Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

NEW: Fold becomes the first Bitcoin only financial services company to go public on the NASDAQ 👏

They already have 1,000 BTC on their balance sheet 🚀 Source: Bitcoin magazine

The last time Tech stocks were at these levels relative to the S&P500, Tech stocks crashed, particularly relative to the rest of the market.

Source: J-C Parets

One for the Bulls... As shown below, during this tech pullback, forward 12-months EPS in tech has actually ticked higher.

So you could argue that this is mostly a positioning and sentiment pullback, especially in tech... Source: Bloomberg, RBC

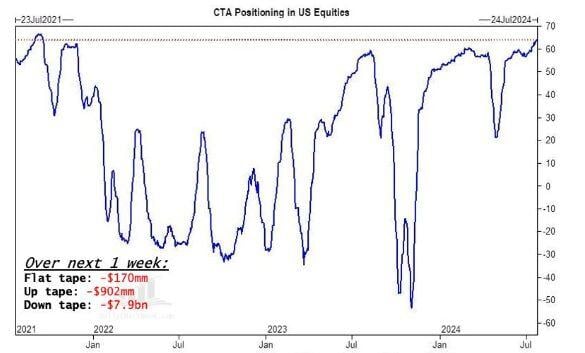

CTAs will dump stocks over the next week in EVERY SINGLE SCENARIO warns Goldman Sachs.

If the market trades lower, CTAs are projected to sell more than $7 billion worth of equities.

WHAT A DAY...

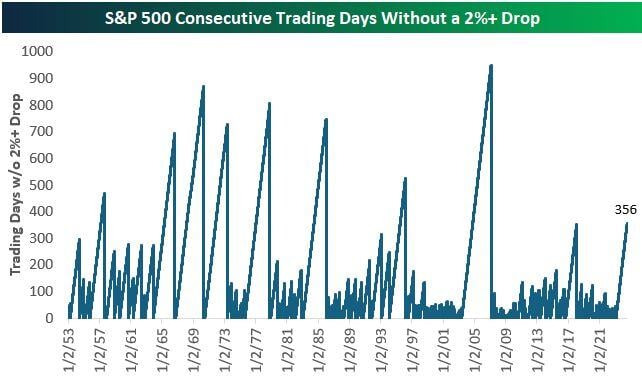

🌩 Mag 7 stocks all finished in the red today and have erased erased over $500 BILLION of market cap today. ⚡ Nasdaq and S&P 500 had worst their day since 2022 ☄ The S&P 500 just fell over 2% for the first time in 356 trading sessions. It ended the longest stretch without a >2% pullback since 2007 Source: Bloomberg

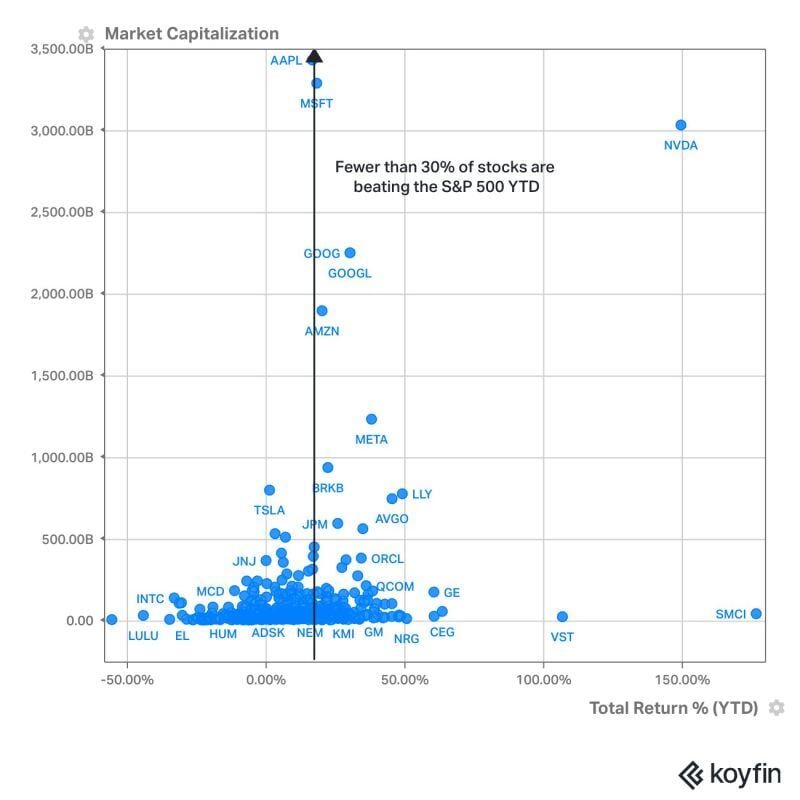

So far in 2024, only 29.8% of the stocks in the S&P500 are outperforming the benchmark.

Source: Koyfin

"The H1 results reflect LVMH's remarkable resilience, backed by the strength of its Maisons and the responsiveness of its teams in a climate of economic and geopolitical uncertainty."

Bernard Arnault Below $LVMH Q2 2024 organic revenue growth by business group by Quartr.

Investing with intelligence

Our latest research, commentary and market outlooks