Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🛑 WAKE UP CALL: Could the AI Trade trigger a 15-20% S&P 500 correction? (Goldman Sachs Analysis)

It's not about the current earnings—it's about the Capex future. And if that future changes, the market is in for a shock. Goldman Sachs just dropped a massive warning. The Core Risk: AI Spending Reversal They say that our current S&P 500 valuation is priced for an incredible, long-term AI Capex boom (spending on AI infrastructure). What if that boom stalls? If AI capex growth expectations revert to early 2023 levels, GS estimates the S&P 500 valuation multiple could see a 15-20% DOWNSIDE. That's a huge potential correction driven only by multiple compression. The Extreme Scenario (The Nightmare Fuel) -> Imagine the Hyperscalers slamming the brakes on spending. 🔴 The expected Capex for 2026 is approximately $433 billion. A reversion to the 2022 Capex level of $158 billion would result in a massive reduction of $275 billion—the "Lost Capex." 🔴This $275 billion shortfall represents a 30% reduction to the consensus estimate of $1 trillion in S&P 500 sales growth. Consequently, the expected S&P 500 revenue growth rate would drop sharply from the consensus of 6% to approximately 4%. ➡️ Ultimately, this decrease in spending would pose a substantial downside risk to both the AI investment trade and the broader S&P 500 market. The Takeaway for investors: This isn't about today's P&L. It's about the market's perception of tomorrow's AI-driven growth. A dramatic cut in capex would signal the long-term AI earnings thesis is broken, leading to a much steeper decline in stock valuations than a simple revenue reduction would suggest. 🔑 Don't miss this point: Near-term revenues might only drop modestly, but the hit to long-term earnings growth expectations will crush valuations. Source: Goldman Sachs, Neil Sethi @neilksethi

When you see this chart, do you really want to go short Tesla ?

Source: J-C Parets, TrendLabs

Gold's long-term correlation with the S&P 500 has just reached an extremely high level, only seen in...August 2007.

Source: Guilherme Tavares i3 invest

Wall Street just dropped its 2026 stock market forecast... and they're expecting another year of double-digit gains for US equities! 🚀

The consensus among major investment banks surveyed by the FT sees the S&P 500 soaring past 7,500 by the end of 2026—a roughly 10% increase from current levels. What's fueling the bull market? 📌 The Triumvirate: Analysts at Morgan Stanley point to "easy fiscal, monetary and regulatory policy," including the estimated $129bn in corporate tax cuts from the Trump administration. 📌AI Tailwinds: The market believes it has shrugged off recent jitters over Big Tech valuations. Companies like Nvidia, the world's first $5T company, continue to power the index. 📌Rate Cuts: Investors are pricing in 3-4 quarter-point Fed rate cuts by the end of next year, boosting sentiment. The Great Debate: 🐂 Most Bullish (Deutsche Bank): Sees the S&P hitting a massive 8,000, betting on corporate earnings broadening out beyond tech. 🐻 Most Cautious (Bank of America): Forecasts just 7,100, warning that AI spending and data center build-out have yet to appear in better earnings. "For now investors are buying the dream." Note however that while such gains would mark the seventh year of double-digit gains in the past eight, they would represent a slowdown from the 16.6 per cent rise so far in 2025 and the average over the past decade - see chart below https://lnkd.in/eKYt6PK7 Source: FT

In case you missed it... The Russell 2000 index is well ahead of the Nasdaq100 $NDX over the past 6 months.

Source: The Market Ear, LSEG Workspace

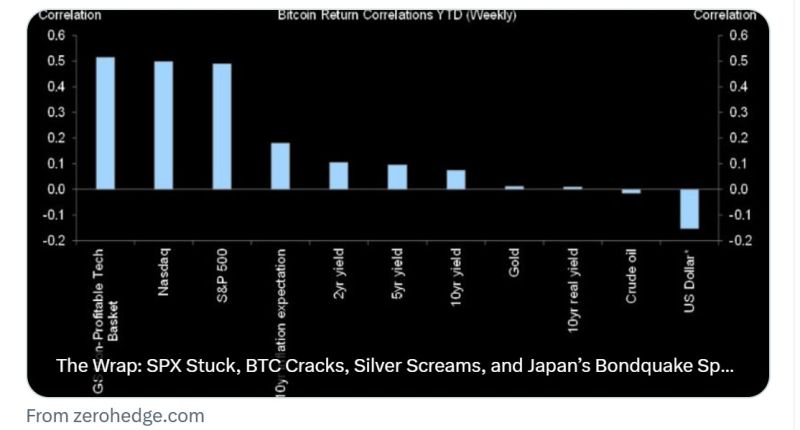

The Market Ear: "When you trade BTC, you're basically trading unprofitable tech, not a store of value, not dollar debasement".

As shown below, bitcoin has a high correlation with unprofitable tech stocks and the Nasdaq.

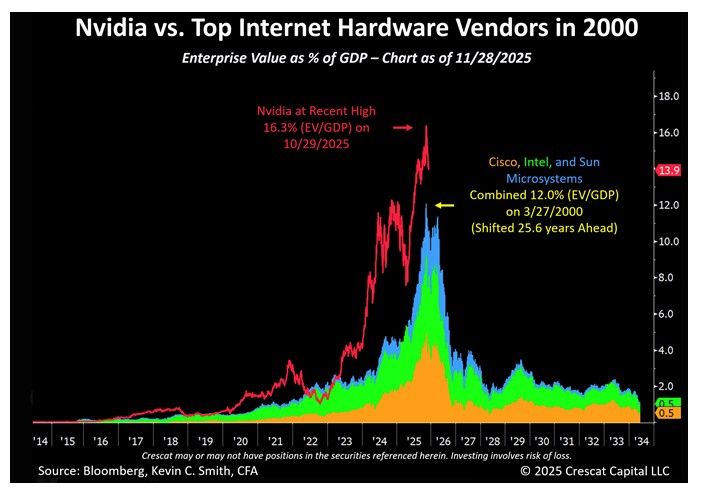

Great chart by Tavi Costa showing Mega-caps hardware stocks Entreprise Value as a % of GDP - 2000 vs. today...

We think Nvidia has a different profile. Still, this is a scary one...

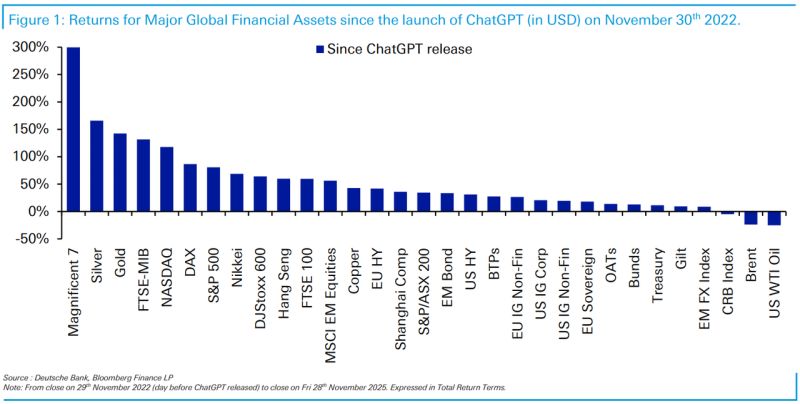

🔥 Three Years Since The Launch Of ChatGPT, Here Are The Biggest Winners And Losers 🔥

To celebrate ChatGPT’s 3-year anniversary, Deutsche Bank kicked off “AI Week” — using AI to build every Chart of the Day. And the first set of charts tells an incredible story: 🚀 Winners: The Magnificent 7 didn’t just outperform… they rewrote market history. Nvidia: +1,020% Broadcom: +712% Western Digital: +500% Meta: +499% The Mag-7 as a group? ~+300% since late 2022. Stunning. 💥 Losers: Market darlings turned disasters: First Republic – gone SVB – collapsed Moderna – -85% from 2022, -95% from peak Pfizer? Now trading back at 1998 levels and -60% from its highs, despite 3× the earnings it had in 2000. 💡 The Lesson: In just three years, AI exploded, market leadership flipped, and the biggest winners and losers were almost impossible to predict in real time. Nothing in markets is permanent — not hype, not dominance, not even “blue-chip safety.” A perfect way to kick off AI Week. Source: DB, zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks