Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

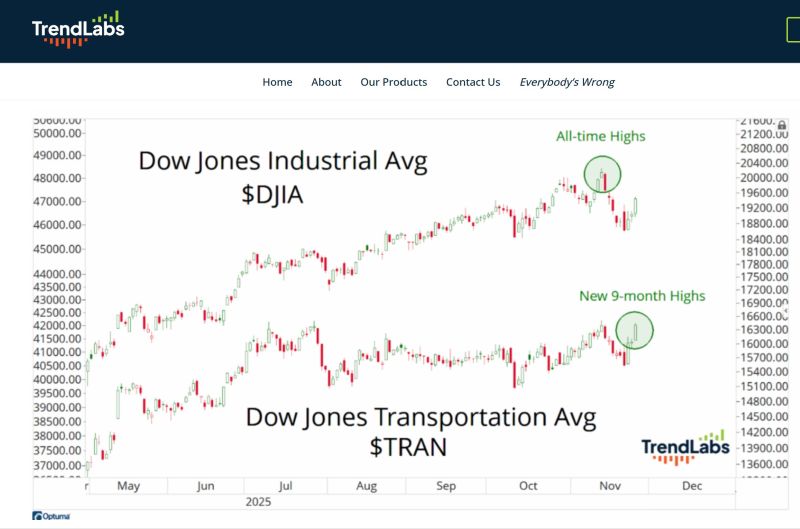

Dow Theory says this is a bull market

Most people watch the Dow Jones Industrial Average (DJIA) and think they understand the market. But smart investors know: The trend isn’t real until the Transportation Index agrees. Here’s why ⬇️ 🔍 The Logic (100+ years old… still undefeated) If manufacturers (Industrial Average) are doing well, they should be shipping more goods. If more goods are being shipped, transportation companies (Transportation Average) should also be trending up. Production ↑ → Shipping ↑ → Healthy trend confirmed If Industrials rise but Transports fall? 🚨 Something’s off. Demand may be weakening. 🧠 How Dow Theory Uses This ✔️ Bull trend confirmed Both DJIA and DJTA make higher highs + higher lows. ✔️ Bear trend confirmed Both make lower lows + lower highs. ❌ No confirmation One goes up, the other flat/down → The trend is suspect. Momentum may be false or weakening. Source chart: J-C Parets

In case you missed it...

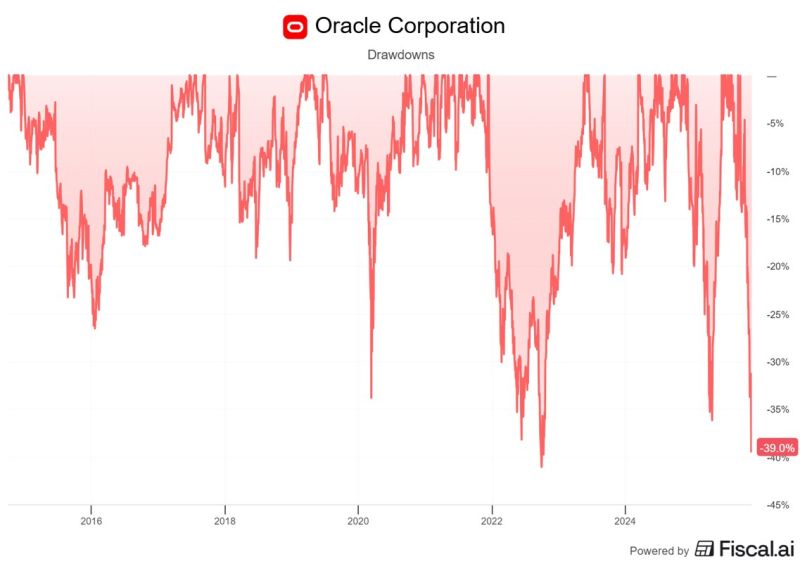

Oracle $ORCL is now approaching its largest drawdown in a decade Source: Shay Boloor @StockSavvyShay

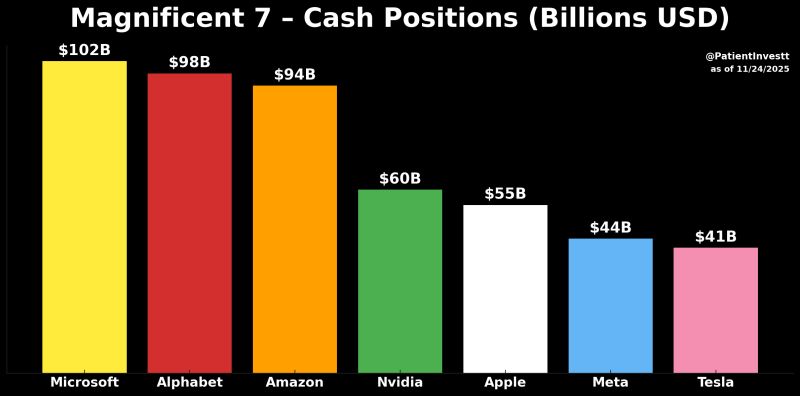

Magnificent 7s Cash Position💰:

$MSFT: $102 Billion $GOOGL: $98 Billion $AMZN: $94 Billion $NVDA: $56 Billion $AAPL: $55 Billion $META: $44 Billion $TSLA: $41 Billion Patient Investor @patientinvestt

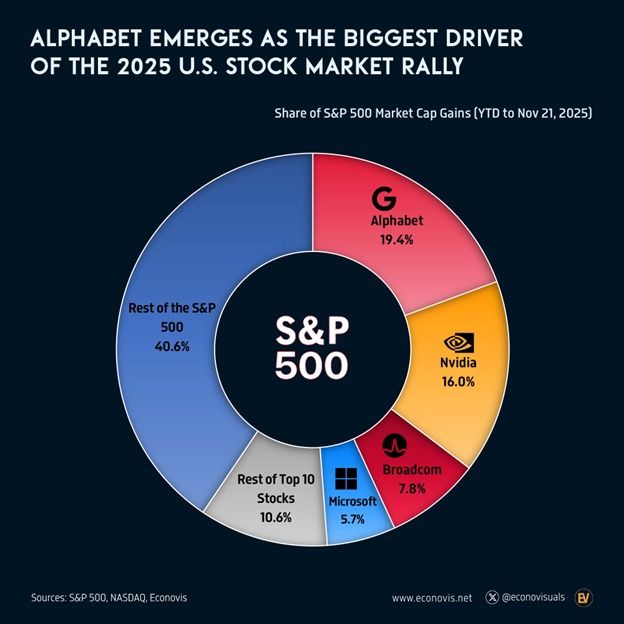

🚀 Big Tech Is Carrying the Entire Stock Market — Literally

Alphabet ($GOOGL) has been the single biggest driver of the S&P 500 this year… accounting for 19.4% of the index’s entire YTD gain. That’s what happens when you add $1.3 trillion in market cap in 11 months. Right behind it? Nvidia ($NVDA): +16.0% contribution (+$1.05T) Broadcom ($AVGO): +$520B Microsoft ($MSFT): +$380B Together with the rest of the mega-cap giants, the top 10 stocks now make up 59.4% of the S&P 500’s total gain this year. Which means the other 490 companies combined contributed just 40.6%. Source: The Kobeissi Letter, econovisuals

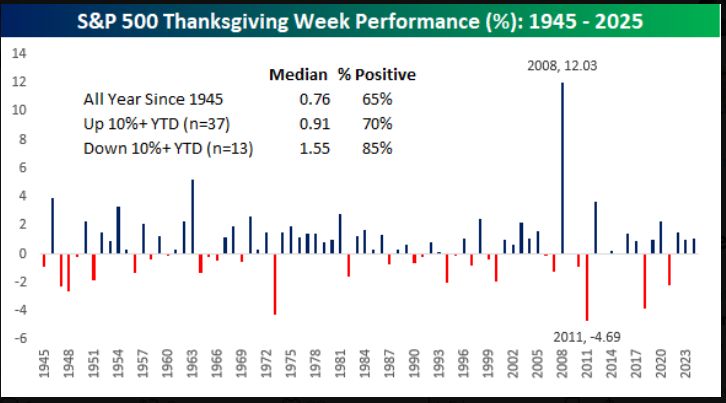

Late November gonna late November?

Stocks bottomed on November 20 and have staged a pretty impressive three day rally. Exactly in line with normal seasonality... Source: Ryan Detrick, Carson

It may be a short week, but Thanksgiving week has traditionally been good for equities.

source : bespoke

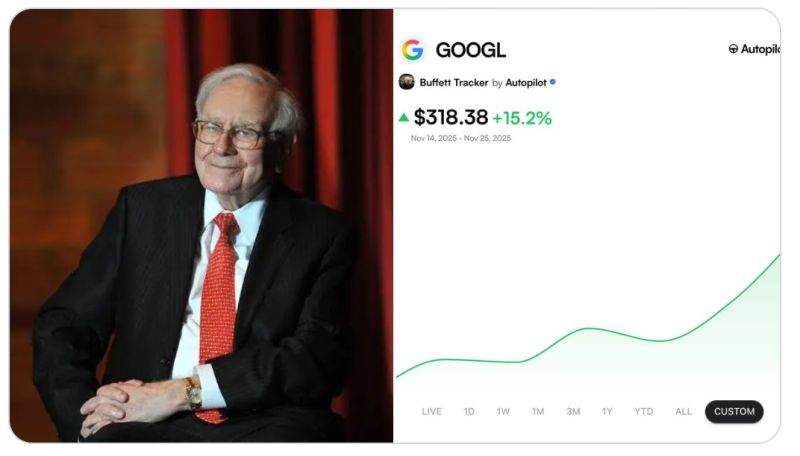

Google $GOOGL is now up 15% since Buffett's Berkshire disclosed a $4B stake

Source: Michael Burry Stock Tracker ♟ @burrytracker

Investing with intelligence

Our latest research, commentary and market outlooks