Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Berkshire Hathaway’s cash pile swelled to a record $276.9 billion last quarter as Warren Buffett sold big chunks in stock holdings including Apple

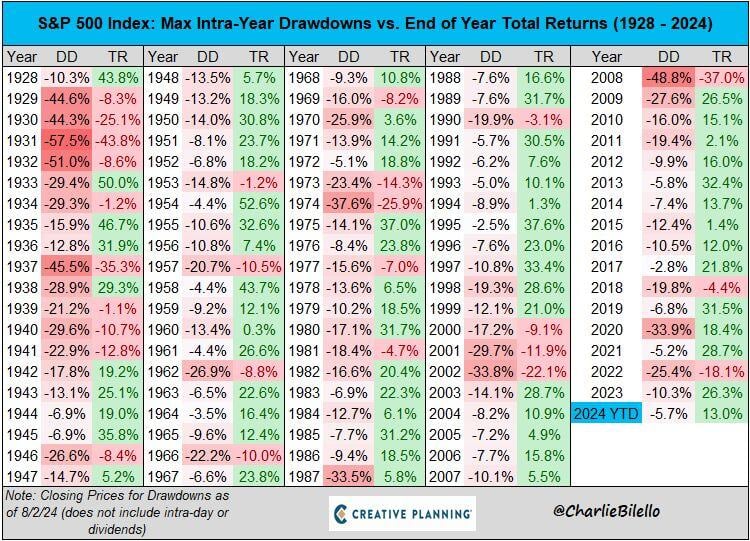

The Omaha-based conglomerate’s cash hoard jumped significantly higher from the previous record of $189 billion, set in the first quarter of 2024. The increase came after the Oracle of Omaha sold nearly half of his stake in Tim Cook-led tech giant in the second quarter. Berkshire has been a seller of stocks for seven quarters straight, but that selling accelerated in the last period with Buffett shedding more than $75 billion in equities in the second quarter. That brings the total of stocks sold in the first half of 2024 to more than $90 billion. The selling by Buffett has continued in the third quarter in some areas with Berkshire trimming its second biggest stake, Bank of America, for 12 consecutive days, filing this week showed. For the second quarter, Berkshire’s operating earnings, which encompass profits from the conglomerate’s fully-owned businesses, enjoyed a jump thanks to the strength in auto insurer Geico. Operating earnings totaled $11.6 billion in the second quarter, up about 15% from $10 billion a year prior. $BRK Berkshire Hathaway Q2 FY24. • Stock repurchase $0.3B. • $AAPL stake cut by nearly half. • Segment margin 14% (+2pp Y/Y). • Cash and short-term securities $277B. Source: App Economy Insights, CNBC

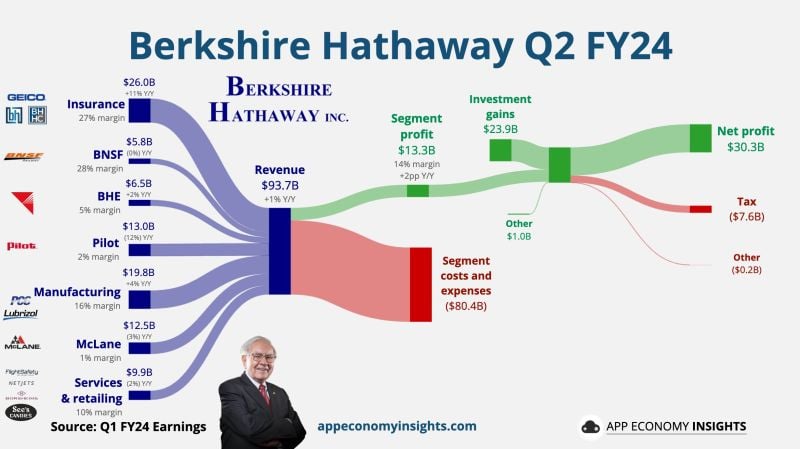

Almost all Japanese stock gains for 2024 wiped out in 3 days...

Today was an absolute chaos in Japan as stocks plummeted more than 6%, the largest decline in 8 years, and experienced 2 circuit breakers during the session... What will the BOJ save first? The Yen, Japanese stocks or the JGBs (of which they already own 50%)? Source: www.zerohedge.com

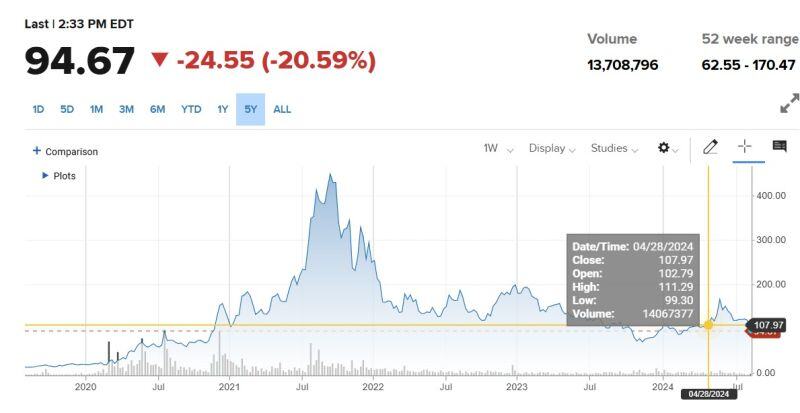

BREAKING >>> Intel stock, $INTC, crashed over 12% after-hours yesterday evening after reporting Q2 2024 earnings and suspending their dividend.

They reported EPS of $0.02, below expectations of $0.10, on revenue of $12.8 billion, below expectations of $12.9 billion. Intel also announced that they will be laying off 15,000 of their employees. A difficult quarter for Intel. Source: The Kobeissi Letter

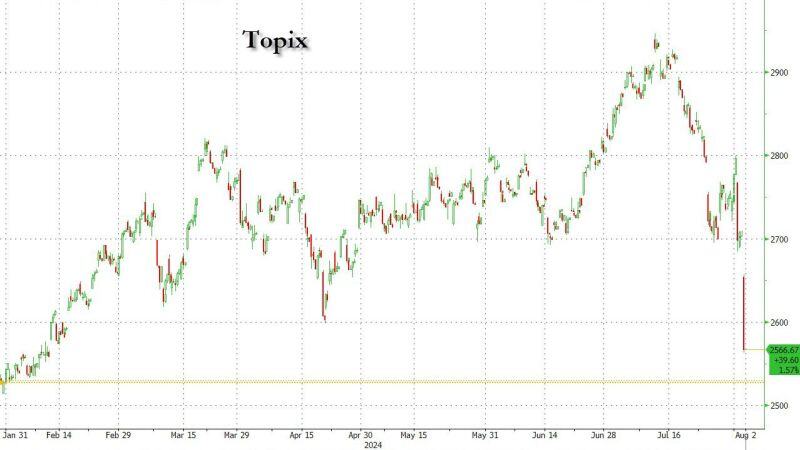

Ferrari (RACE) boosted its full-year guidance when delivering second-quarter results that topped revenue expectations on Thursday.

The Italian automaker now projects 2024 net revenue of more than 6.55 billion euros ($7.07 billion), up from more than EUR6.4 billion, and adjusted earnings per share (EPS) of at least EUR7.90, up from at least EUR7.50. “We are delighted to announce excellent financial results in the second quarter of 2024, which demonstrate again a strong execution and continued growth." – Benedetto Vigna, CEO Ferrari $RACE Q2 2024 in a nutshell: Shipments +3% *EMEA +1% *Americas +13% *Greater China -18% *APAC +4% Revenue +16.2% EBIT +17% *marg 29.9 (29.7) EPS +25% Source: Quartr

Do you remember Moderna $MRNA ???

Moderna beats estimates but slashes guidance on low EU sales, competitive U.S. vaccine market. It is down -20% today and -79% from its covid all-time-high. Moderna: "Net product sales for Q2 24 were $184M, reflecting a 37% YoY decrease. This reduction aligns with the expected shift to a seasonal COVID-19 vaccine market.." Moderna had $241M in total sales in Q2 and $1.6B in total operating expenses. Adding interest income, they burned $1.27B in one quarter. Cash on balance sheet is down to $2.47B. I fully expect expect them to do large capital raise to dilute shareholders. Source: JaguarAnalytics, The Transcript

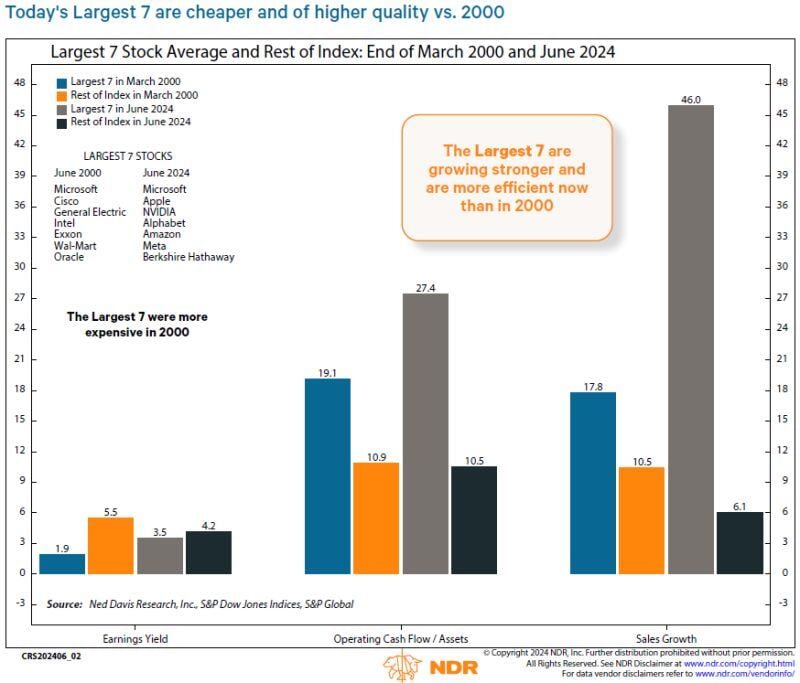

"The Largest stocks today have cheaper valuations compared to the Largest 7 in 2000"

@NDR_Research thru Mike Z.

Investing with intelligence

Our latest research, commentary and market outlooks