Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

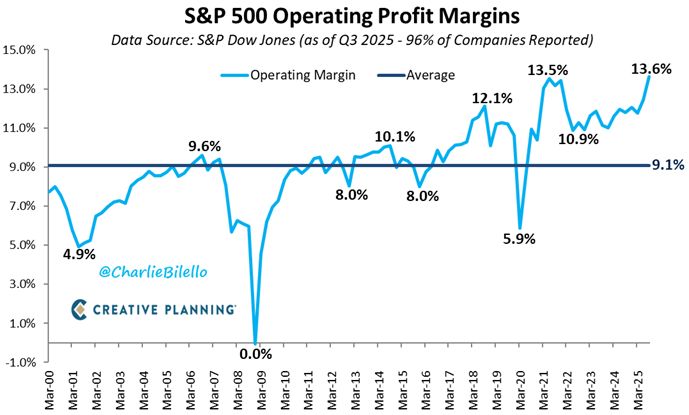

S&P 500 profit margins rose to 13.6% in the 3rd quarter, their highest level in history.

Source: Charlie Bilello

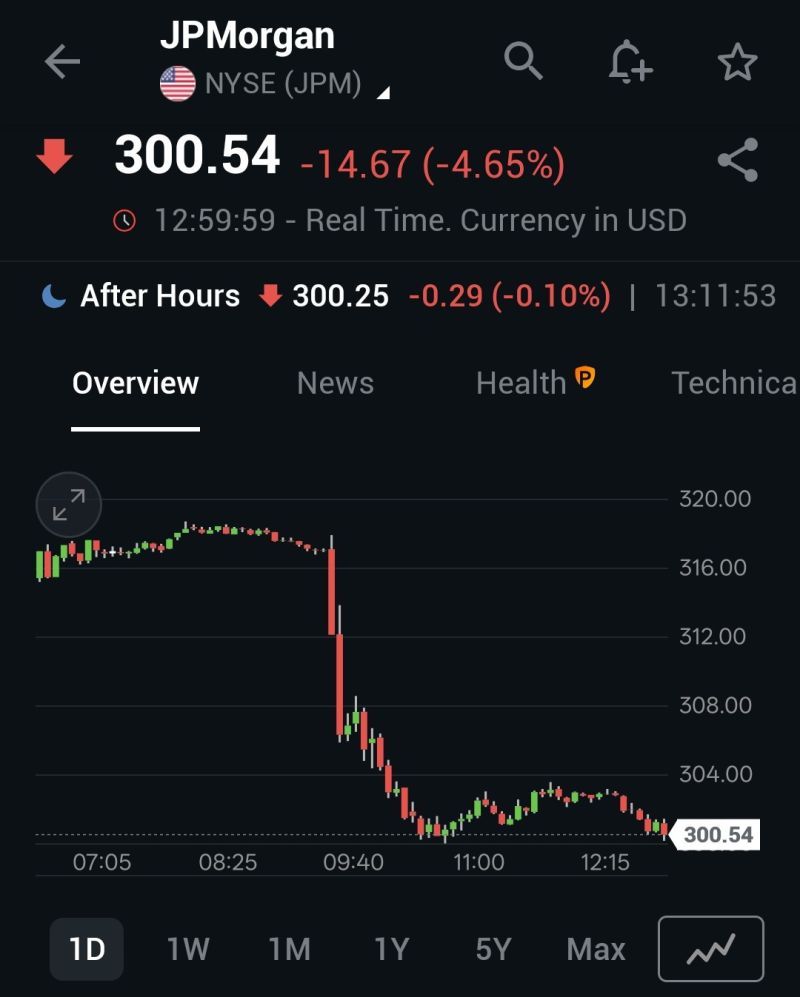

🚨 In case you missed it...

JPMorgan cracked nearly 5% yesterday after the bank told investors that it will spend billions of dollars more in expenses ...

In case you missed it...

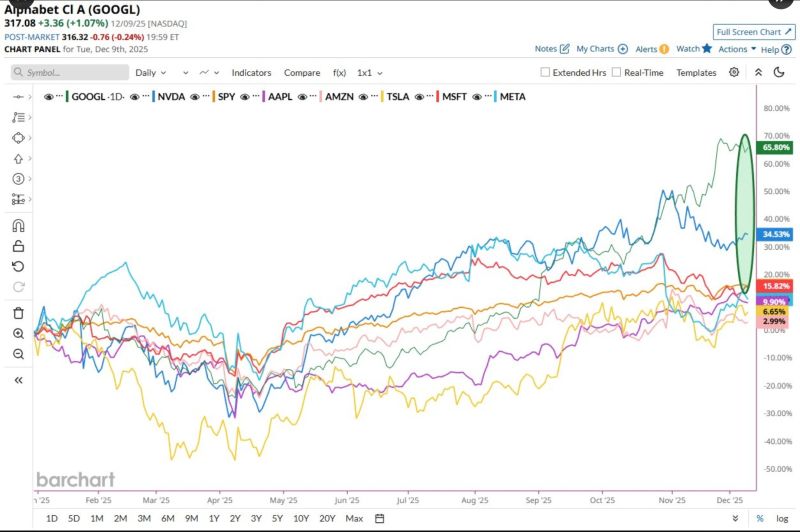

Alphabet $GOOGL and Nvidia $NVDA are now the only 2 Magnificent 7 stocks that are outperforming the S&P 500 this year Source: Barchart

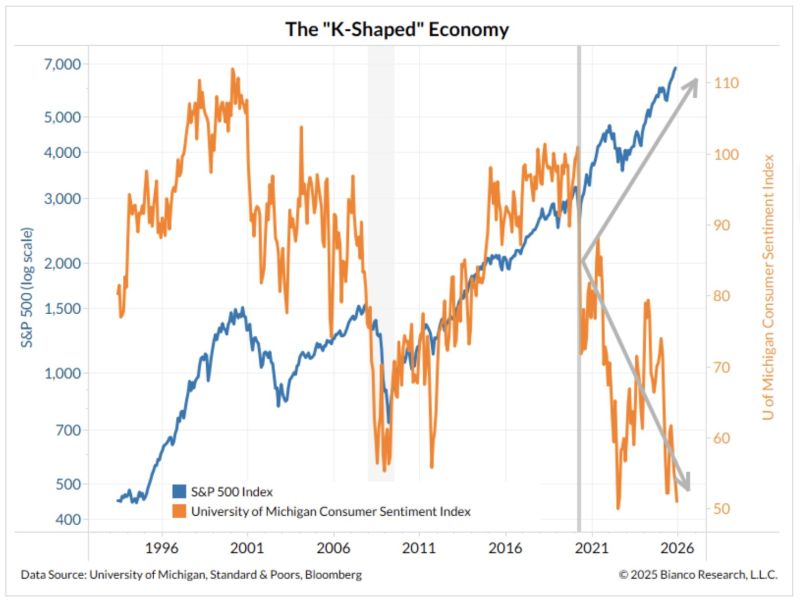

Consumer confidence down, stock market up

A K-shaped economy captured in one chart. (via Bianco Research thru HolgerZ)

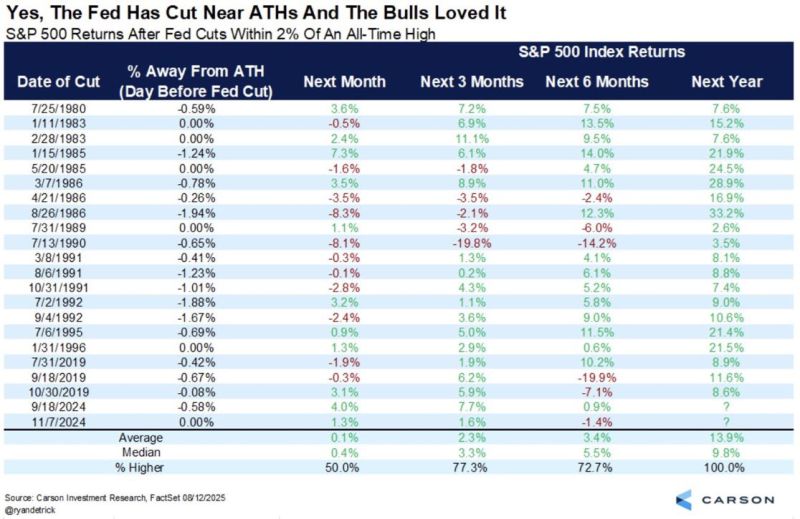

When the Fed cuts interest rates within 2% of stock market all-time highs, the S&P 500 has gone on to finish higher over the next 12 months 20 out of 20 times (100% hit rate) 🚨🚨🚨

Note however that the market reaction in the 3 to 6 months is mixed Source: Carson, Barchart

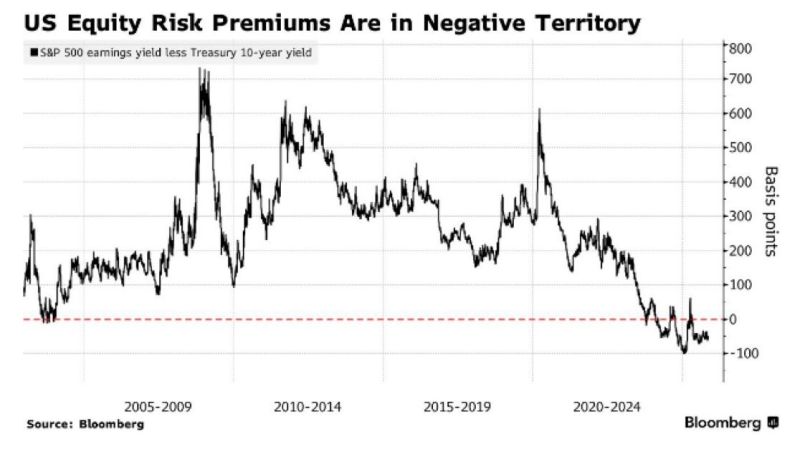

U.S. Equity Risk Premium is now negative 🚨

On a risk-adjusted basis, stocks offer zero return for investors 👀 Source: Bloomberg, Barchart

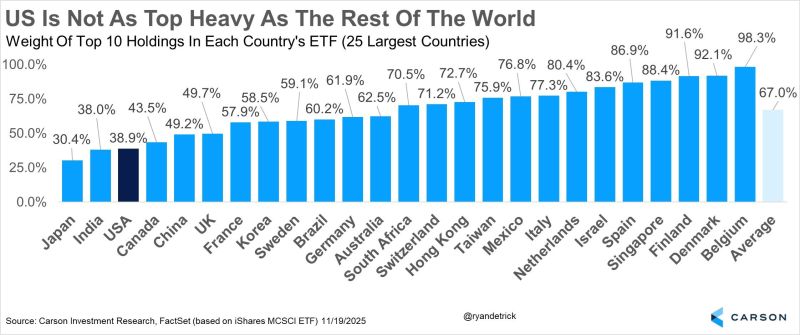

Great chart from Ryan Detrick thru Eugene Ng on X

The top 10 stocks account for ~39% of the US stock market. But many more countries are far higher, China ~49%, Australia 62%, Taiwan 76%, and even Singapore is ~88%.

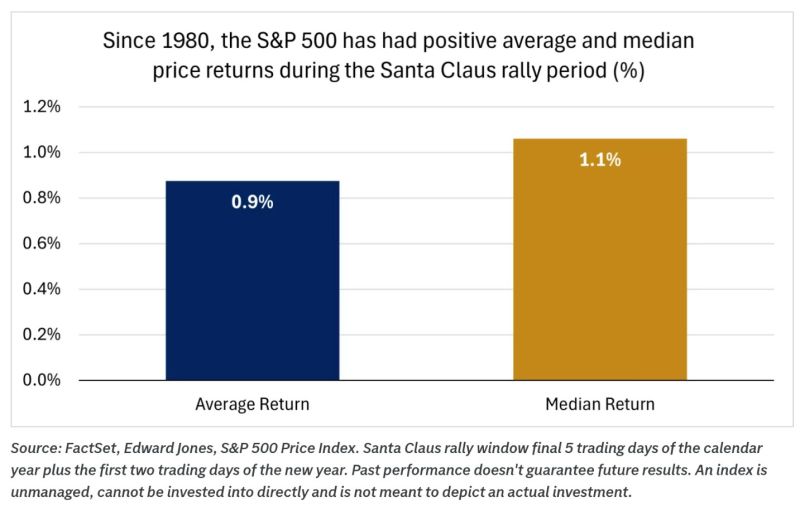

Will Santa be coming to town this year? 🎅

The last five trading days of the year plus the first two trading days of the new year are known as the "Santa Claus rally". Since 1980, there have been positive returns 73% of the time, with average S&P 500 upside of 1.1%. Source: Edward Jones thru Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks