Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

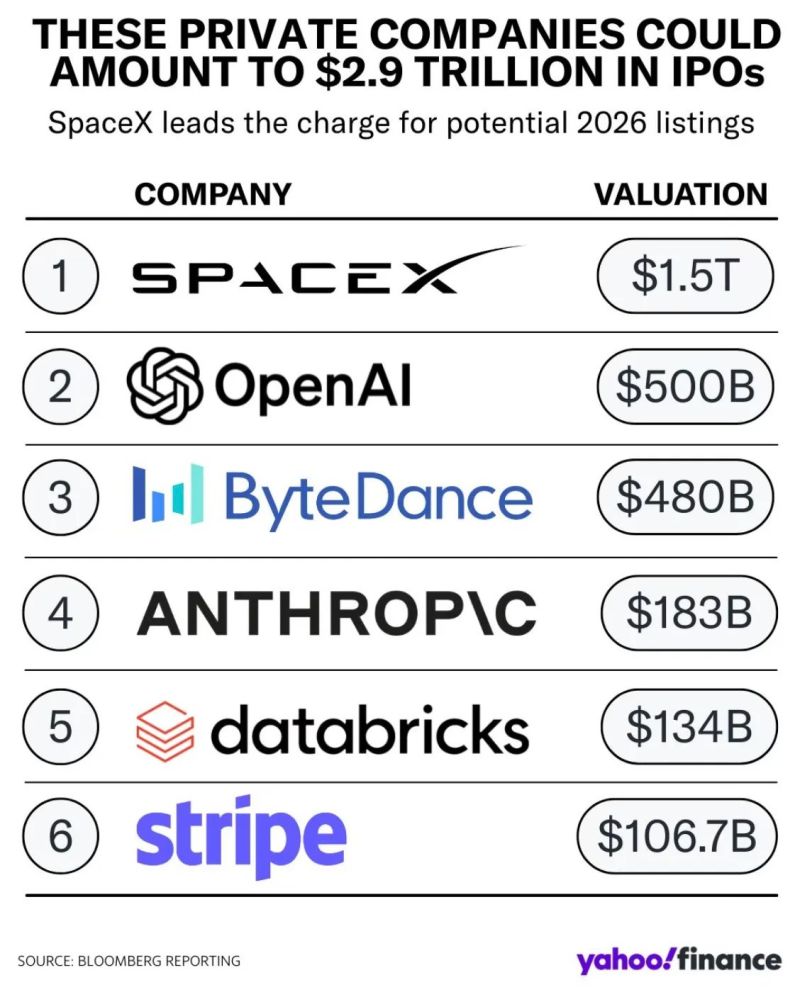

2026 is expected to be the year of BIG IPOs.

See below a nice chart from @YahooFinance on some huge IPOs expected next year. Source: Ryan Detrick

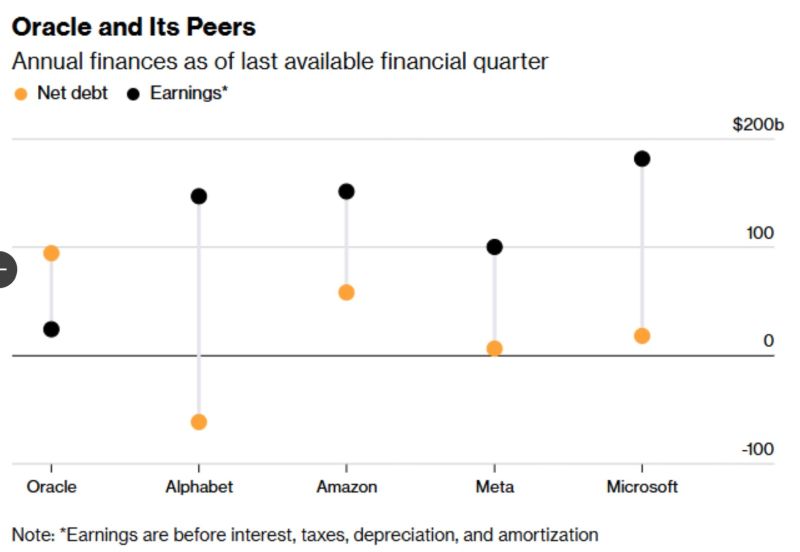

Oracle and its peers... earnings versus debt

(based on last available financial quarter) Source: Bloomberg

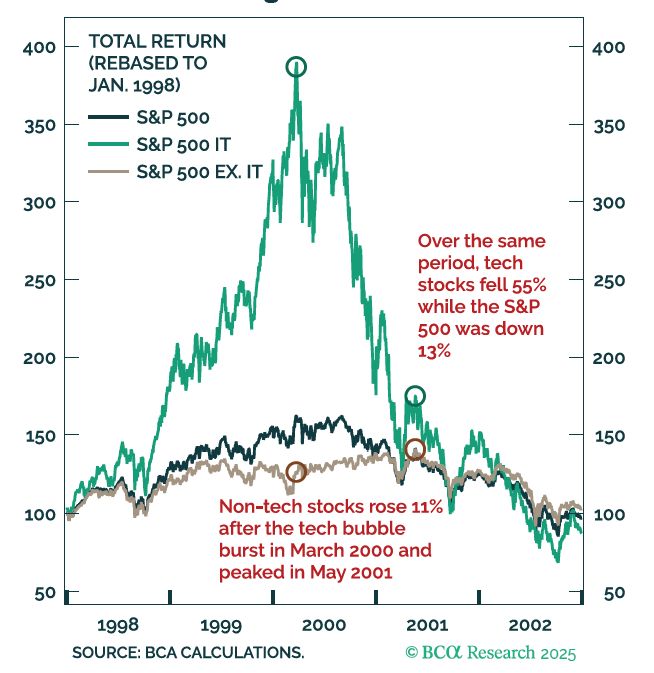

🗓️ A Look Back at the Dot-Com Bubble's Aftermath

For those unfamiliar with the late-1990s internet bubble that burst in March 2000: the pain was initially confined. As Peter Berezin of BCA Research highlighted, non-technology stocks continued their ascent for a full year before the broader market succumbed to the 2001 recession. Is this history set to repeat, ushering in another "great rotation" in the coming months?

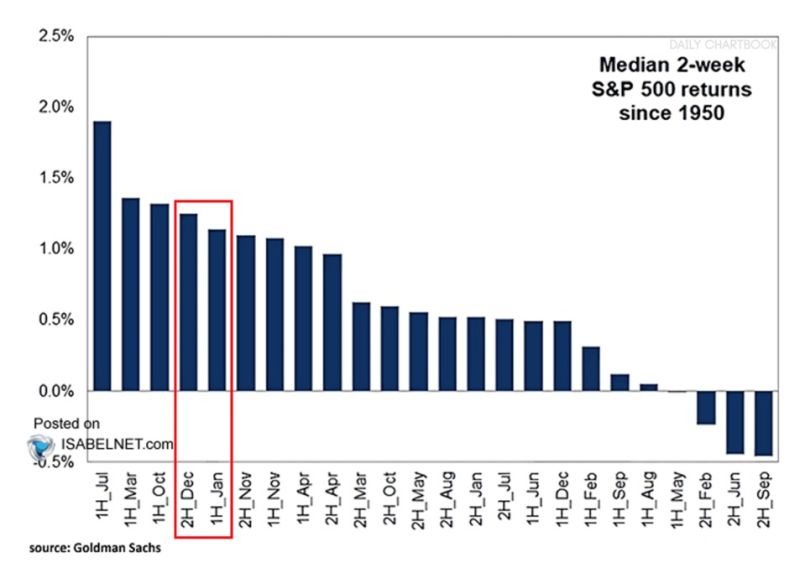

We are running into the 4th and 5th best 2-weeks periods.

And they happen to be back-to-back... Source: Goldman Sachs, isabelnet, RBC

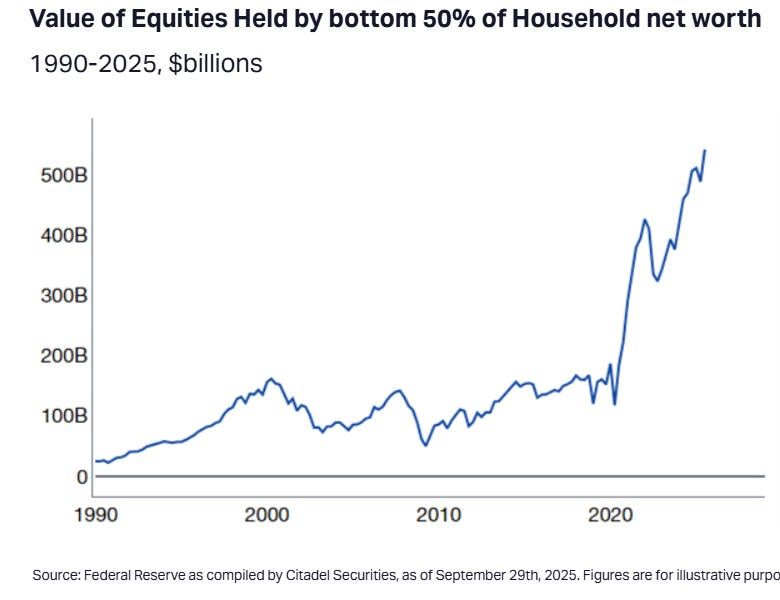

🤯 The Hidden Engine Powering the US Economy

Everyone is talking about interest rates and inflation, but here’s the underappreciated truth: The average US household’s net worth has silently exploded thanks to unbelievable equity returns over the last five years. 📈 That extra few hundred dollars on discretionary spending? It’s mentally offset by a stock portfolio that's sitting significantly higher. The Takeaway: This "wealth effect" isn't just a coincidence, it's likely among the reasons why the long-predicted recession keeps failing to materialize. When people feel richer, they spend! Source: Boring_Business @BoringBiz_

Update: the world didn't end. New all-time closing high

Source: Charlie Bilello

SMALL IS BIG...

The Russell 2000 US small-caps index is extending the break out move. This looks like an inverse head and shoulders formation. Plenty room to run before we reach trend channel highs. Source: LSEG, The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks