Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

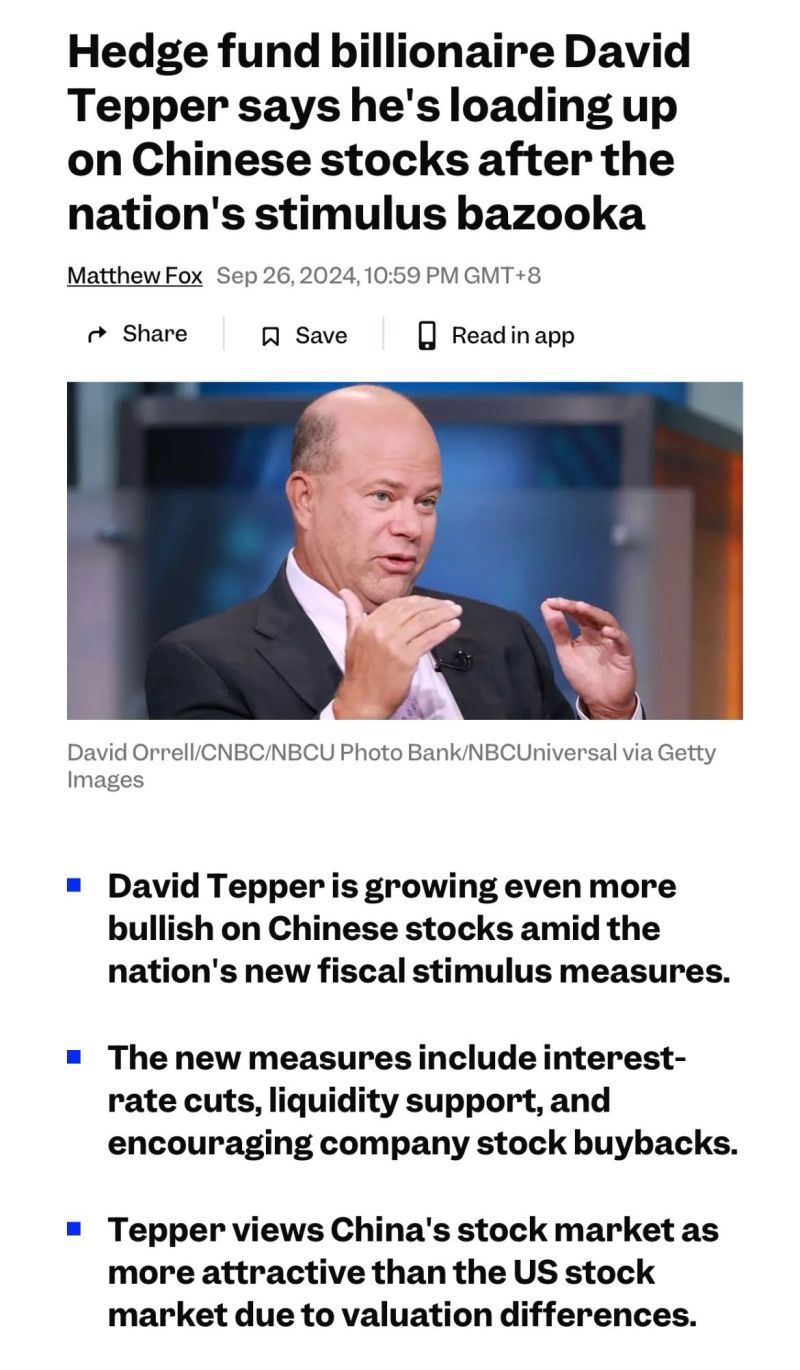

David Tepper, who runs the $6 billion hedge fund Appaloosa Management, is growing even more bullish on Chinese stocks amid the nation's new fiscal stimulus measures.

Tepper views China's stock market as more attractive than the US stock market due to valuation differences. Source: Markets Insider

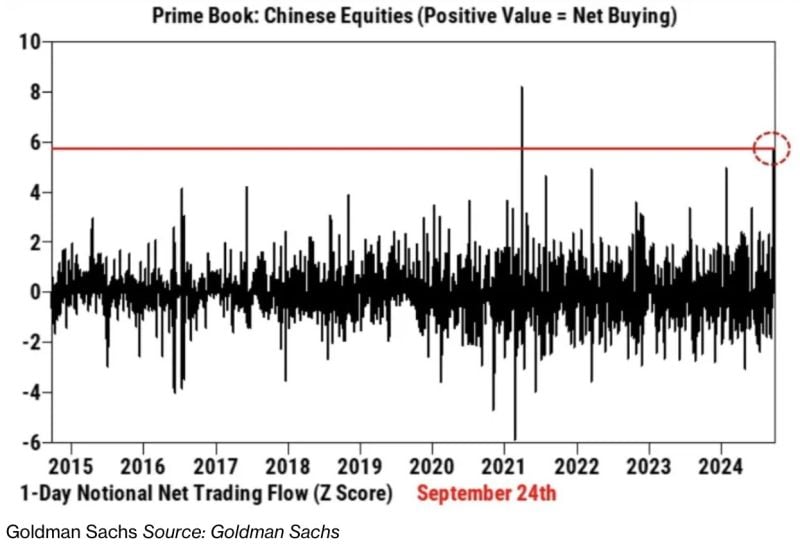

China shorts are "ALL-IN".

Even more than at *the* Bottom. Source: Macro charts

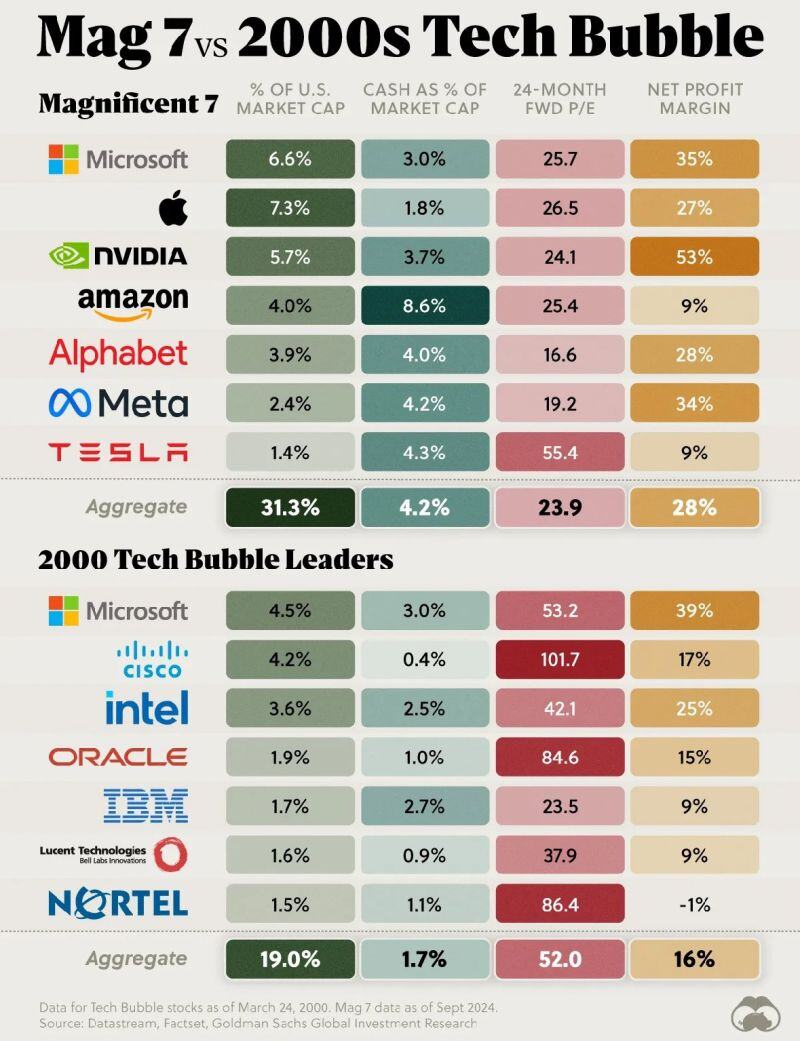

🔥US STOCK MARKET DOMINANCE KEEPS GROWING🔥

The American stock market accounts for nearly 50% of global market capitalization. It has reached a MASSIVE $55 trillion, or ~200% of US GDP, the most on record. This is almost TRIPLE the value of the Asian and European exchanges. Source: Global Markets Investor, The Daily Shot

Investors bought the most amount of Chinese Stocks on Tuesday in 3.5 years 👀

Source. Barchart, Goldman Sachs

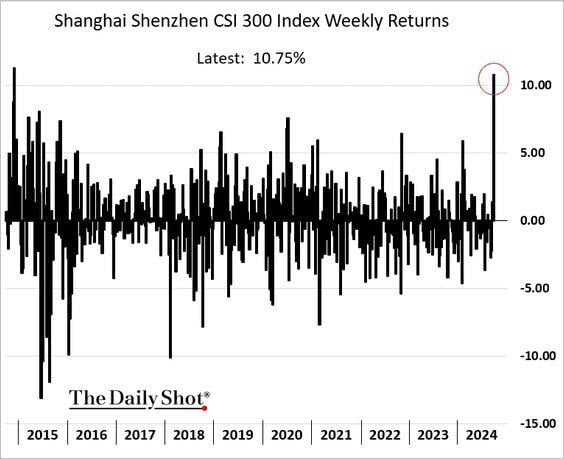

China's stock market is having its best week in nearly a decade.

Source: (((The Daily Shot))) @SoberLook

📢 CHINESE INVESTMENT FIRMS CAN NOW BORROW FROM CENTRAL BANK TO BUY STOCKS.

WILL WE SEE A TRUE RECOVERY OF CHINESE STOCKS OR WILL IT BE ANOTHER FALSE START? Source: Radar

Investing with intelligence

Our latest research, commentary and market outlooks