Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

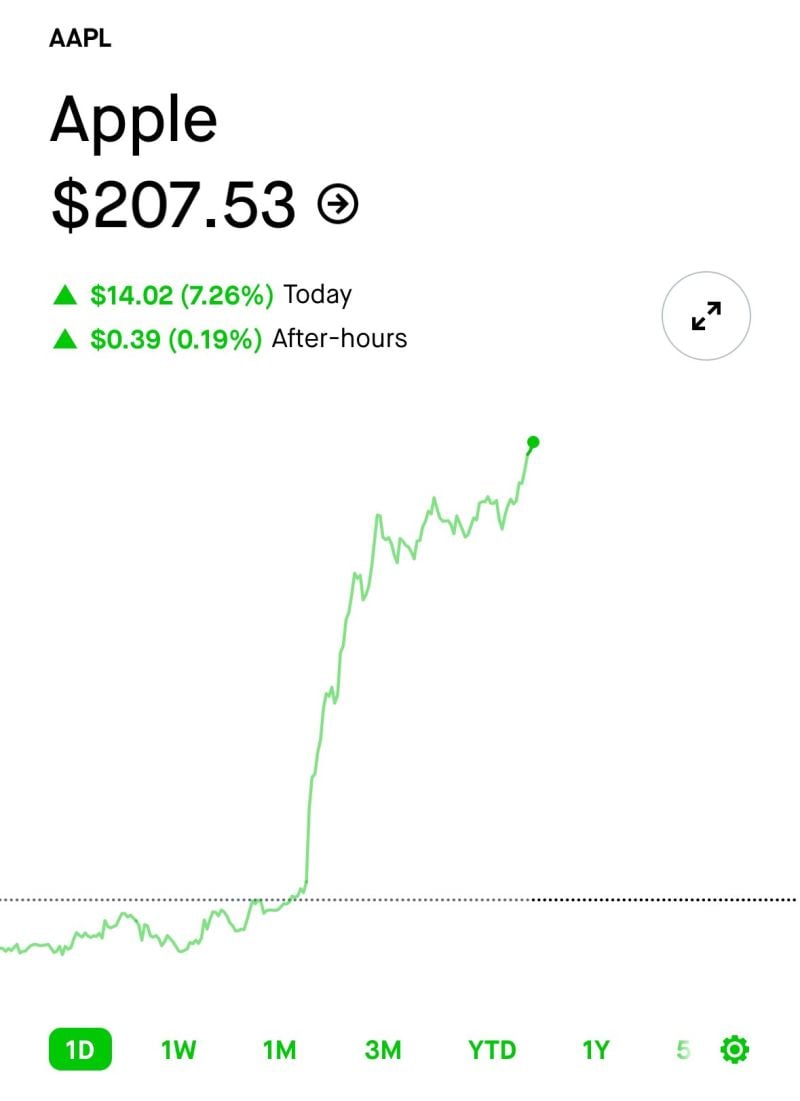

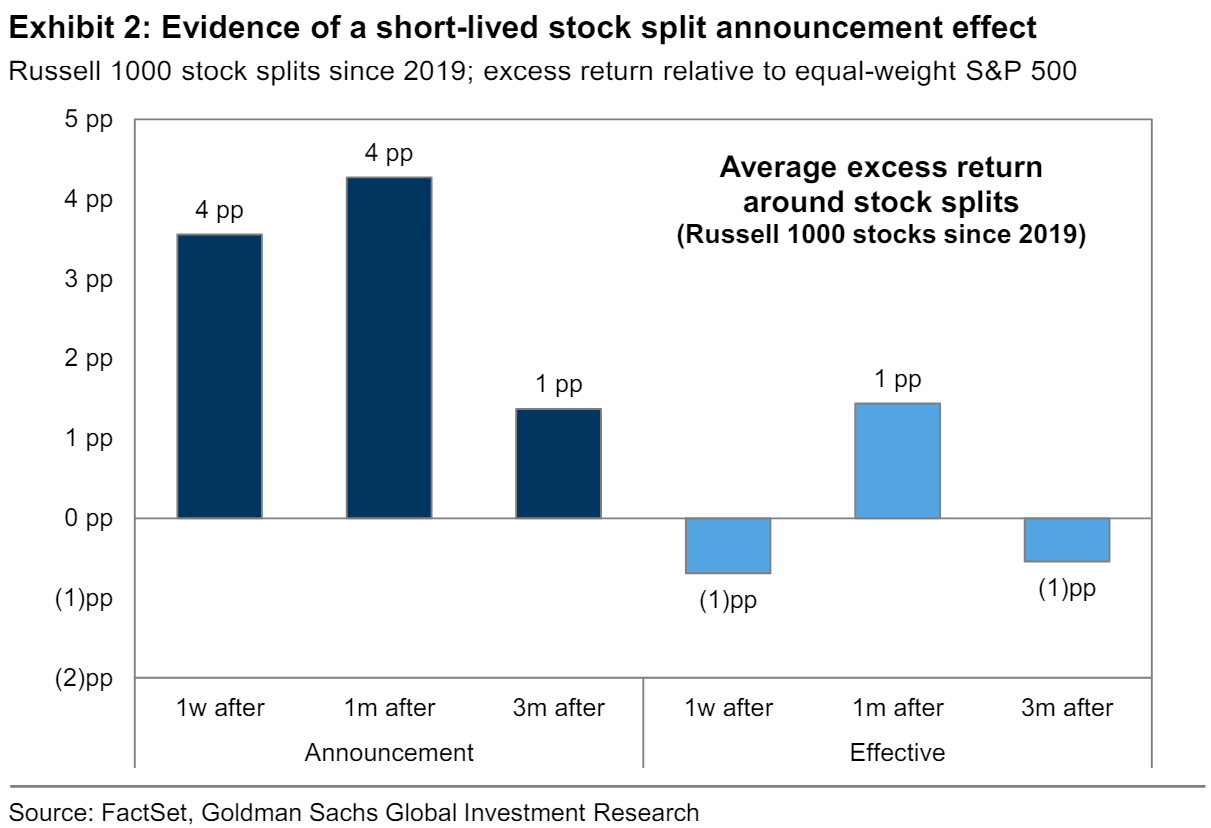

Goldman Sachs on the mixed impact of corporate stock splits

“Share prices typically rise after a firm announces a stock split. In theory, there is no change in the underlying value of a company when it splits its stock. However, empirically, the academic literature has generally found positive announcement effects around stock splits. We consider a sample of 46 Russell 1000 firms that completed stock splits since 2019. On average, these stocks generated a 4 pp excess return vs. the equal-weight S&P 500 in the week following stock split announcement. However, the stock price did not evidence a clear reaction after the stock split took effect. In addition, because many companies announce stock splits alongside earnings releases, it can be challenging to know how much of the stock rallies are due to the stock split as opposed to strong earnings results”. Source: Goldman Sachs

Goldman and Bank of America expect another bounce as July Communist Party meeting seen including more support measures.

Source: South China Morning Post

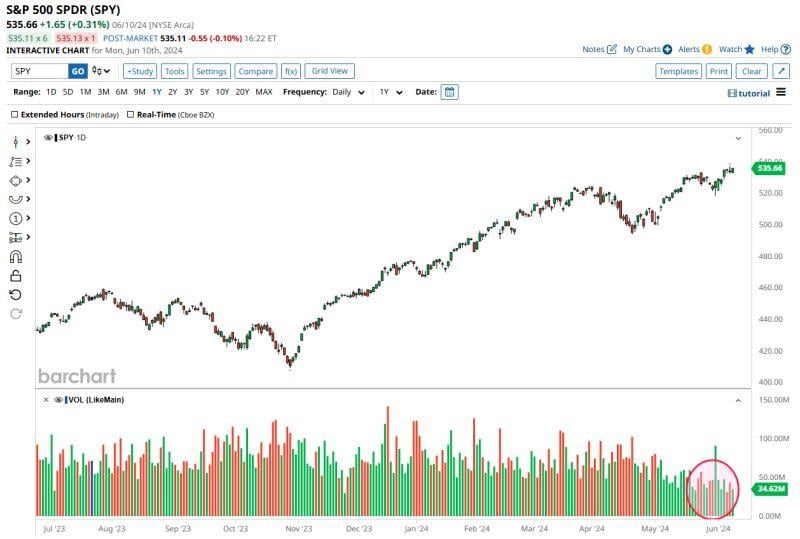

The SP500 closed the week at new all-time highs.

And a whopping 33 stocks on the NYSE closed at new highs. That's only 1.4% of stocks on the most important exchange in the world hitting new highs. Source: J.C. Parets @allstarcharts

S&P 500 continues to hit record highs on EXTREMELY low volume.

Today was the 4th lowest volume day of the year for $SPY. Three of this year's four lowest volume days have come in the last week. All 4 of the lowest volume days have come in the last 3 weeks. Source: Barchart

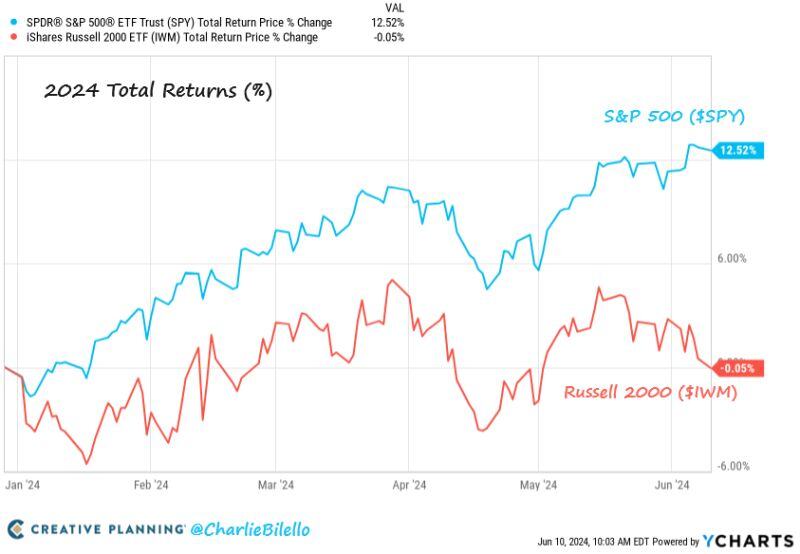

Small cap stocks are now down on the year while Large caps are still up 12.5%. $SPY $IWM

Source: Charlie Bilello

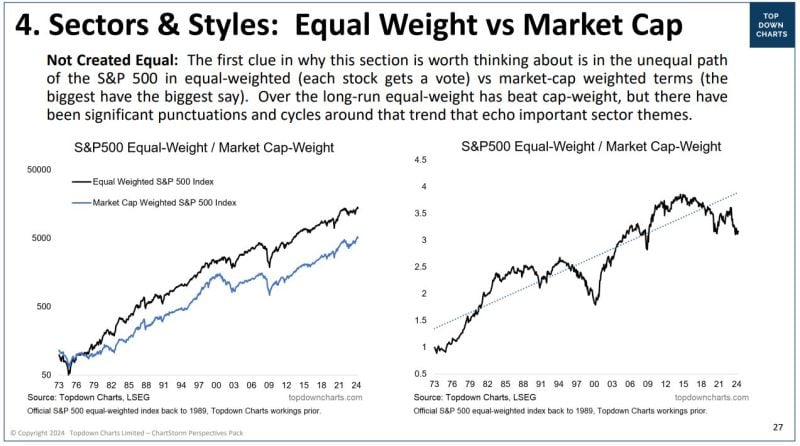

Below is an extract of a great chart pack by Topdown Charts / Callum Thomas

https://lnkd.in/eCV4GauM Over the long-run equal-weight has beat cap-weight, but there have been significant punctuations and cycles around that trend that echo important sector themes.

Investing with intelligence

Our latest research, commentary and market outlooks