Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

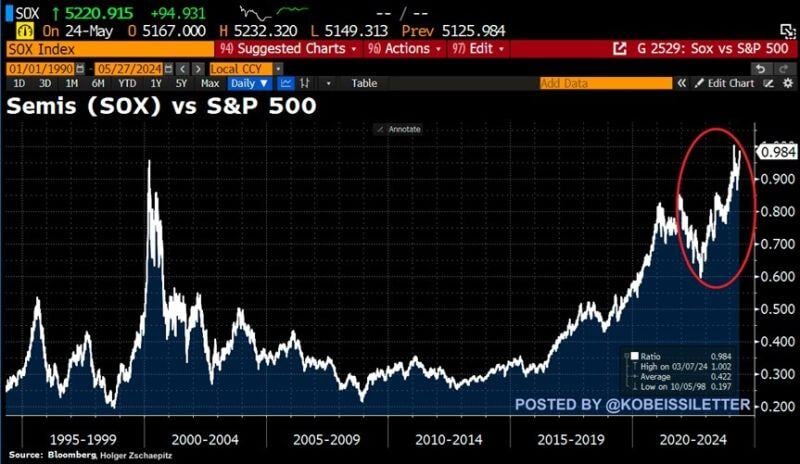

The Semiconductor Index, $SOX, relative to the S&P 500 has once again exceeded Dot-com bubble levels.

The Semis vs S&P 500 ratio has roughly doubled in just 2 years. This comes after a massive semiconductor sector rally of 85% compared to a 35% gain in the S&P 500. The rally has been led by NVIDIA, $NVDA, which has seen a 560% surge during this time. Meanwhile, the top 10% of stocks in the US now reflect ~75% of the entire market, the most since The Great Depression of 1929-1939. Source: The Kobeissi Letter, Bloomberg

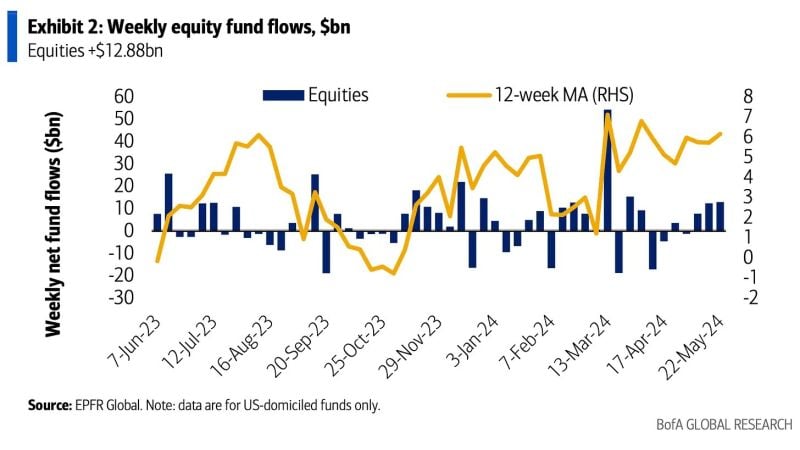

Inflows to equities accelerated to +$12.88bn (largest in 2 months) this week.

via BofA

S&P 500 $SPX hasn't declined by 2% or more for 317 consecutive trading days, the longest streak since a 351-day stretch that lasted from Sep 2016 through Feb 2018.

Source: Barchart

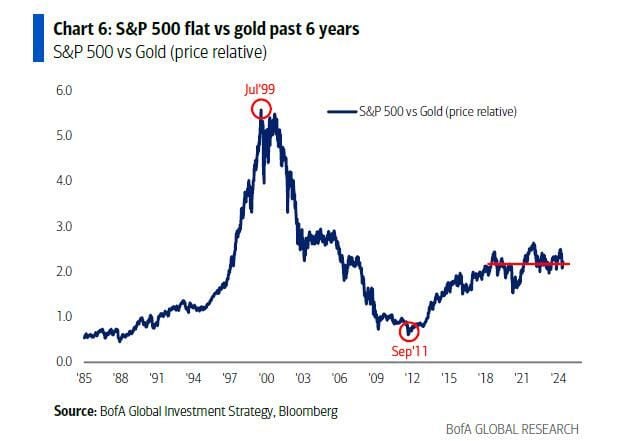

Did you know that the S&P 500 has been basically flat vs gold over the last six years? 🤔

Source: Markets & Mayhem, BofA

Deckers Outdoor acquired the Hoka brand roughly a decade ago.

At the time, Hoka’s annual sales were around $3 million. In the past year, sales topped $1.8 billion. And since the acquisition, Decker’s stock has risen by more than 2,000%... (btw I love these shoes !!!) Source: Jon Erlichman

$RSP (S&P Equal-weight) vs. $SPX (S&P 500) just broke key support level

Source: Ian McMillan

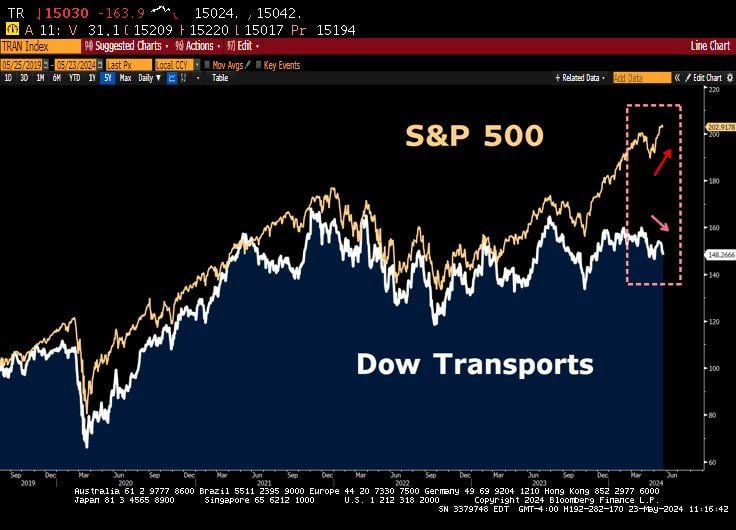

Divergence between DJ Transports and S&P500 is something to watch.

The former is seen as a reliable indicator of domestic activity Source: Lawrence McDonald, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks