Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

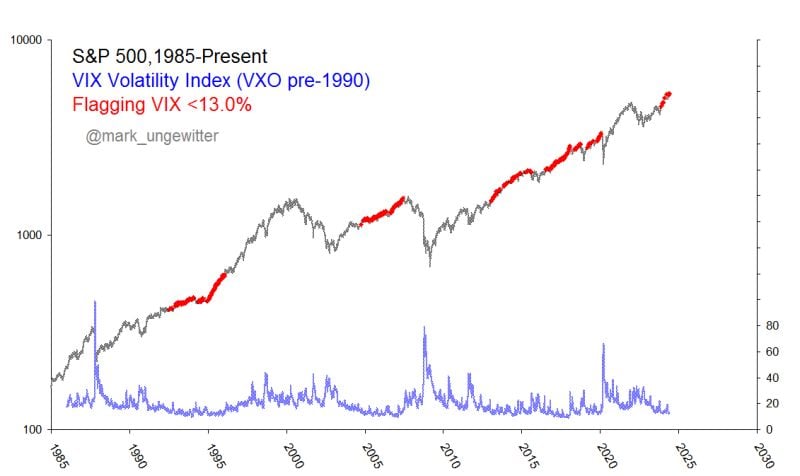

Low-volatility regimes can last longer than you think.

Source: Mark Ungewitter

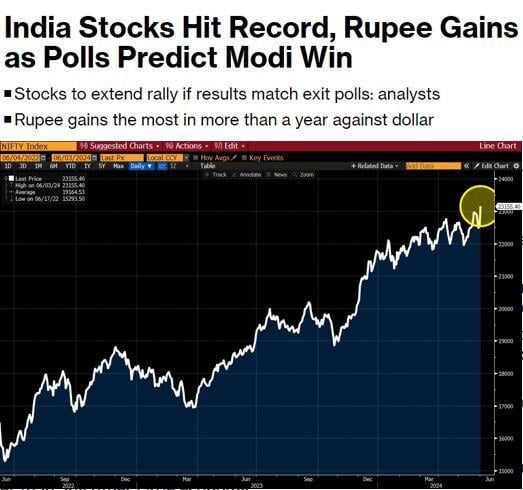

Exit polls show a clear victory for Prime Minister Modi’s party BJP + allies (called NDA = National Democratic Alliance).

The market is likely to view this very favorably, expecting another 5 years of policy stability, reforms and visibility on growth. Source: Bloomberg, David Ingles

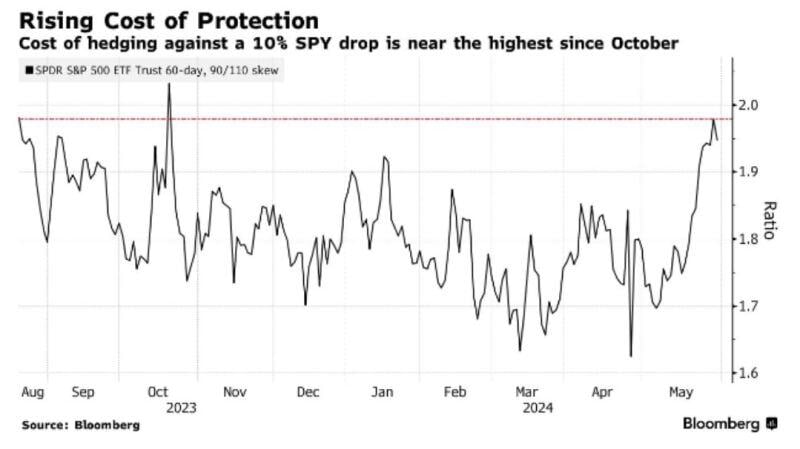

The cost to hedge a 10% drop in the S&P 500 reached its highest level since October

Source: Win Smart, Bloomberg

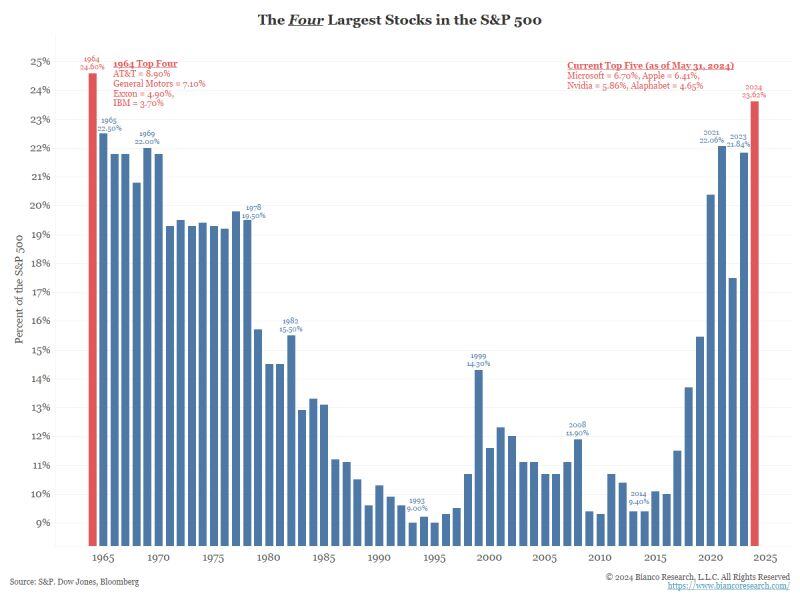

The equal-weighted SP500 relative to the S&P 500 index has dropped to its lowest level since March 2009.

This year, the S&P 500 has gained ~10% while the equal-weighted index rallied just 3%. At the same time, Magnificent 7 stocks have rallied over 50%. Since the ratio peaked in February 2023, the S&P 500 is up ~29% compared to a 7% gain of the equal-weighted index. Meanwhile, the top 10% of US stocks now account for ~75% of the S&P 500, the most since the 1930s’. The market has never been driven by so few names. Source: The Kobeissi Letter

Penny stock trading is booming.

Seven of the top 10 most traded US equities in May are penny stocks worth less than $1. None are profitable Source: FT, Gunjan Banerji

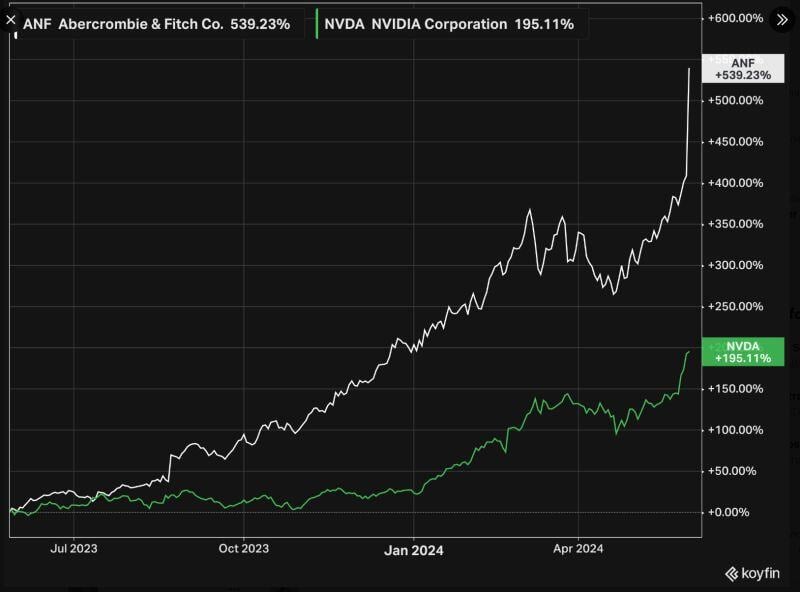

Abercrombie & Fitch $ANF making Nvidia $NVDA shareholders look poor...

Abercrombie & Fitch reported its financial results for the first quarter today. Here's what its CEO Fran Horowitz said in a press release on Wednesday. Abercrombie & Fitch stock is now up close to 70% versus the start of 2024. Source: Conor Mac, InvestmentTalkk

Investing with intelligence

Our latest research, commentary and market outlooks