Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

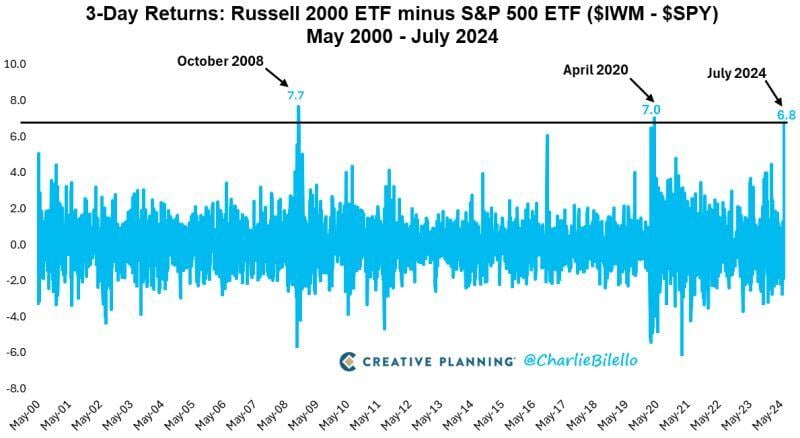

Us small caps are up 6.8% over the last 3 trading days while US Large Caps are flat.

The 6.8% spread is 6 standard deviations above the mean & the 3rd largest small outperformance since inception of the first small cap ETF in May 2000. $IWM $SPY Source: Charlie Bilello

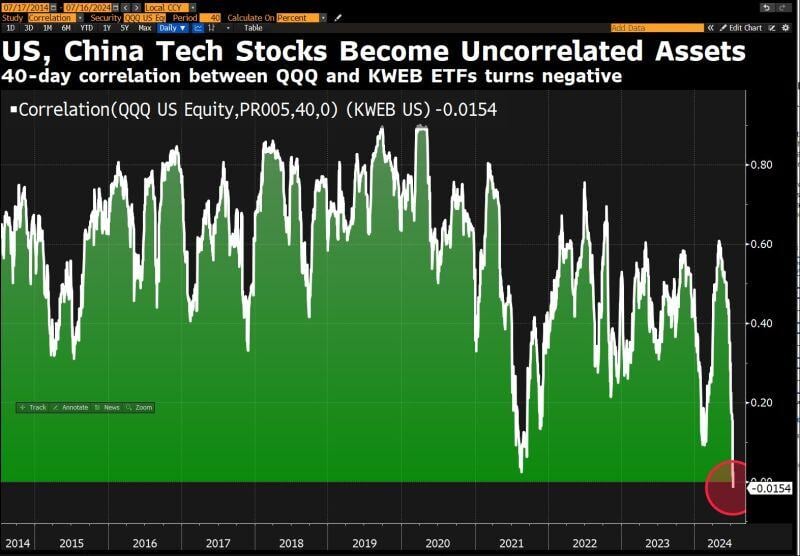

Us and China tech stocks have now become completely decoupled from each other, from a markets perspective.

David Ingles: "The 40-day correlation of $QQQ & $KWEB has turned negative. These are two behaviourally different assets FOR NOW. What might be good for one, may not necessarily boost the other. Chart underscores many global stories: difference in AI representation in each market, tech decoupling, geopolitical rifts, economies in different parts of their cycles". Source: David Ingles on X, Bloomberg

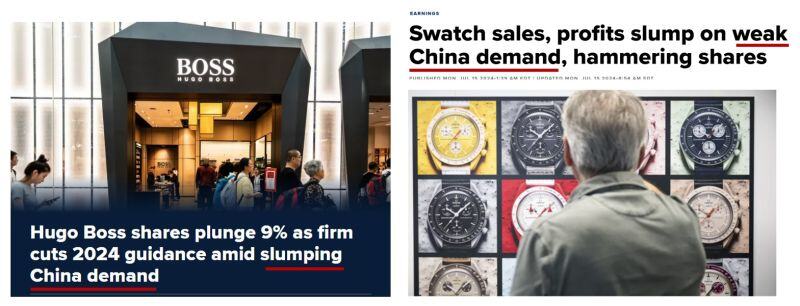

Weak China demand is weighing on European luxury & consumer discretionary stocks.

- Swatch Group (UHR SW) reported a steep fall in first half sales and earnings on Monday as the world’s biggest watchmaker struggled with weaker demand in China. The company’s drop in turnover was triggered by a slump in demand for luxury goods in China, including Hong Kong and Macau, with only the Swatch brand bucking the negative trend, increasing its sales in China by 10%, the company said in a statement. - Hugo Boss (BOSS GY) shares plunged as much as 10% Tuesday after the company cut its sales outlook. The German fashion house said Monday that it expects full-year sales of up to 4.35 billion euros ($4.73 billion) on macroeconomic challenges, particularly in China. The retailer becomes the latest high-end fashion line to warn of persistent woes in the luxury sector. Source: CNBC

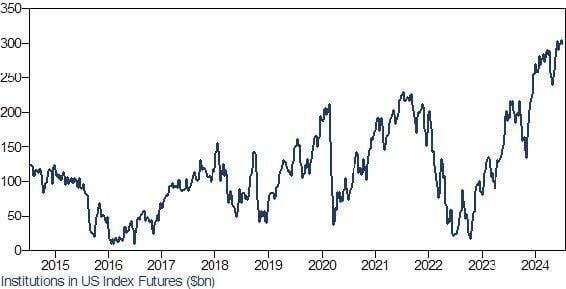

US equity futures traders have never, ever been 'longer' than they are now...

Source: GS

Trump Media shares $DJT surge 50% in premarket trading after assassination attempt

.

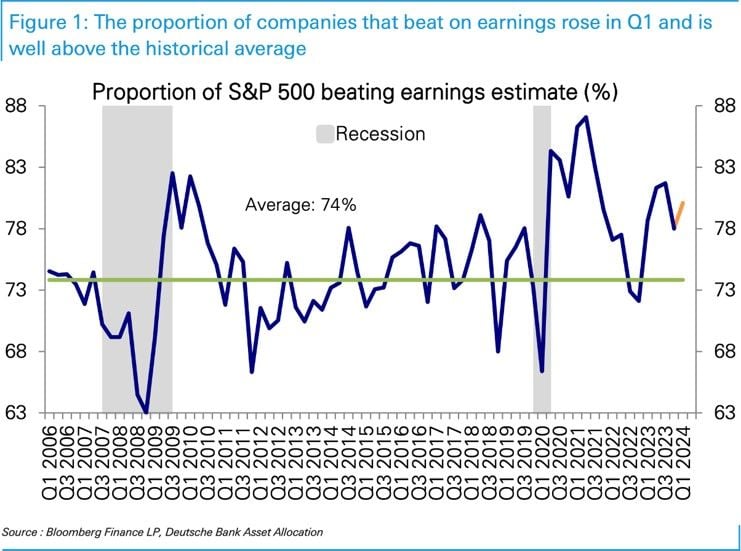

As we get into the heat of EPS season...

DB notes that more companies have been beating and by a larger amount in recent quarters. If this continues, it is tough to bet against this market... Source: Deutsche Bank, RBC

Investing with intelligence

Our latest research, commentary and market outlooks