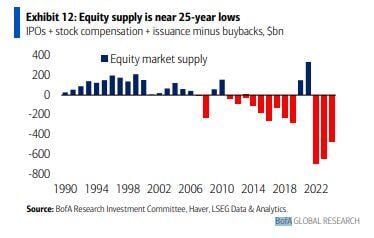

BofA (Woodward):

"the net supply of US equities has shrunk -$473bn. The steady growth of buybacks, a key source of demand, has overwhelmed sources of new supply such as share issuance, IPOs, and stock-based compensation." So basically we have: 1) US stocks: shrinking supply, (ever-) increasing demand 2) US Treasuries: rising supply, decreasing demand Source: Neil Sethi

The king reports earnings exactly ONE WEEK from today. $NVDA

Source: TrendSpider

$SPY The S&P 500 had its best-performing week of 2024. Here are the top-performing stocks from last week: 👇🏻

Source: The Future Investors @ftr_investors

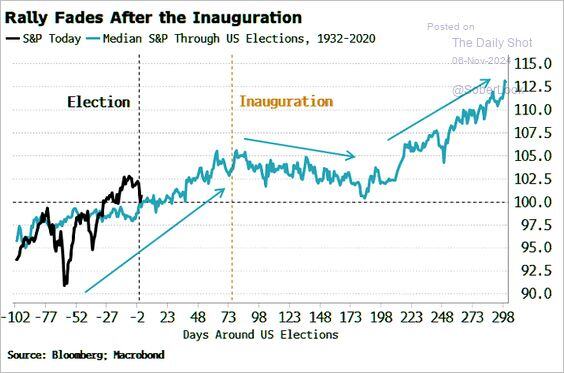

Following the election, the SP500 typically rallies through inauguration day before moderating.

Source: Bloomberg, Macrobond, Mike Zaccardi, CFA, CMT, MBA, The Daily Shot

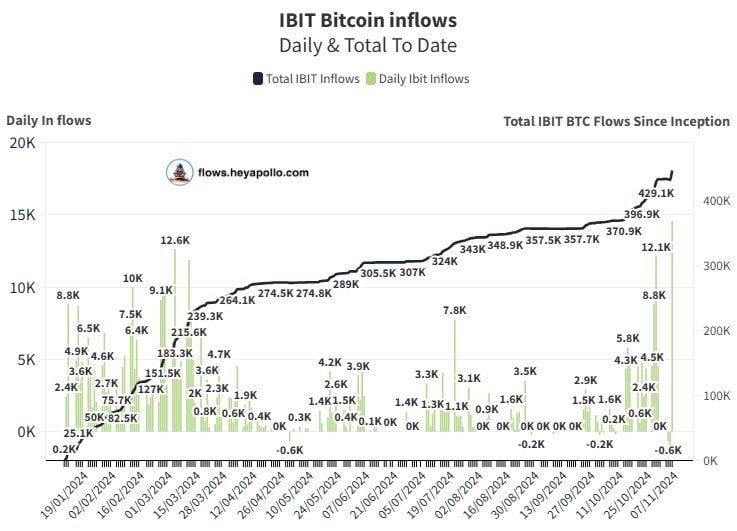

BlackRock had its LARGEST inflow in history with 14,588

Only 450 $BTC were mined...

Another day, another record: The top 10 companies in the S&P 500 now account for a record 37% of the index.

This percentage officially exceeds peak levels seen during the 2000 Dot-Com bubble by 10 percentage points. Over the last decade, the market concentration has more than DOUBLED. Furthermore, the top 10 stocks alone now have a market cap of ~$18.7 TRILLION. This means that the top 10 stocks in the US now have a combined market cap that is $1 trillion higher than the entire European stock market. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks