Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

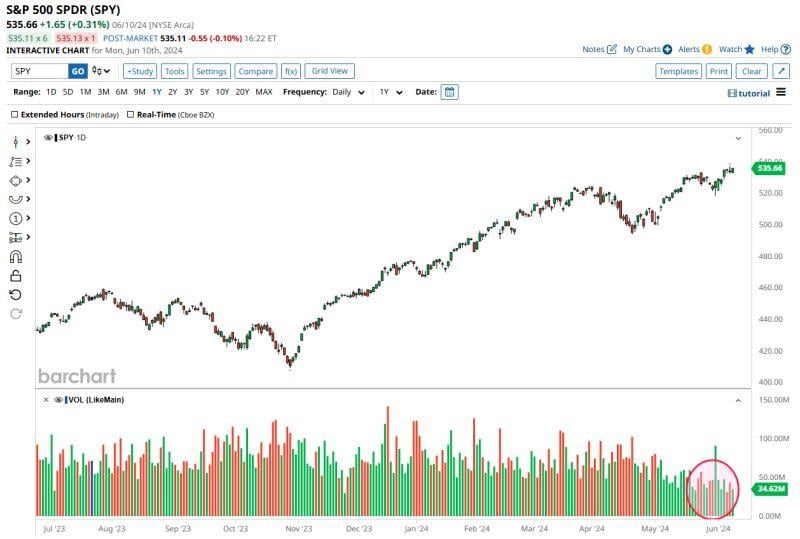

S&P 500 continues to hit record highs on EXTREMELY low volume.

Today was the 4th lowest volume day of the year for $SPY. Three of this year's four lowest volume days have come in the last week. All 4 of the lowest volume days have come in the last 3 weeks. Source: Barchart

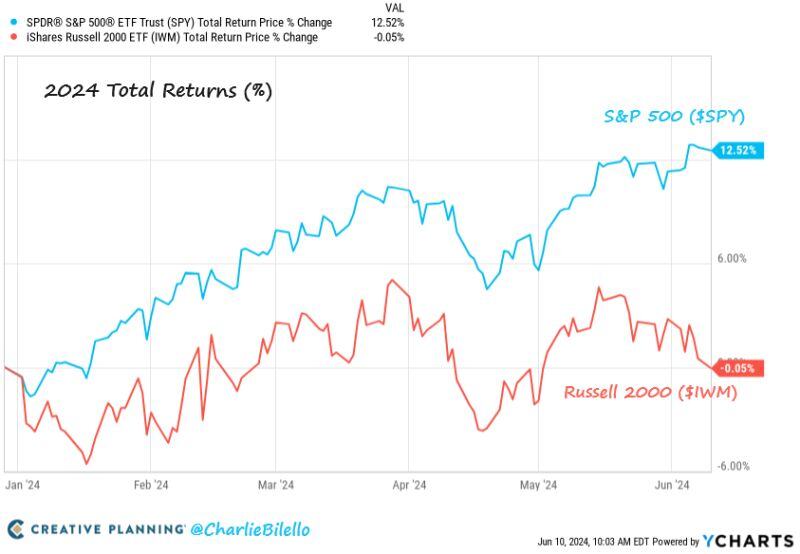

Small cap stocks are now down on the year while Large caps are still up 12.5%. $SPY $IWM

Source: Charlie Bilello

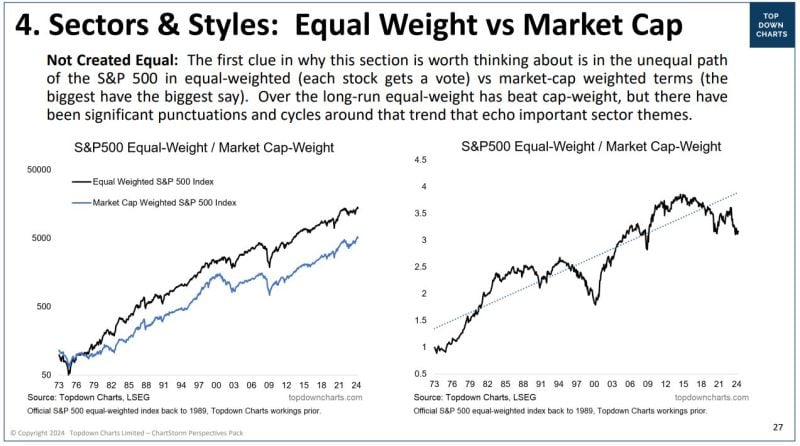

Below is an extract of a great chart pack by Topdown Charts / Callum Thomas

https://lnkd.in/eCV4GauM Over the long-run equal-weight has beat cap-weight, but there have been significant punctuations and cycles around that trend that echo important sector themes.

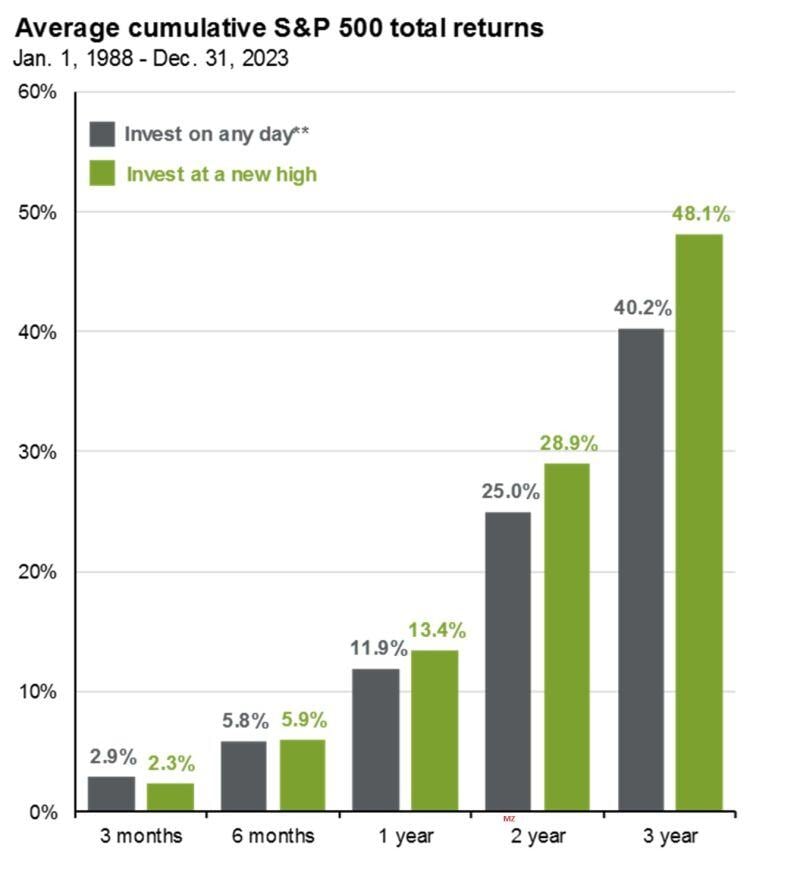

Reminder: investing at all-time highs is safer than investing during drawdowns $SPY

Source: Mike Zaccardi

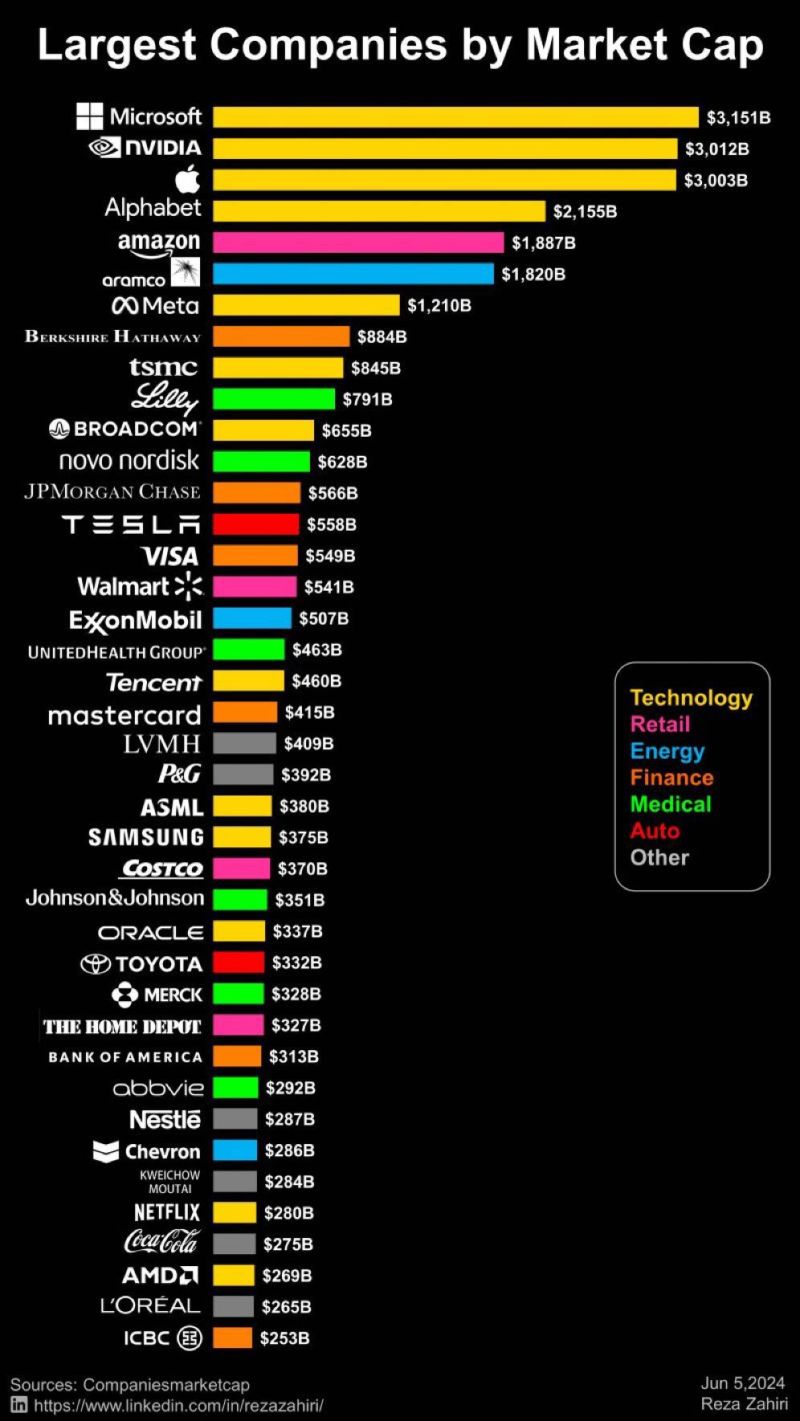

World's largest companies by market cap & the most valued companies

Source: Reza Zahiri

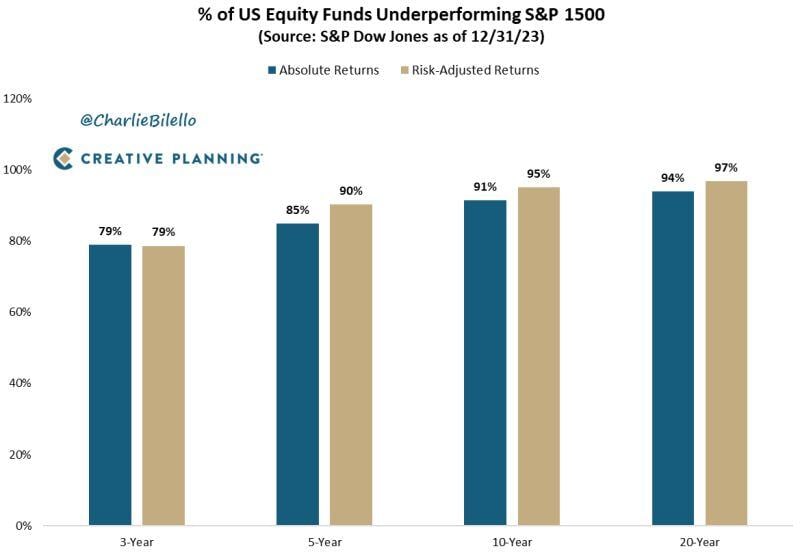

A staggering percentage of US equity funds are underperforming the S&P 1500.

The longer the time period the higher the percentage of underperformers. Source: Charlie Bilello

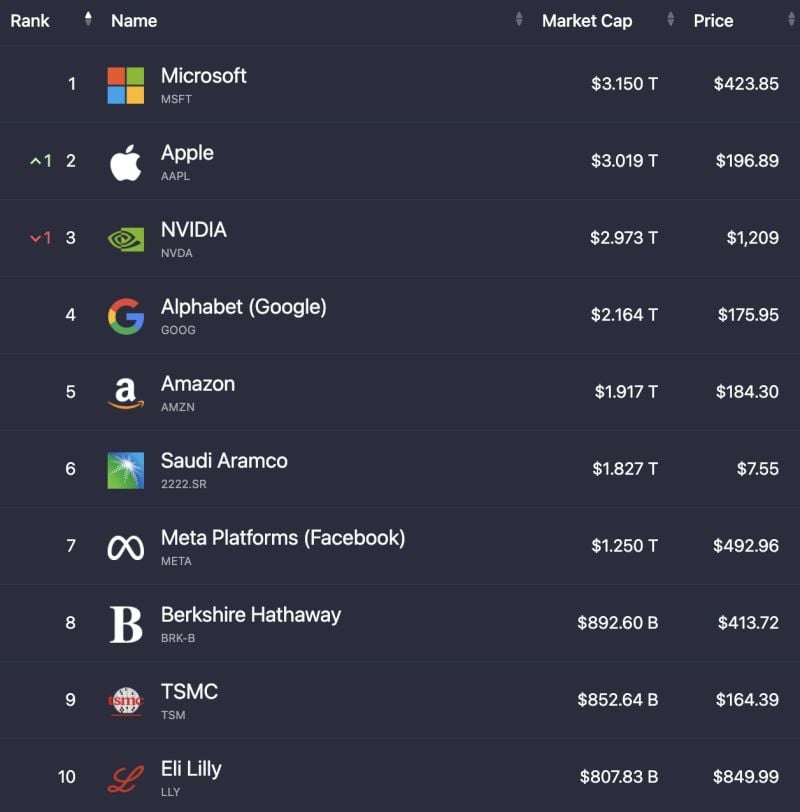

The top 10 largest stocks in the world are now worth a combined $18.85 Trillion up from $18.21T last week.

Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks