Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

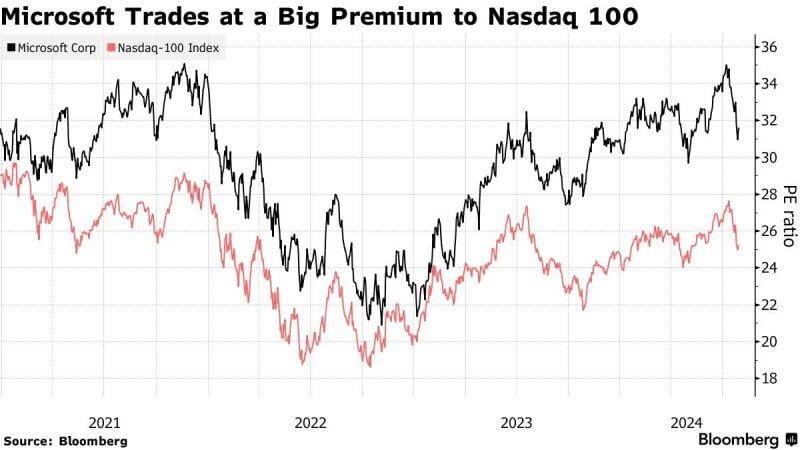

$MSFT trades at quite a large premium to the NASDAQ 100. Will the premium shrink after yesterday's earnings release?

Source: Bloomberg

A critical week ahead for the Nasdaq 100 QQQ which is sitting at critical trendline support at the time of FOMC meeting + $AAPL $MSFT $AMZN $META earnings...

Source; Trend Spider

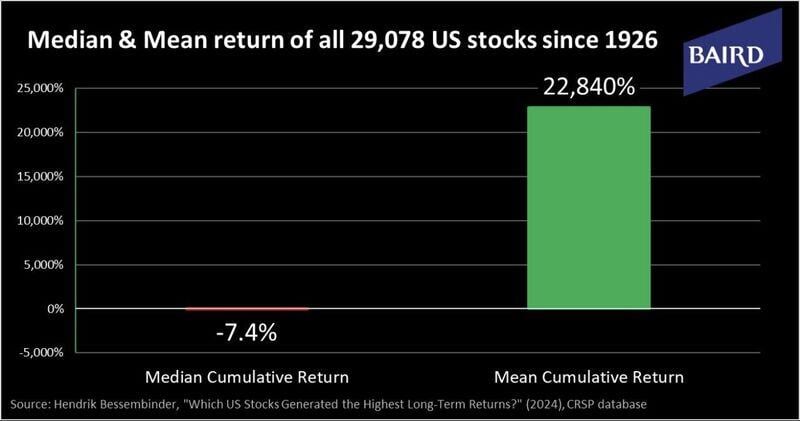

The difference between the MEDIAN and the MEAN CUMULATIVE returns of US stocks since 1926 is amazing...

As mentioned by @SpencerHakimian on X: "Stock returns are so skewed to the 4% of stocks that are responsible for all equity market returns that have occurred in the past 100 years. Statistically, it is virtually impossible to outperform an index over time since you would have needed to specifically own the tiny percentage of stocks that beat the index, and specifically avoid the vast majority of stocks that underperformed the index. Individual stock picking turns investing from a positive sum game to a negative sum game. Index investing is like being the casino. Individual stock picking is like being the gambler". Source: Baird, Michel A.Arouet

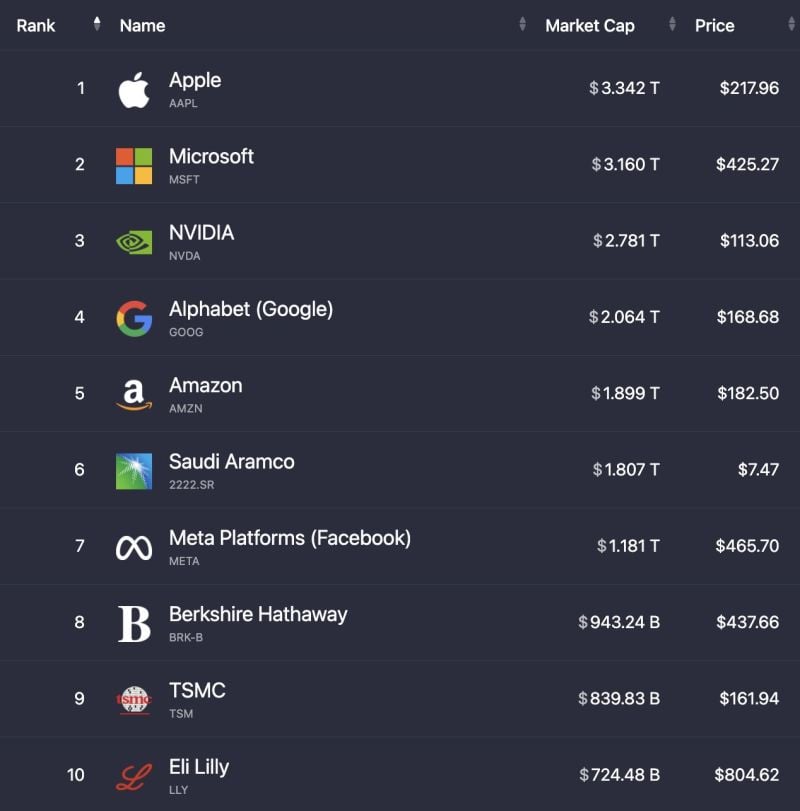

The top 10 largest stocks in the world are now worth a combined $18.74 Trillion down from $19.31T last week

Source: Evan

Under the surface, the US equity market looks stronger than before...

This might be counterintuitive to many investors who got hurt this week on their large-cap growth positions, the market looks actually healthier than it was a few weeks ago...As highlighted by the great J-C Parets, there are plenty of new all-time highs everywhere: DJ Industrial average, S&P 500 equal-weight, Mid-cap 400, etc. A mentioned by J-C Parets, we just saw the most amount of stocks on the NYSE above their 200 day moving average that we've seen this entire bull market. We also saw the most amount of stocks on the NYSE and the Nasdaq hitting new 52-week highs that we've seen this whole bull market. You can go sector by sector and you'll see. Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks