Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

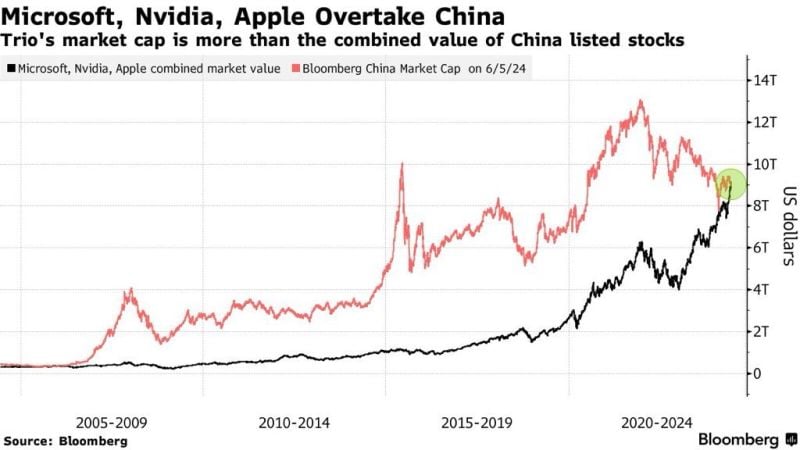

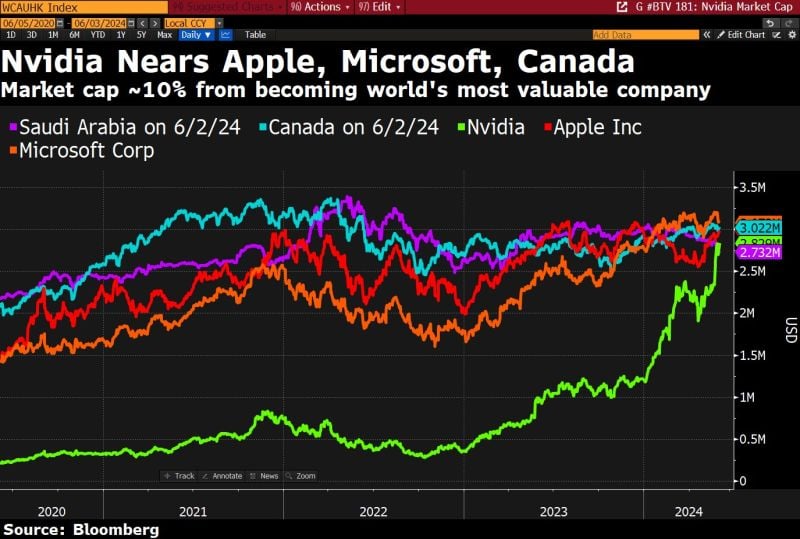

It’s official: Nvidia, Apple, and Microsoft are now bigger than China’s entire stock market.

Source: Bloomberg, www.zerohedge.com

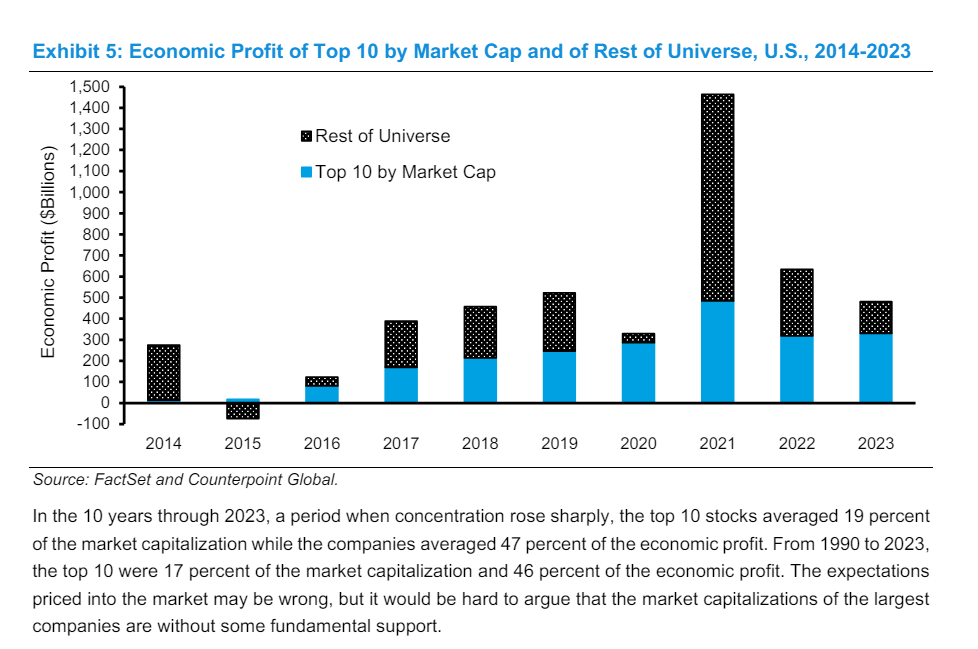

Michael Mauboussin latest research about stock market concentration: "How much is too much?"

Please read Michael Mauboussin’s (head of Morgan Stanley’s Consilient Research) latest article in which he argues that the rising concentration in the US stock market indices is justified by the companies’ underlying fundamentals. The article can be freely accessed on the Morgan Stanley Investment Management website. Source: Consilient Research for Morgan Stanley Investment Management’s Counterpoint Global

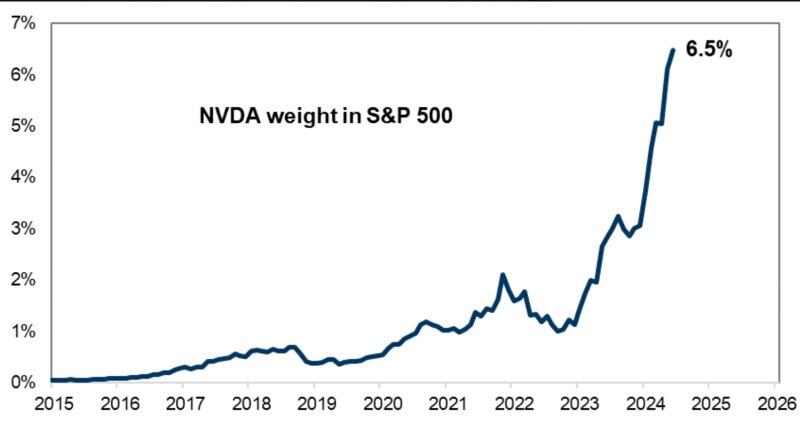

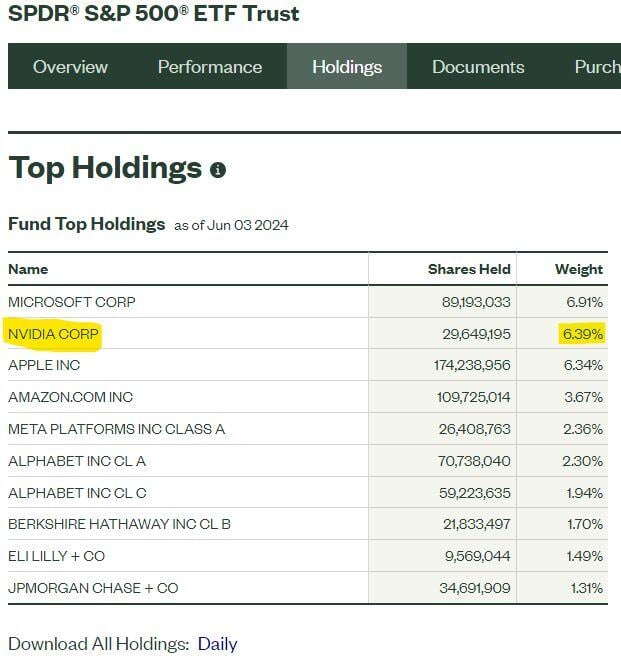

Nvidia $NVDA hit a new all-time high today of $1,166 and has passed Apple to become the 2nd largest holding in the S&P 500.

$SPY $NVDA $AAPL Source: Charlie Bilello

Nvidia is within single digits now of becoming the world's most valuable company $NVDA

•5% away from Apple •6% away from Canada •9% away from Microsoft Source: Bloomberg, HolgerZ

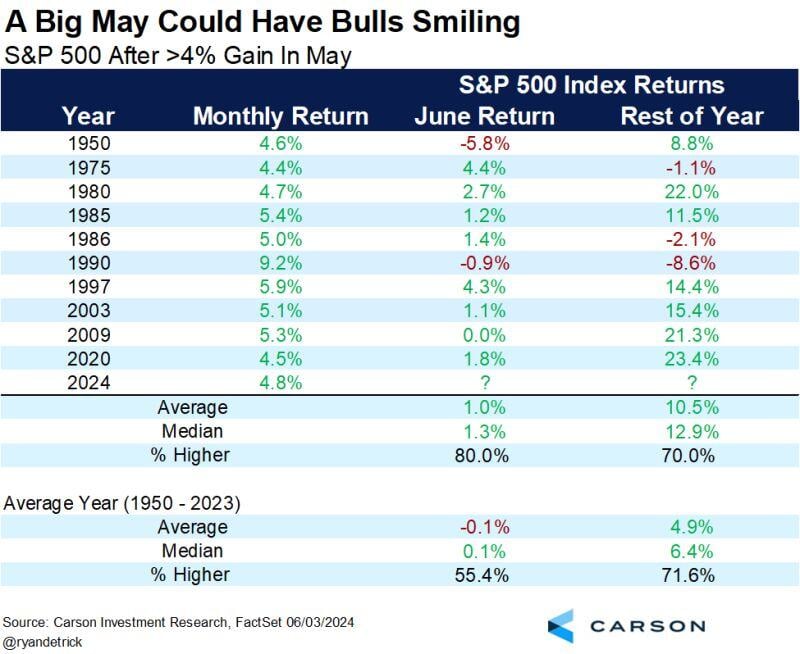

Best May for the S&P 500 in 15 years.

Looking at the 10 best monthly returns ever in May showed the future returns were quite impressive. When May return was above 4%, the rest of year up was double the average year (10.5% vs 4.9%) and June was up 1.0% on average vs negative. Source: Carson, Ryan Detrick

BREAKING: Mexico's stock market ETF, $EWW, crashes 11% after as the Mexican stock market posts its worst day since 2008.

The Mexican Peso also lost 4.5% against the US Dollar in its biggest one-day drop in years. This comes after Claudia Sheinbaum was elected as the next president of Mexico. Source: The Kobeissi Letter

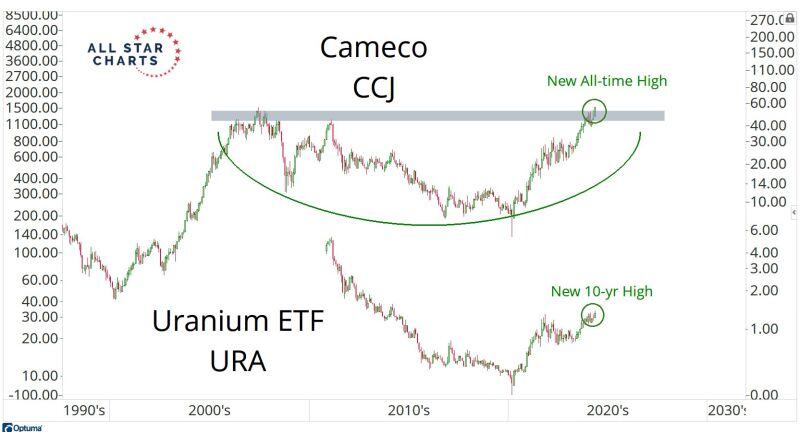

Interesting technical development for the uranium mining stocks with the $URA ETF trading at a 10-year high while sector leader Cameco $CCJ is trading at a new all-time-high.

Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks