Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

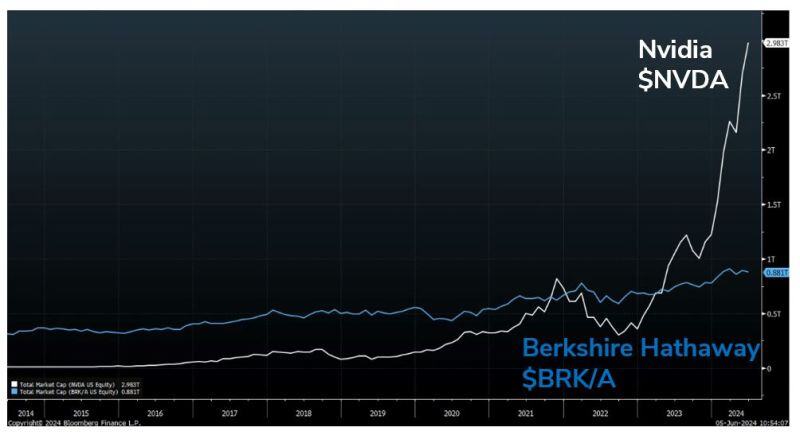

Over the past 32 trading days, Nvidia $NVDA has gained more than $1 trillion in market cap.

To put that into some sort of perspective, the 6-week gain is greater than the total market cap of Berkshire Hathaway $BRKA, which Warren Buffett has spent 6 decades in building... Source: Jesse Felder

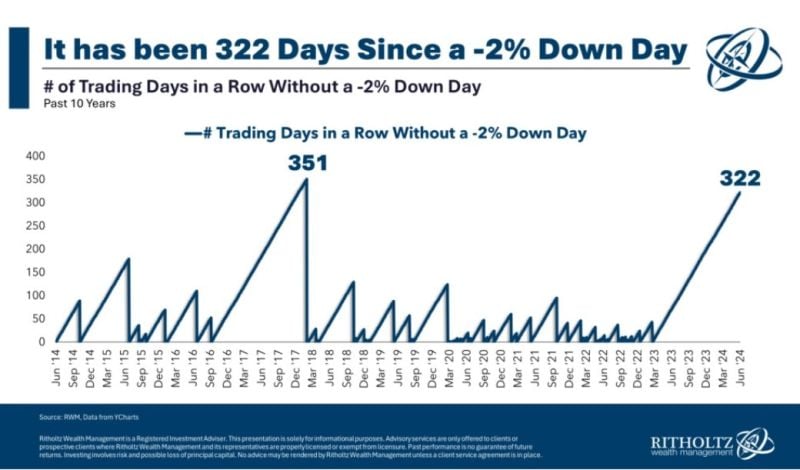

It has been a very quiet year so far for US equity markets...

No down day > 2% for the SP500 despite Middle East conflict, China doing military exercises around Taiwan, Fed interest rates cuts expectations moving from 6 to less than 2, etc. Source chart: Ritholtz

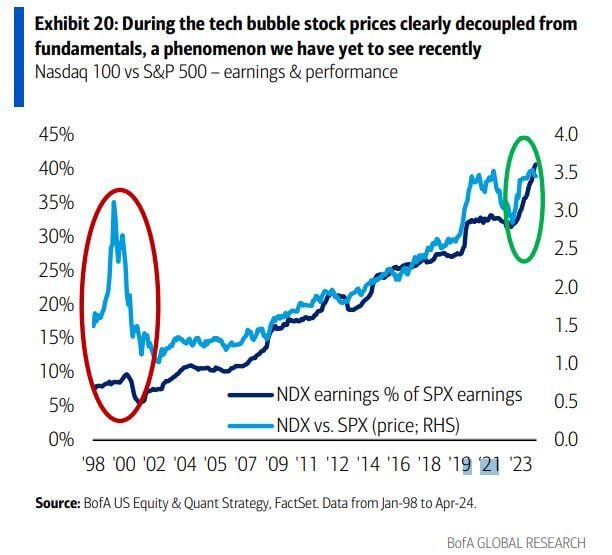

Dot Com Bubble vs. Now - Things don't look similar - at least from an earnings angle

Source: Barchart, BofA

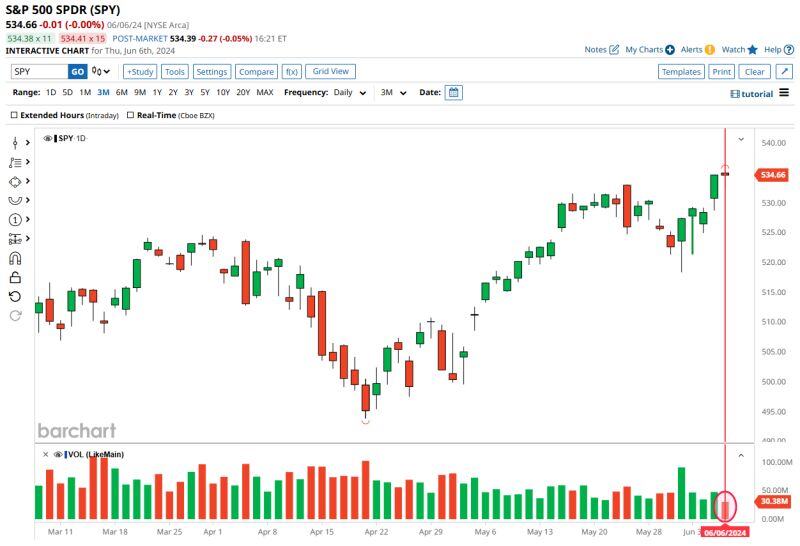

🚨: S&P 500 $SPY finished with its lowest volume in 18 years (excluding holiday-shortened trading days)

Source: Barchart

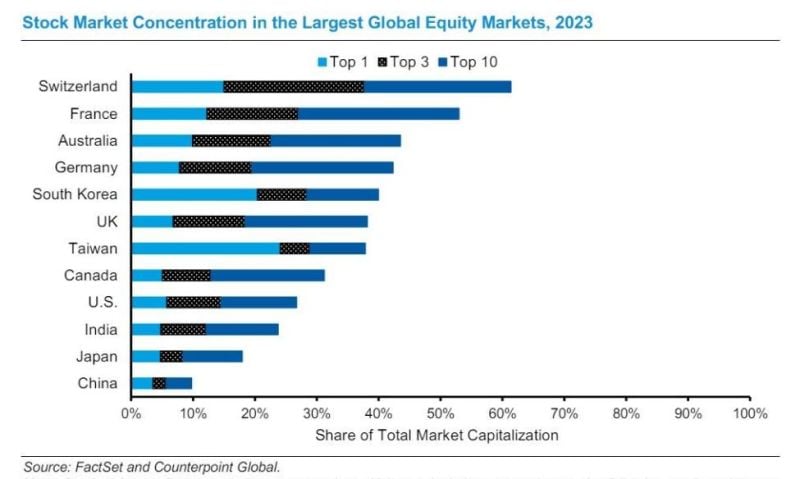

What US stock market concentration? Exhibit below

courtesy of Morgan Stanley and Factset - shows the market concentration at the end of 2023 for a dozen of the largest markets around the world. The U.S. is the fourth MOST DIVERSIFIED market notwithstanding the recent increase in concentration...

BREAKING: Nvidia stock, $NVDA, officially crosses above $1,200 for the first time in history.

Nvidia now has a market cap of $2.95 TRILLION and is just 3% away from passing Apple, $AAPL, as the largest public company in the world. To put things into perspective: the market cap per employee of Nvidia has hit almost $100,000,000. Source: Bloomberg, HolgerZ

Just 3 stocks - Microsoft $MSFT, Nvidia $NVDA, and Apple $AAPL - now account for 20% of the S&P 500

Source: Barchart

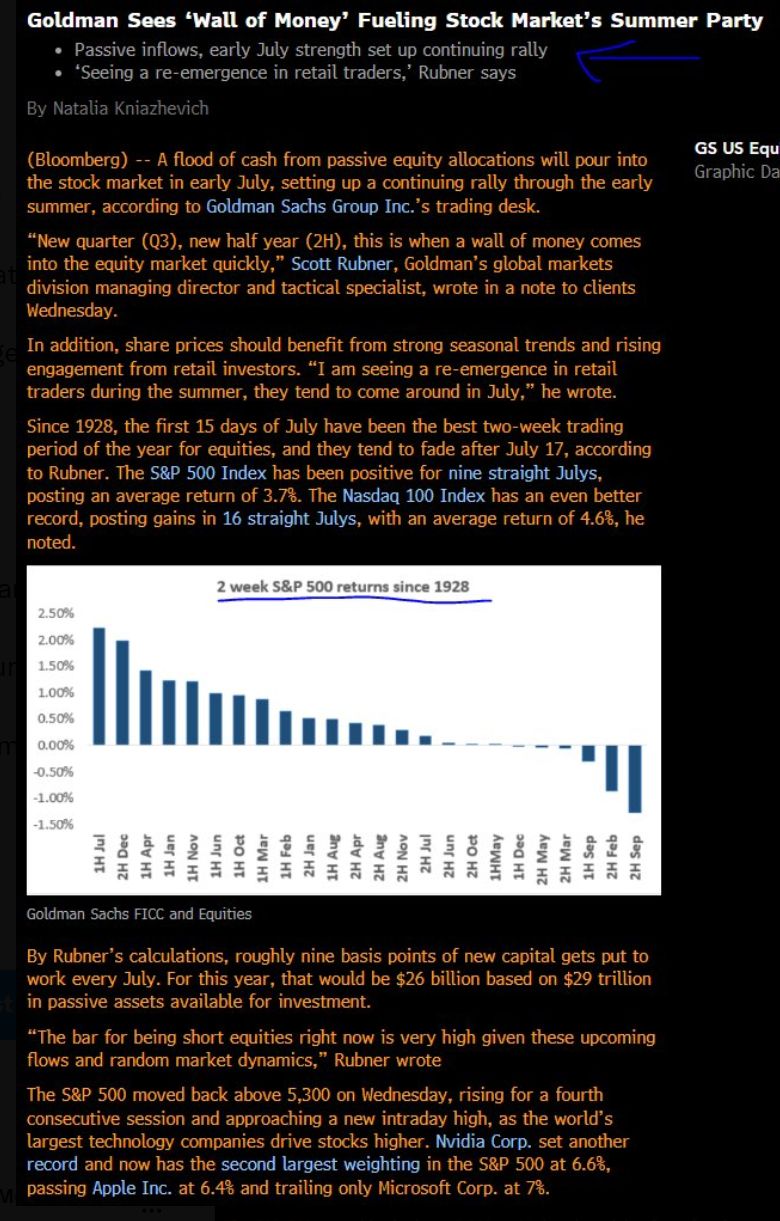

* Goldman Sees ‘Wall of Money’ Fueling Stock Market’s Summer Party

Source: Carl Quintanilla, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks