Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

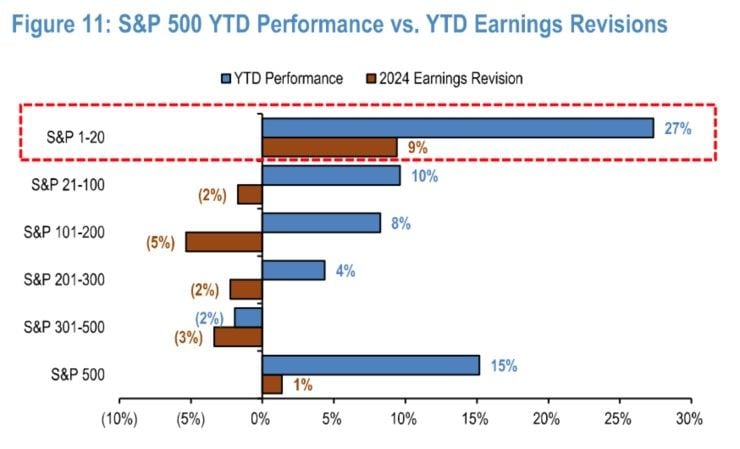

S&P EPS positive revisions have been a tailwind for the market.

However, note that EPS revisions outside of the top 20 have been NEGATIVE YTD and during the last 12 months. Source: JP Morgan

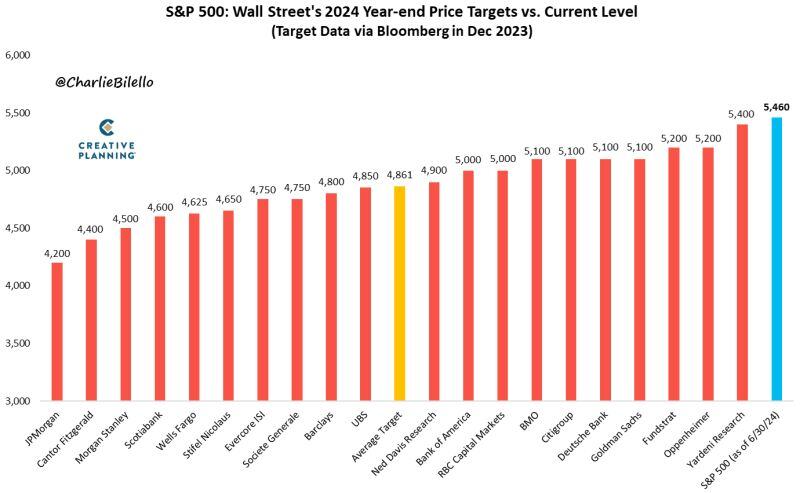

At 5,460, the S&P 500 ended the first half above every 2024 year-end price target from Wall Street strategists

We're 12% higher than average target price of 4,861. $SPX Source: Charlie Bilello

$SPY We are halfway through 2024.

Let's see the best 10 and worst 10 performers in the S&P 500 so far: The Best 10: 1. $SMCI - Supermicro - 188.2% 2. $NVDA - Nvidia - 149.5% 3. $VST - Vistra - 123.2% 4. $CEG - Constellation Energy - 71.3% 5. $LLY - Eli Lilly - 55.3% 6. $MU - Micron - 54.1% 7. $NRG - NRG Energy - 50.6% 8. $CRWD - Crowdstrike - 50.1% 9. $ANET - Arista Networks - 48.8% 10. $TRGP - Targa Resources - 48.2% The Worst 10: 1. $WBA - Walgreens Boots -53.7% 2. $LULU - Lululemon -41.6% 3. $INTC - Intel -38.4% 4. $EPAM - Epam Systems -36.7% 5. $WBD - Warner Bros Discovery -34.6% 6. $ALB - Albemarle -33.9% 7. $GL - Globe Life -32.4% 8. $MKTX - Marketaxess -31.5% 9. $PAYC - Paycom -30.8% 10. $NKE - Nike -30.6% Source: The Future Investors

That was another new all-time high quarterly close for both the S&P500 and Nasdaq100

That's now 3 in a row. Source: J.C. Parets @allstarcharts

BREAKING: Walgreens stock, $WBA, crashes nearly 25% after drugstore chain cuts profit guidance due to "challenging" consumer environment.

"We assumed the consumer would get somewhat stronger” but “that is not the case,” Walgreens CEO said. Walgreens cut their earnings per share outlook by 12.5% yesterday. The stock is now down 88% from its all time high and 55% in 2024. Another sign that consumers are struggling? Source: The Kobeissi Letter

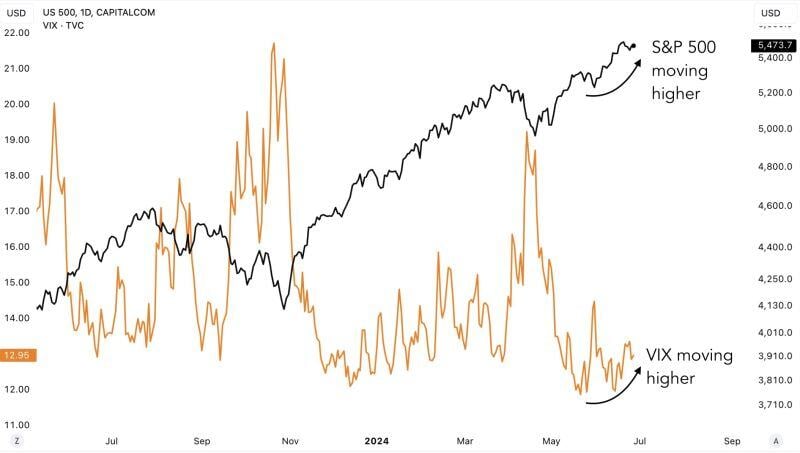

Major divergence spotted:

The VIX has been trending higher since mid-May. But even the SP500 has been moving higher. This is an anomaly. Source: Game of Trades

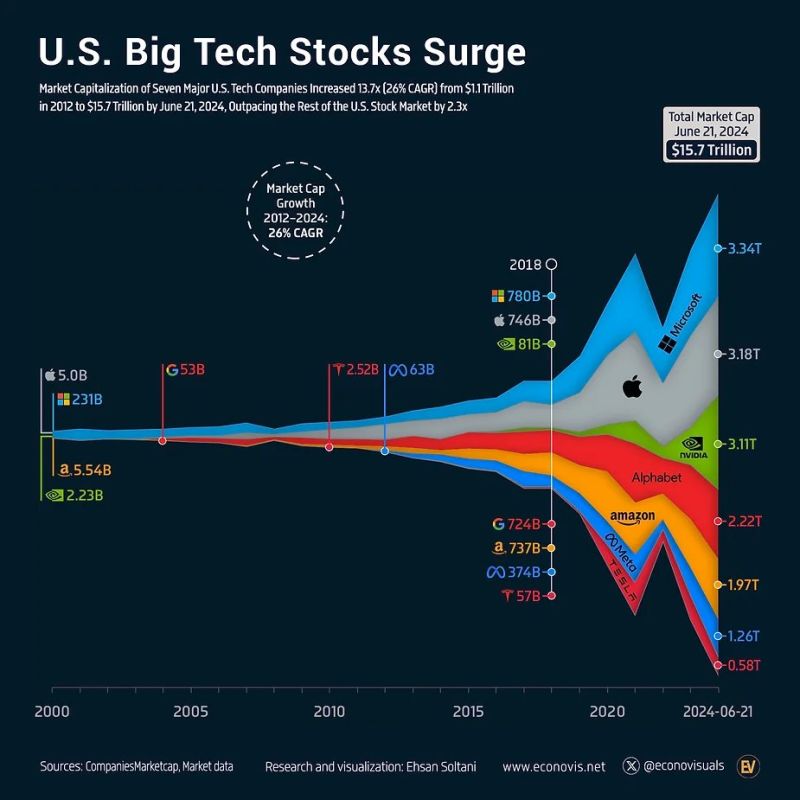

Visualizing the incredible surge in tech stocks 📊

Markets & Mayhem 🤖

Investing with intelligence

Our latest research, commentary and market outlooks