Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

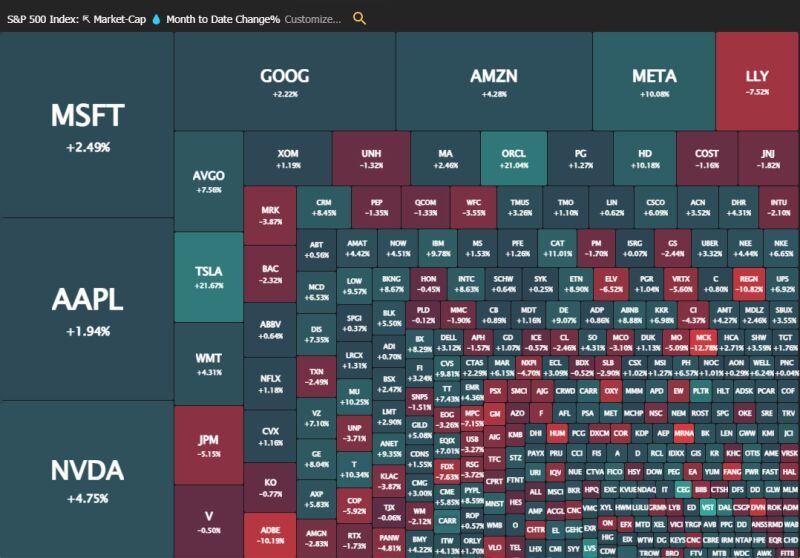

China's Stock Market Today as China’s factory activity contracts less than expected in September.

1. Chinese stocks up 6% today and 18% in 5 days 2. Beijing 50 index posts RECORD 15% intraday jump 3. RECORD 1 trillion Chinese Yuan traded in 30 minutes 4. Brokerages open 24/7 to accommodate retail traders 5. Commerce Ministry says it will "improve policy effectiveness" 6. Chinese brokerages crashing due to high traffic China up 25% in just over 2 weeks. Source: The Kobeissi Letter, David Ingles, Bloomberg

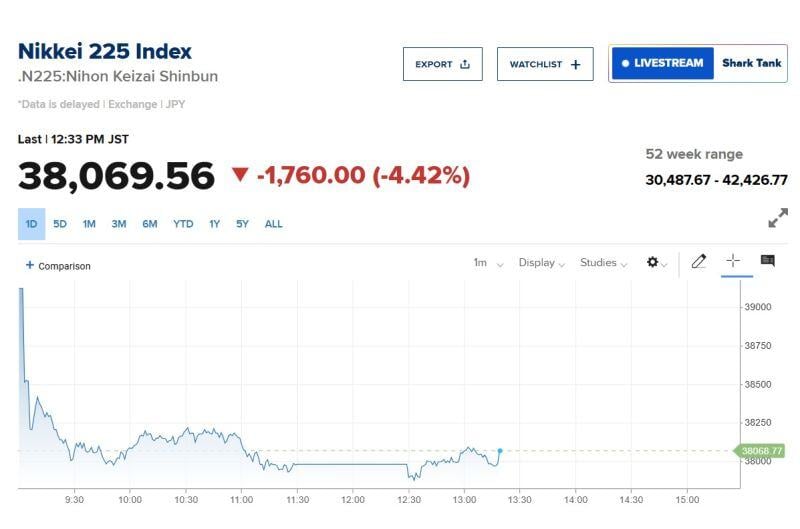

Nikkei is DOWN -4% following Ishiba's victory

The background: On Friday (after the close of Japan's markets) Ishiba, a 67-year-old former defence and agriculture minister, was elected LDP president on his fifth attempt and will succeed Fumio Kishida as Japan’s prime minister after a parliamentary vote on October 1 Immediately after Ishiba’s victory was declared on Friday, the yen surged more than 1 per cent against the dollar on market perceptions that he would not resist efforts by the Bank of Japan to normalise monetary policy and to push ahead with interest rate increases. Japanese equities had risen earlier on Friday amid expectations that one of Ishiba’s more market-friendly rivals would win. But Nikkei 225 now slumps more than 4 per cent as a response to the stronger yen.

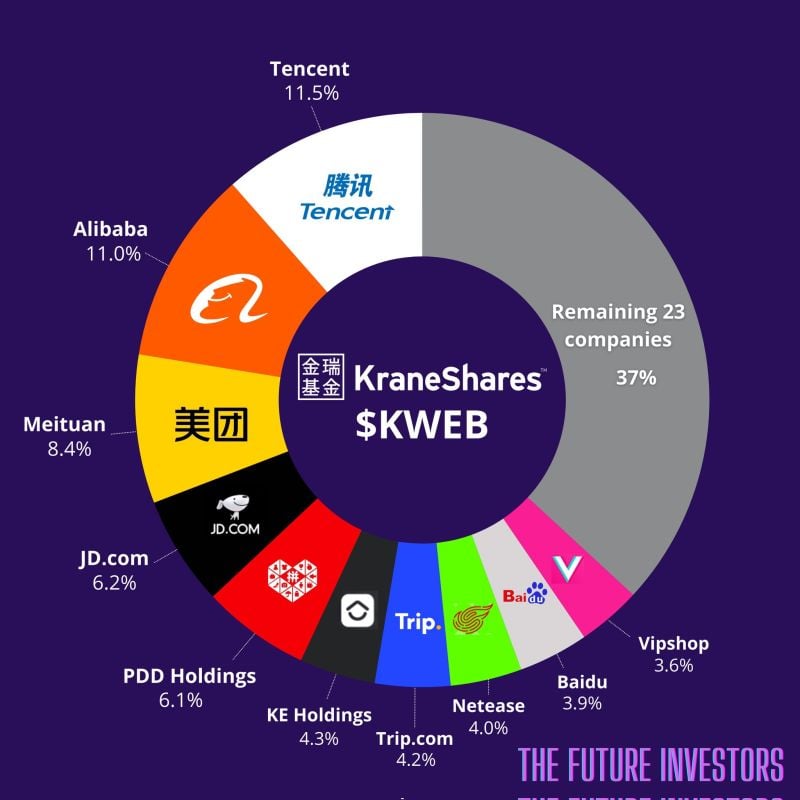

Many investors consider the KraneShares CSI China Internet ETF $KWEB as the best instrument to get exposed to China.

Here is the breakdown of this ETF. Do you invest in China?

BREAKING: Super Micro Computer stock, $SMCI, has now been halted 3 TIMES and is down 13%.

This comes just minutes after the US Justice Department announced a probe into the company. $SMCI recently delayed their 10-K filing for FY2024. The company said additional time is needed "to complete assessment of its internal controls over financial reporting." Source: The Kobeissi Letter

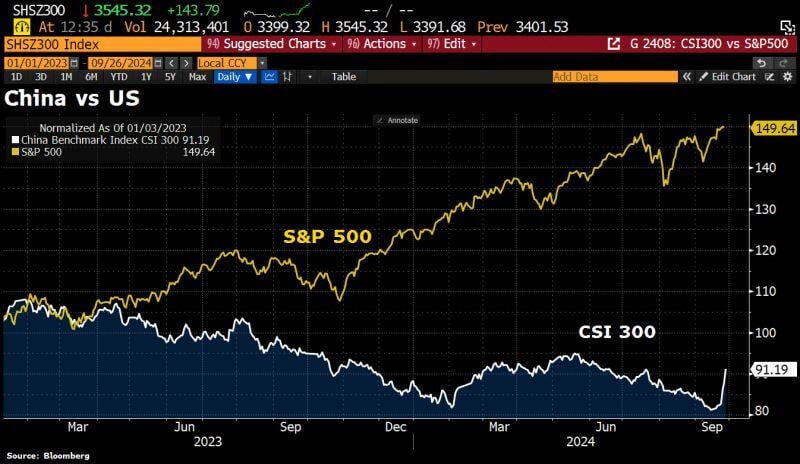

BCA's Marko Papic (@Geo_papic) sees Chinese monetary & fiscal stimulus as a "fairly big deal": "This is Beijing’s 'Whatever It Takes' moment.

Effectively, Beijing has reached a point where the policy focus shifts from guarding against moral hazard to guarding against political risks." He bets, that we are at the start of a major rotation out of US assets. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks