Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Nasdaq 100 and Bitcoin have moved in tandem for the past 4+ years.

With the recent Tech rally, the Nasdaq is showing its largest divergence versus Bitcoin during this time frame. Will we see bitcoin catch up or Tech catch down? Source: David Marlin

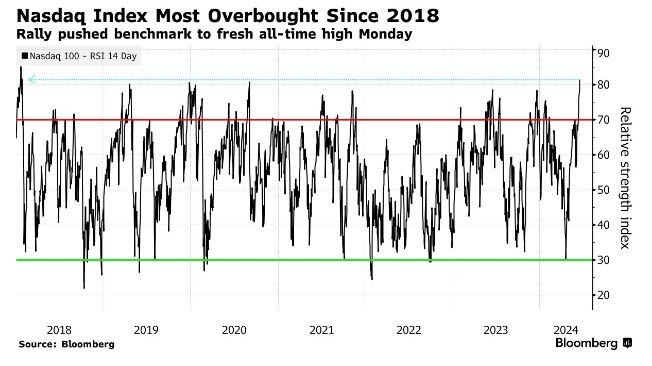

Mega Cap Tech Stocks hit their most overbought level in more than 6 years last week

Source: Barchart, Bloomberg

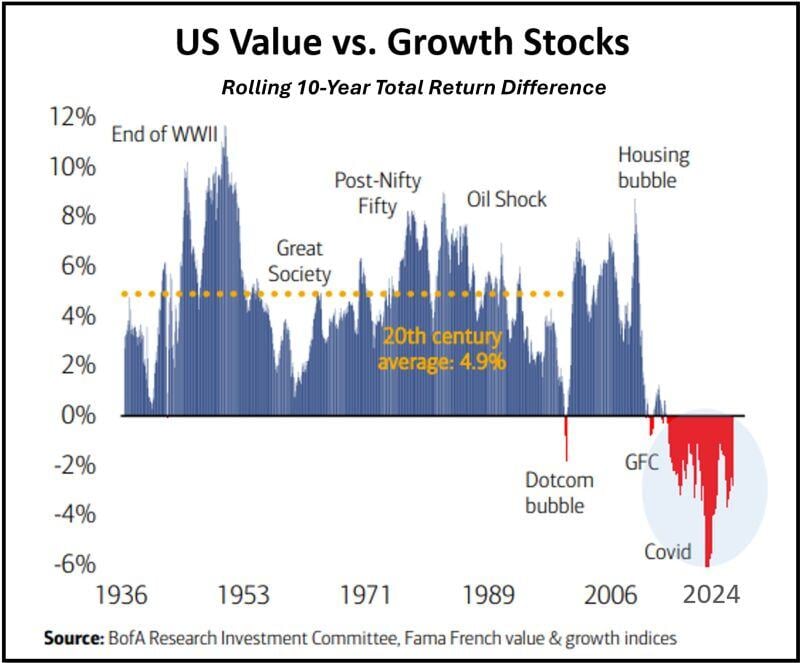

Was the recent trend of growth stocks outperforming value stocks an anomaly, driven mainly by lower capital costs that favored growth over profitability?

As shown below, history shows that US value outperformed US growth most of the time (using rolling 10-year Total Return) Source: Tavi Costa, BofA

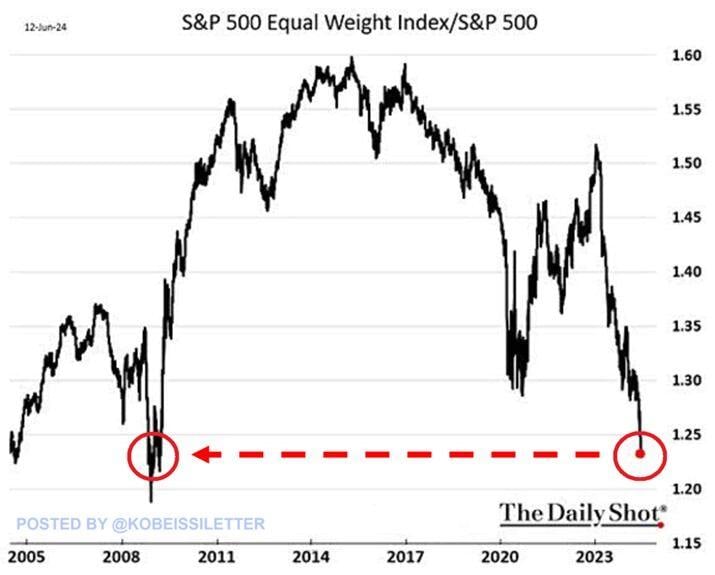

Large tech stocks just keep getting bigger: The S&P 500 Equal Weight index relative to the S&P 500 is now at its lowest level since the 2008 Financial Crisis

This ratio has accelerated as the S&P 500 has rallied by 14% year-to-date while the equal-weight by just 5%. The disconnect has been driven by the 5 largest stocks which have seen a 32% gain combined this year. Since January 2023, the S&P 500 is up a massive 41% while the equal-weight index is up just 16%. At the same time, Russell 2000 Equal Weight is nearly flat, up just ~3%. Source: The Kobeissi Letter, The Daily Shot

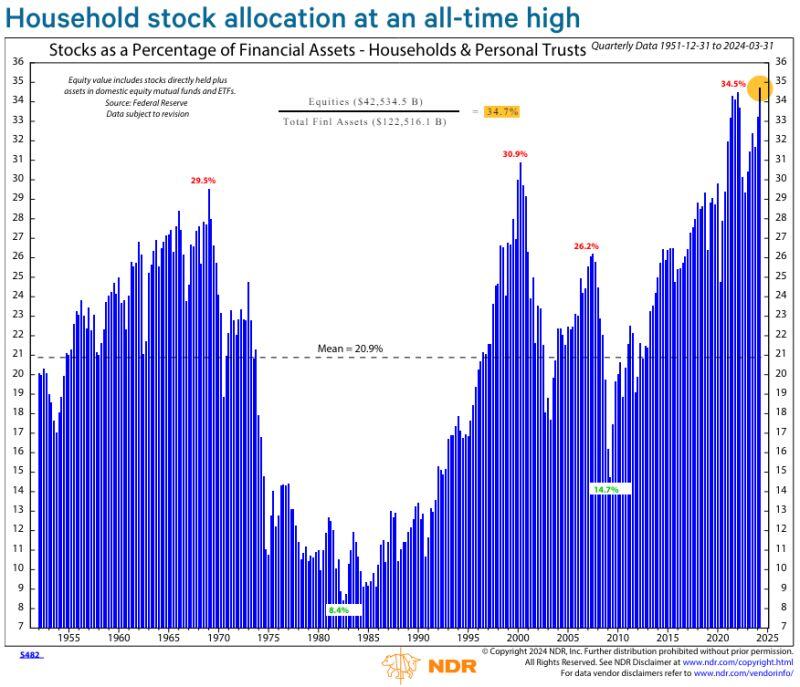

U.S. household stock allocation has reached an all-time high

Source: NDR_Research

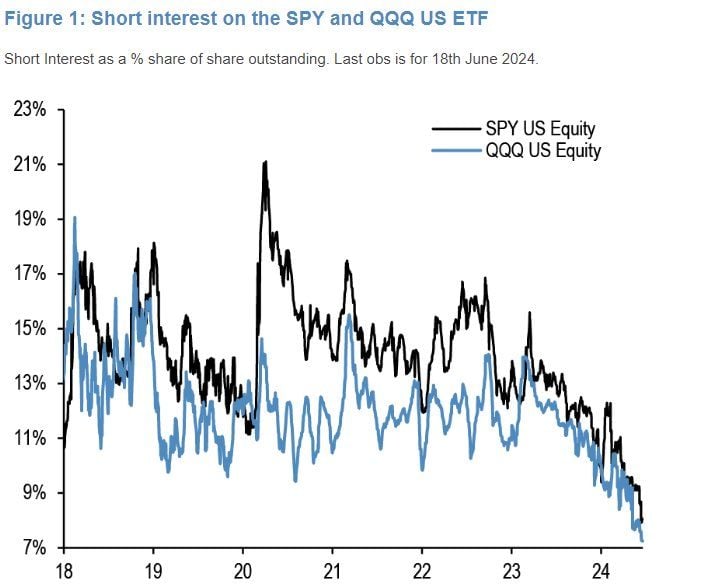

Short interest on the $SPY SPDR S&P 500 ETF and $QQQ Powershares Nasdaq 100 ETF as a % of shares outstanding is at record low levels

Source: JP Morgan

Gautam Adani is uber-bullish on indian equities "There has never been a better time to be Indian"

Source: Nikhil Oswal

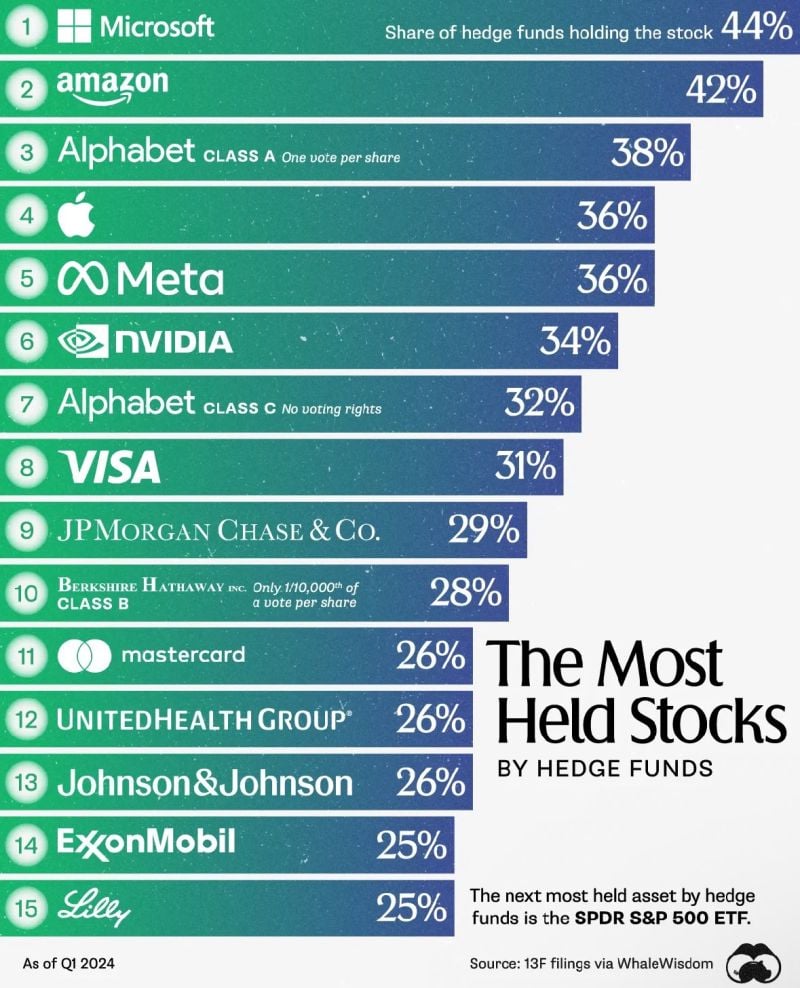

Here are the most held stocks by hedge funds

Source: Savvy Trade, Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks