Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

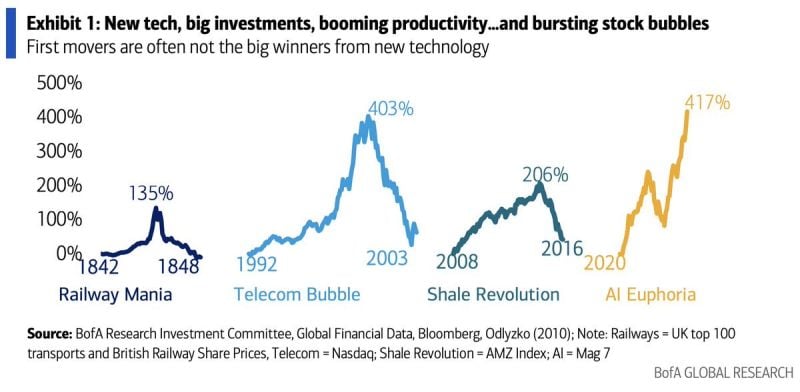

Meanwhile: The tech sector now represents 44% of the S&P 500 index when including Amazon, Alphabet, and Meta.

The pendulum has probably swung too far in one direction, and investors are running out of ideas to justify these historical distortions. Source: Tavi Costa, Bloomberg

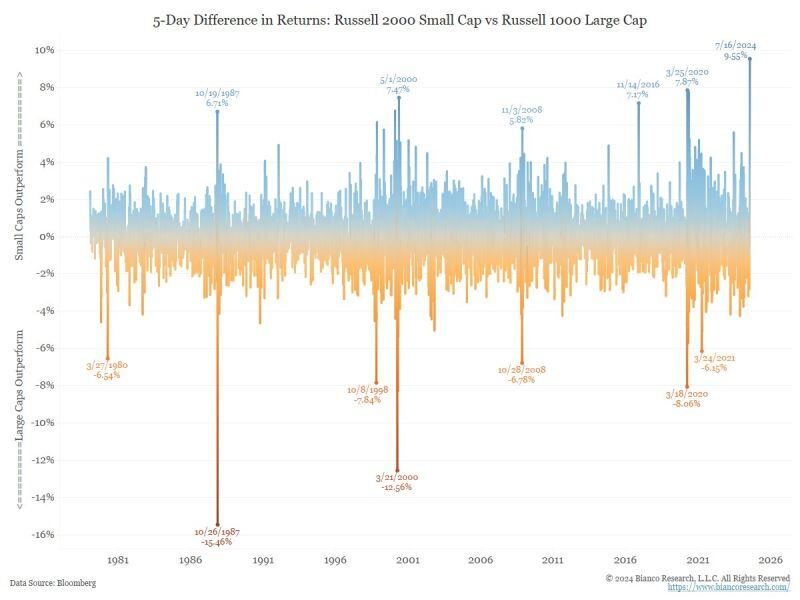

The biggest outperformance of small-cap stocks over large-cap stocks, over a 5-day period, in history.

Data starts in 1978 Source: Jim Bianco

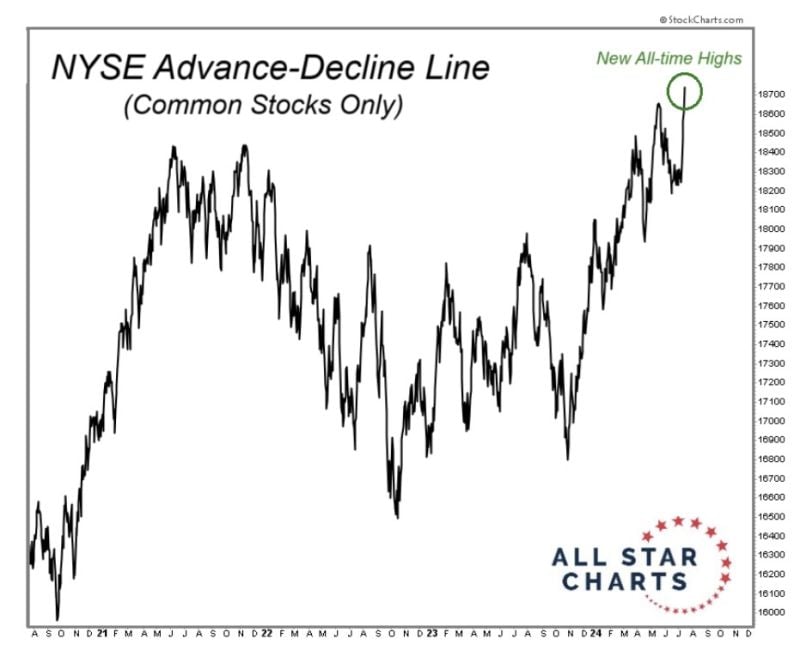

The NYSE A-D Line keeps making new highs. The US equity bull market is not just 7 stocks.

It's not just Tech. And it's not just large-caps. Yes some correction and rotation can take place from time to time. But it remains a bull market until proven otherwise. It's just a bull market... And it has been for over 2 years now. Source: J-C Parets

Global chip stocks from Nvidia to ASML fall on geopolitics, Trump comments.

Global chip stocks fell sharply, with ASML , Nvidia and TSMC posting declines amid reports of tighter export restrictions from the U.S. and a ramp-up of geopolitical tensions fueled by comments from former U.S. President Donald Trump. ASML’s Netherlands-listed shares were down 11%, while Tokyo Electron shares in Japan closed nearly 7.5% lower. The moves came after Bloomberg on Wednesday reported that the Biden administration is considering a wide-sweeping rule to clamp down on companies exporting their critical chipmaking equipment to China. Washington’s foreign direct product rule, or FDPR, allows the U.S. to put controls on foreign-made products even if they use the smallest amount of American technology. This can affect non-U.S. companies. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks