Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

How are the 'Magnificent 7' Tech stocks doing so far this year?

🟢 Nvidia Is Up +134.2% $NVDA 🟢 Meta Is Up +58.6% $META 🟢 Amazon Is Up +26.1% $AMZN 🟢 Apple Is Up +18.5% $AAPL 🟢 Alphabet Is Up +16.8% $GOOGL 🟢 Microsoft Is Up +15.7% $MSFT 🔴 Tesla Is Down -4.1% $TSLA Note that S&P 500 and Nasdaq are both up +19.6% YTD

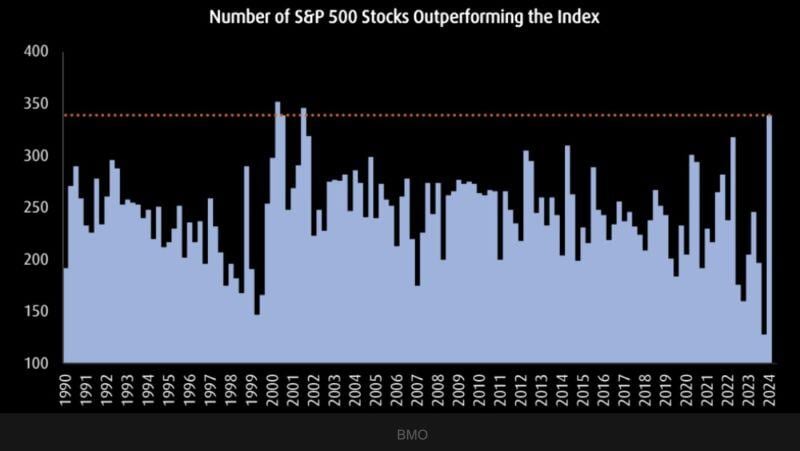

The number of sp500 stocks outperforming the index is the highest since 2002.

Source: Barchart, BMO

Small Cap Stocks $IWM have now traded green for 7 consecutive days, their longest winning streak since November 2022

Souce: Barchart

Jim Cramer is simply the best...

a pristine track-record...

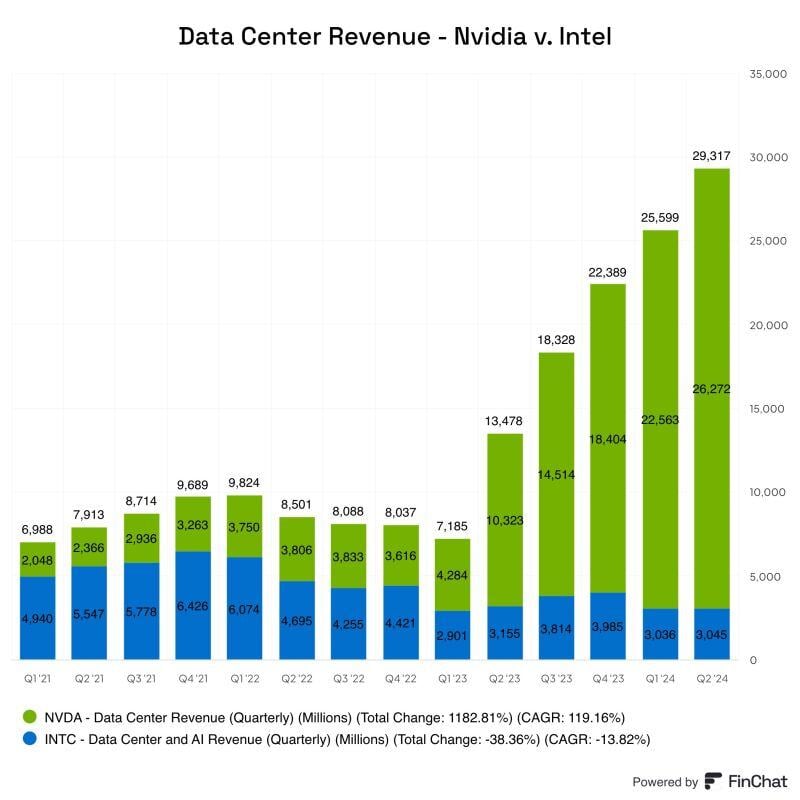

2 years ago, Intel had a bigger data center business than Nvidia.

$NVDA $INTC Source: FinChat @finchat_io

The bulls are running WILD pre-market. Thank you Mr Powell...

$DIA +1.18% $SPY +1.61% $QQQ +2.18%

Investing with intelligence

Our latest research, commentary and market outlooks