Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Not a bad week for Dr Burry who is heavily invested in China stocks Alibaba $BABA, Bidu $BIDU and JD.com $JD...

Note that another big bet from Burry - Shift4 payments $FOUR - has also been doing great recently... Source: Guru Focus, Yahoo Finance

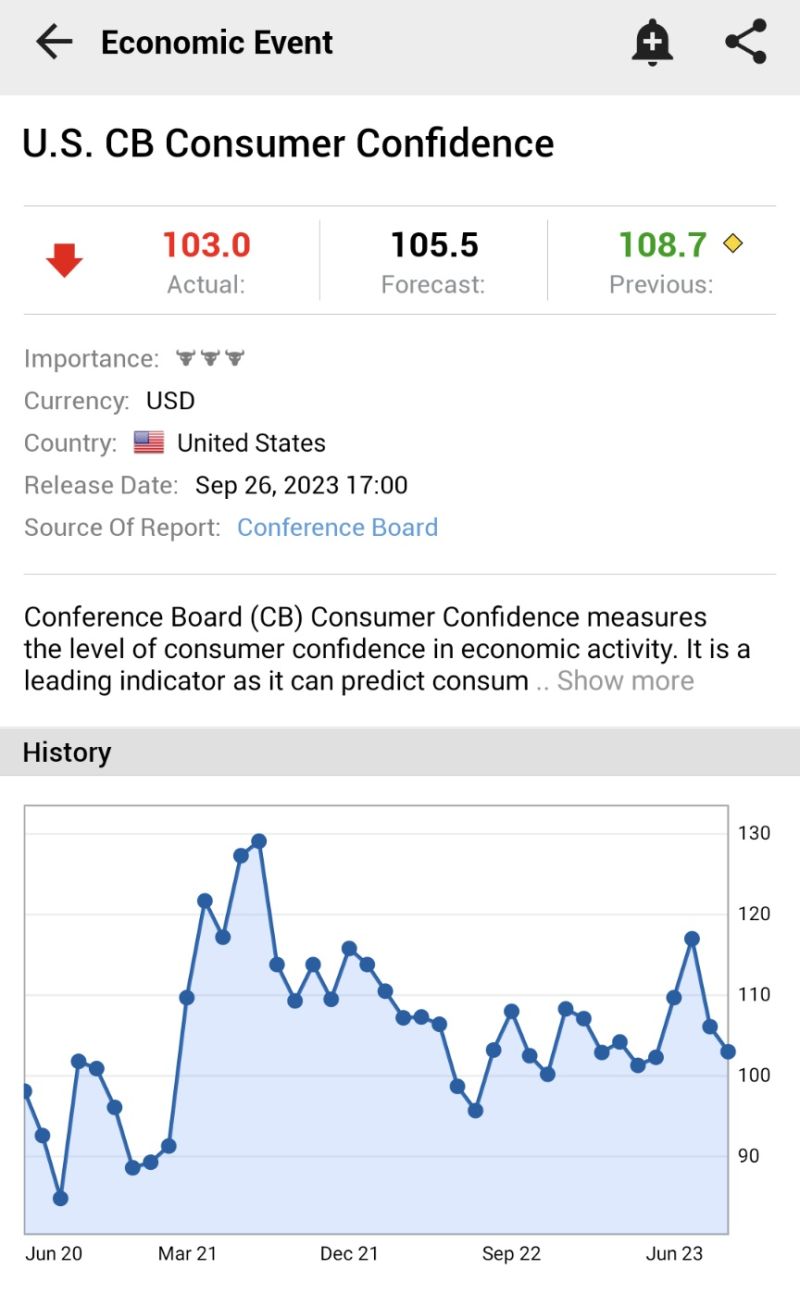

US stocks recorded only small gains yesterday as investors were cold feet by weak consumer confidence numbers

*U.S. SEPTEMBER CB CONSUMER CONFIDENCE SINKS TO 103.0; EST. 105.5; PREV. 108.7 *THIS WAS THE LOWEST LEVEL SINCE MAY 2023 Source: www.investing.com

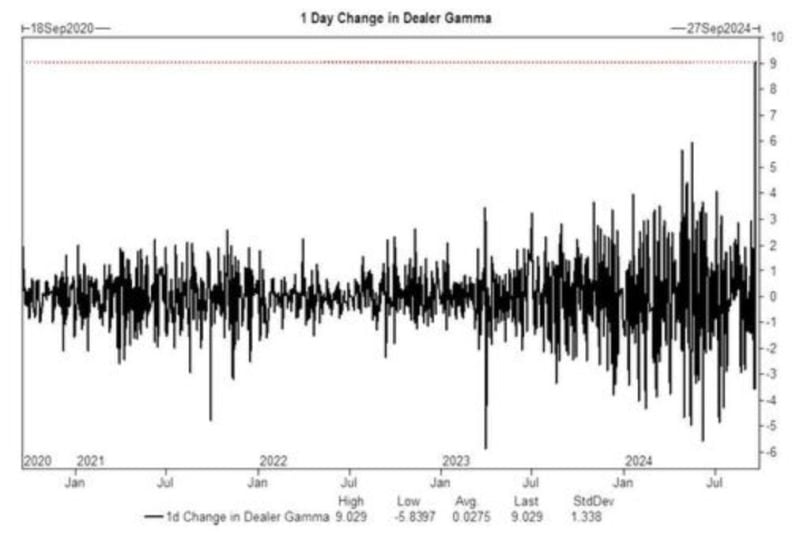

Friday's daily change in S&P 500 Dealer Gamma, $9 Billion, was the largest in history

Source: Barchart

AMERICANS CURRENT VALUE OF STOCK MARKET INVESTMENTS IS SKYROCKETING

The median amount of US consumers' stock market investments hit $237,000. The value has DOUBLED in 1 year. Such a spike has never been seen before. Source: Global Markets Investor

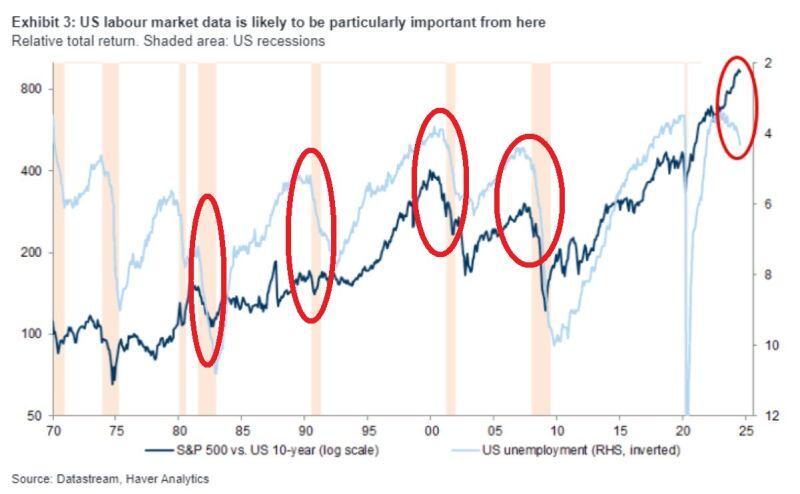

🚨US UNEMPLOYMENT RATE USUALLY RISES BEFORE THE S&P 500 CORRECTION🚨

US jobless rate rose from 3.4% in April 2023 to 4.2% in August near the highest in 3 years. In the past, when the unemployment rate was rising, the S&P 500 index saw significant declines. The us jobs reports in the coming weeks will be key... Source. Global Markets Investor

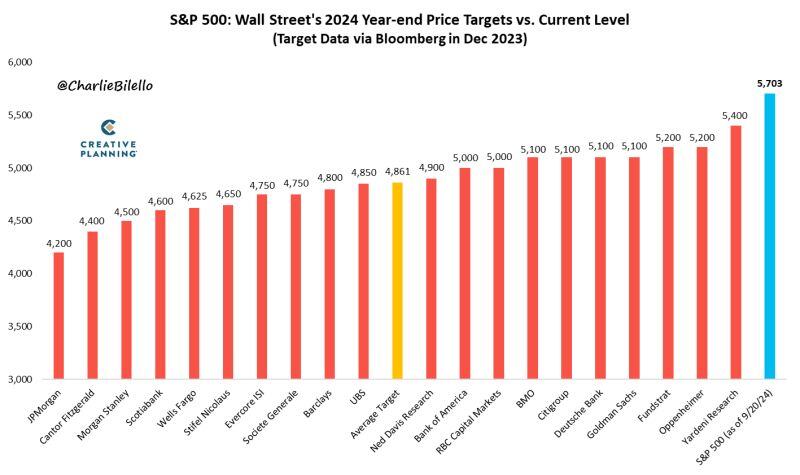

At 5,703, the S&P 500 is now over 300 points above above the highest 2024 year-end price target from Wall Street strategists and 17% above the average target (4,861).

And there's still 3 months to go in the year. $SPX Source: Charlie Bilello

How are the 'Magnificent 7' Tech stocks doing so far this year?

🟢 Nvidia Is Up +134.2% $NVDA 🟢 Meta Is Up +58.6% $META 🟢 Amazon Is Up +26.1% $AMZN 🟢 Apple Is Up +18.5% $AAPL 🟢 Alphabet Is Up +16.8% $GOOGL 🟢 Microsoft Is Up +15.7% $MSFT 🔴 Tesla Is Down -4.1% $TSLA Note that S&P 500 and Nasdaq are both up +19.6% YTD

Investing with intelligence

Our latest research, commentary and market outlooks