Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Inflow mania >>

Rubner: "Global equity funds have seen $190.5 Billion inflows YTD. This is the second largest equity inflows on record (only 2021 saw more inflows). This is +$1.7B worth of equity inflows per day." Source: The Market Ear

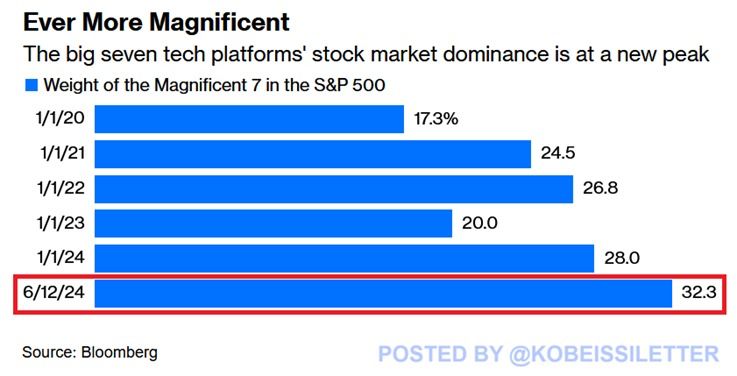

The Magnificent 7's share of the SP500 just hit another all-time high of 32%.

This is 12 percentage points higher than at the beginning of 2023. The weight of these 7 stocks in the index has almost DOUBLED in just over 4 years. This comes as the 3 largest stocks, Apple, Microsoft, and Nvidia, are all officially worth over $3 trillion. Meanwhile, the technology sector just hit another all-time high relative to the S&P 500. Tech is becoming even more dominant. Source: Bloomberg, The Kobeissi Letter

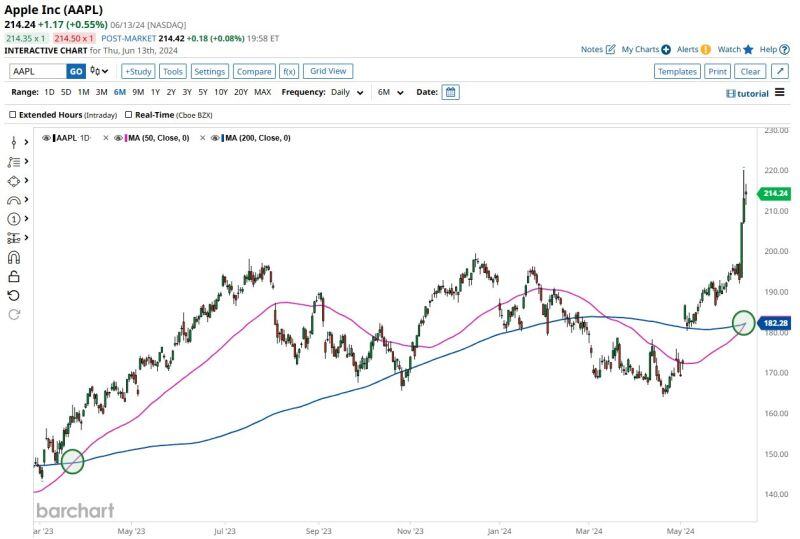

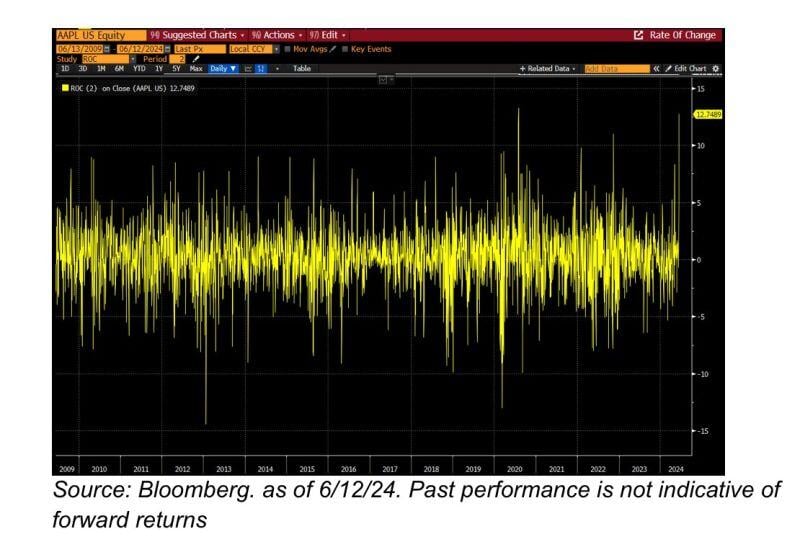

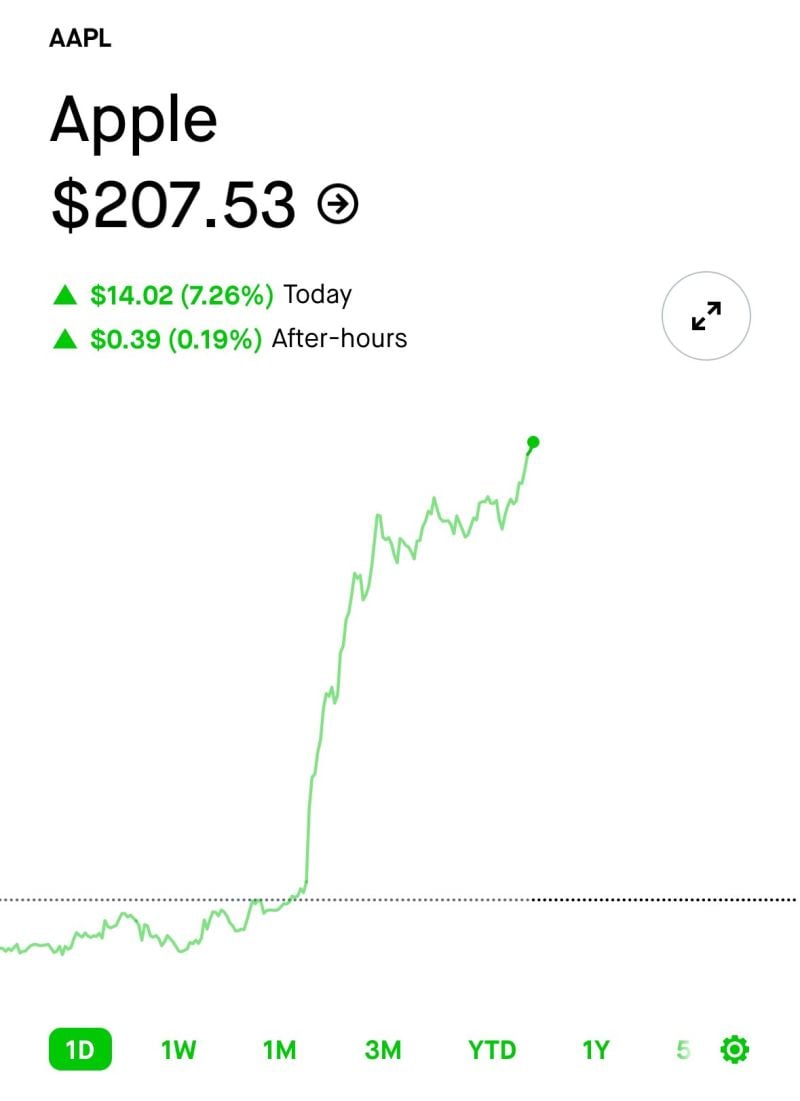

Apple $AAPL … stock up ~12.5% in 2-days, the biggest 2-day move in 15+ years (save a 2-day stretch in Mar’20 off the COVID lows) …

over this stretch, Apple has added nearly ~$400bn in mrkt cap .. larger than the current market cap of 480 co’s ..” - GS desk Source: Carl Quintanilla, Bloomberg

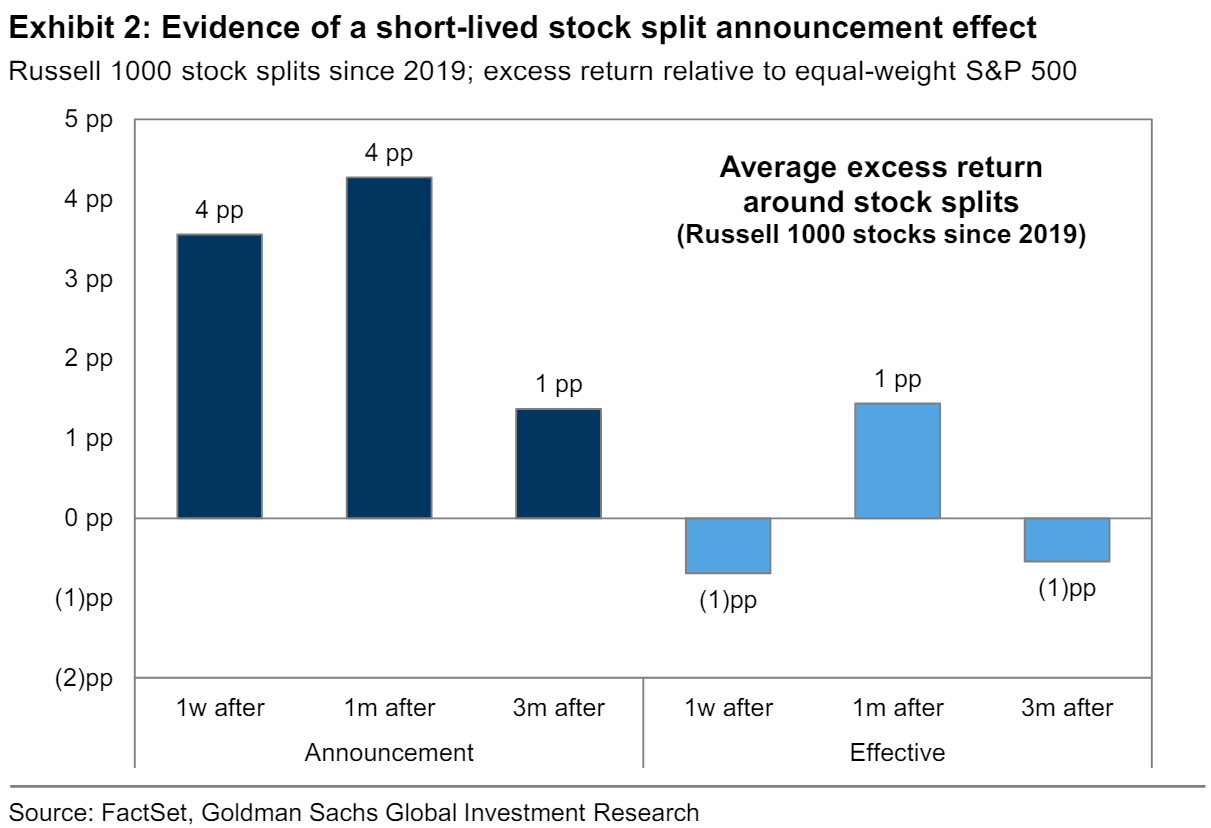

Goldman Sachs on the mixed impact of corporate stock splits

“Share prices typically rise after a firm announces a stock split. In theory, there is no change in the underlying value of a company when it splits its stock. However, empirically, the academic literature has generally found positive announcement effects around stock splits. We consider a sample of 46 Russell 1000 firms that completed stock splits since 2019. On average, these stocks generated a 4 pp excess return vs. the equal-weight S&P 500 in the week following stock split announcement. However, the stock price did not evidence a clear reaction after the stock split took effect. In addition, because many companies announce stock splits alongside earnings releases, it can be challenging to know how much of the stock rallies are due to the stock split as opposed to strong earnings results”. Source: Goldman Sachs

Goldman and Bank of America expect another bounce as July Communist Party meeting seen including more support measures.

Source: South China Morning Post

The SP500 closed the week at new all-time highs.

And a whopping 33 stocks on the NYSE closed at new highs. That's only 1.4% of stocks on the most important exchange in the world hitting new highs. Source: J.C. Parets @allstarcharts

Investing with intelligence

Our latest research, commentary and market outlooks