Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

It seems that many companies are in desperate need for rate cuts...

Source: Bloomberg

BREAKING: Is the BoJ capitulating?

The Bank of Japan Deputy Governor says they WON’T raise rates when the market is unstable. The Yen is getting absolutely destroyed…and the Nikkei is up nearly +3%, Nasdaq Futures is up +1.2% A wild start of August... Source: TradingView

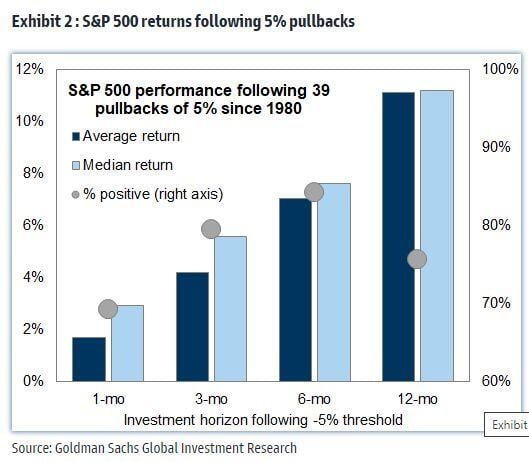

Buying the dip often pays off

Since 1980, an investor buying the sp500 index 5% below its recent high would have generated a median return of 6% over the subsequent 3 months, enjoying a positive return in 84% of episodes. Source: Goldman Sachs, Mike Z.

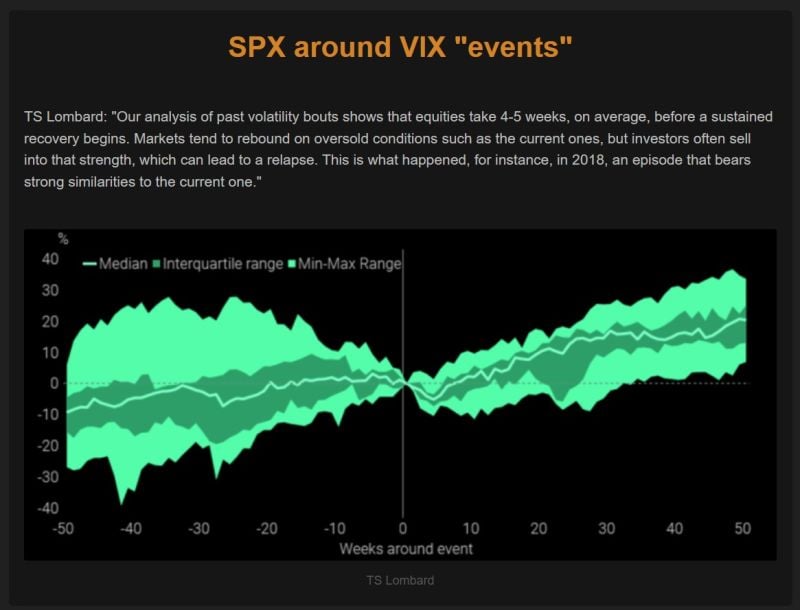

TS Lombard: "Our analysis of past volatility bouts shows that equities take 4-5 weeks, on average, before a sustained recovery begins.

Markets tend to rebound on oversold conditions such as the current ones, but investors often sell into that strength, which can lead to a relapse. This is what happened, for instance, in 2018, an episode that bears strong similarities to the current one." Source: TS Lombard, The Market Ear

BREAKING: The S&P 500 closes 3.0% lower erasing $1.4 TRILLION of market cap today, posting its worst day since September 2022.

The S&P 500 is now just 1.4% away from correction territory. The Nasdaq 100 is in correction territory and will enter a bear market if it falls 7.5% from current levels. In less than one month, the S&P 500 has erased $5 TRILLION in market cap. Source: The Kobeissi Letter

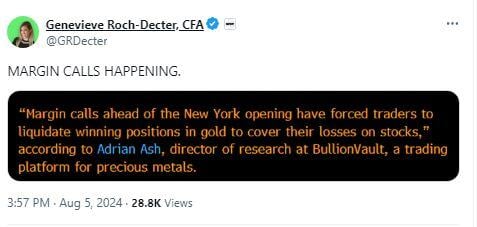

You might wonder why gold is down in a day like today?

diversification does not always work. When margin calls happen everything gets liquidated...

For the history books -> This was the worst day for Japan’s Nikkei stock index since the Black Monday crash of 1987, down 12.4%.

Source: Trading View

Investing with intelligence

Our latest research, commentary and market outlooks