Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

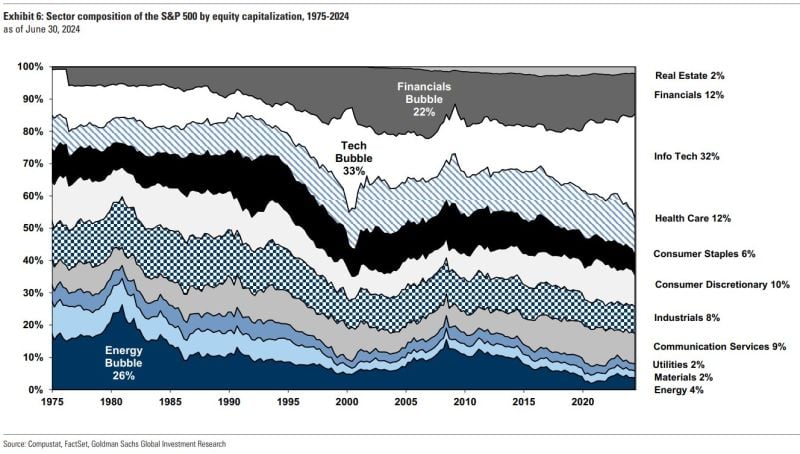

Sector composition of the S&P500 has shifted significantly over time.

energy used to be 26% of the index... Source: Goldman Sachs, Blake B. Millard

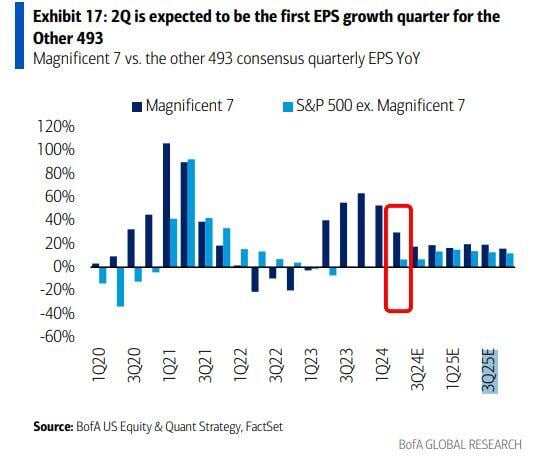

The S&P 493 earnings have been flat to down for the past five quarters.

2Q is expected to mark the first growth quarter for the Other 493. Could it lead to a more balanced market? Source: BofA

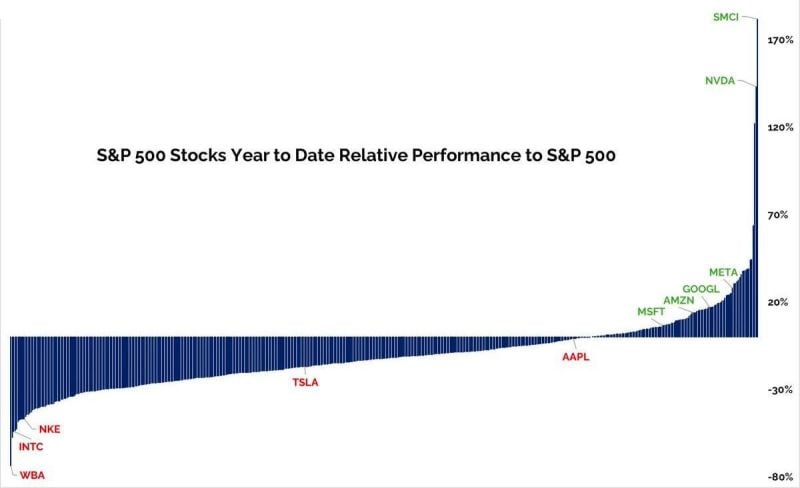

A good chart on how narrow the US market has been this year:

Source: Hidden Value Gems This was actually made originally by Grant Hawkridge https://lnkd.in/e8nwsZYA

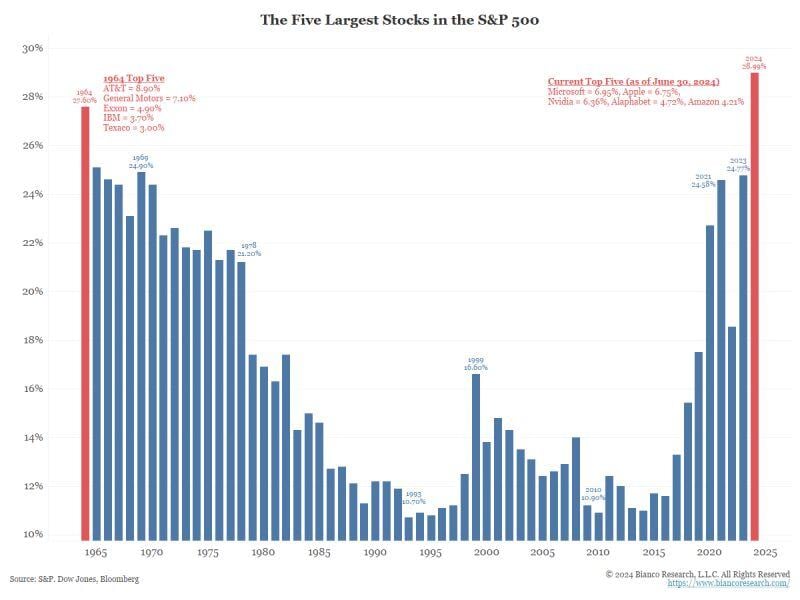

S&P500 concentration at the highest level in at least 60 years: 5 largest stocks within S&P 500 = 28.99%

As mentioned by Jim Bianco: The risk of the current S&P500 concentration is that one day the opposite happens: five stocks could kill the index funds while everything else outperforms... "Restated, one buys an index fund to get diversification. But with record concentration, they are not getting it". Source: Bianco Research

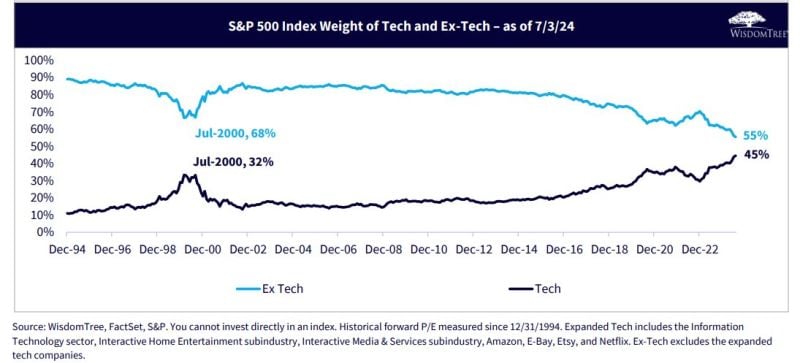

Almost half of the S&P500 is now essentially tech...

Source: Wisdom Tree, Mike Zaccardi

The US equities market explained in one image

Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks