Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Walmart to Transfer Stock Exchange Listing to Nasdaq

Walmart Inc today announced it will transfer the listing of its common stock to The Nasdaq Stock Market LLC (Nasdaq). The company expects its common stock to begin trading on the Nasdaq Global Select Market on December 9, 2025, under its current ticker symbol "WMT". source : bloomberg

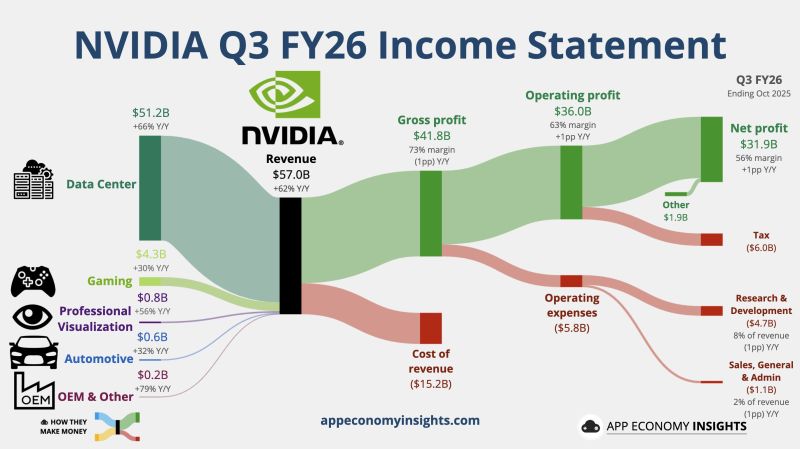

Nvidia $NVDA said sales to just its number one largest customer represented 22% of its total $57 Billion of revenue during Q3

That means someone spent $12.5 Billion with Nvidia during the quarter 🤯 61% of Nvidia $NVDA Q3 revenue came from just 4 customers: $12.54B – Customer A (22%) $8.55B – Customer B (15%) $7.41B – Customer C (13%) $6.27B – Customer D (11%) So who are A, B, C, D in your view ??? Source: Wall St Engine on X, Evan on X

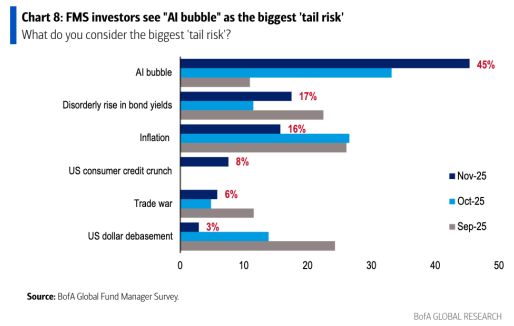

45% of fund managers surveyed by Bank of America in November said an "AI bubble" was the biggest tail risk for markets, spiking from just 11% in September.

Over half of these investors said they think AI stocks are already in a bubble. Source: BofA

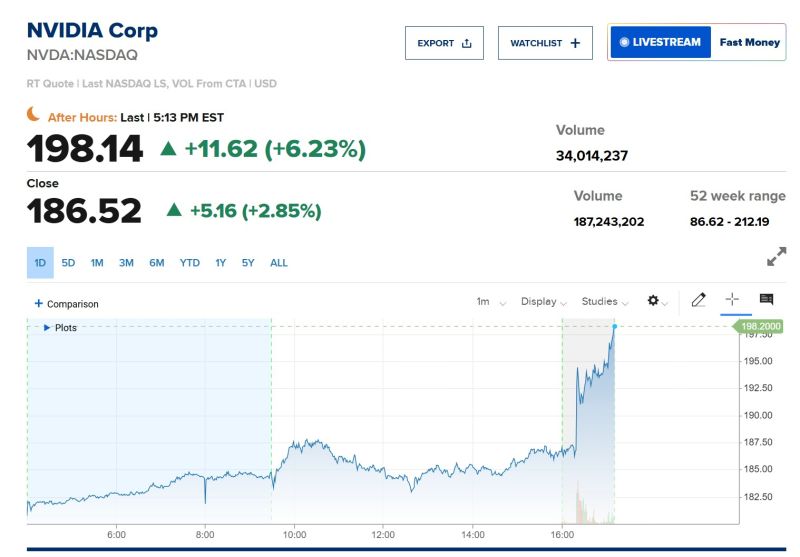

Nvidia $NVDA saves humanity again with blowout earnings... 🚀

Q3 REV: $57.01B vs $55.19B exp. Q3 EPS: $1.30 vs $1.25 exp Q4 REV: $63.7B TO $66.3B vs $62B exp “Blackwell sales are off the charts, and cloud GPUs are sold out.” — Jensen Huang, Q3 FY26 earnings release (Nov 19, 2025) $NVDA is up +6% after-hours... The market is saved

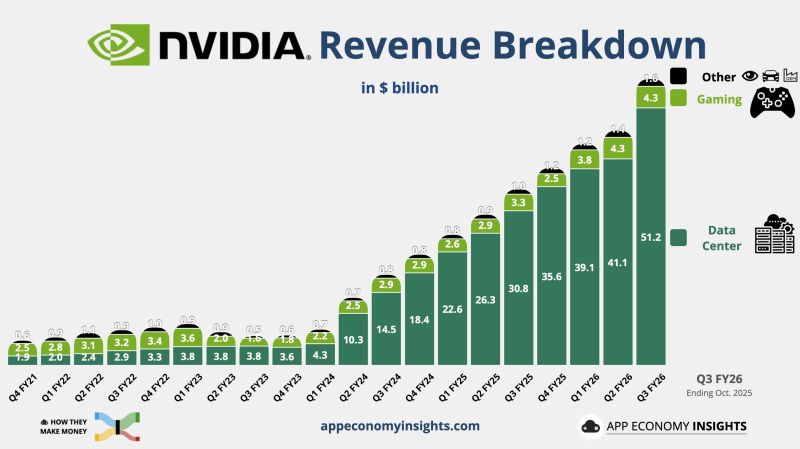

$NVDA NVIDIA Q3 FY26 (October quarter).

• Revenue +62% Y/Y to $57B ($1.9B beat). • Operating margin 63% (+1pp Y/Y). • Non-GAAP EPS $1.30 ($0.04 beat). Q4 FY26 guidance: • Revenue $65B ($3.2B beat). Source: App Economy Insights @EconomyApp

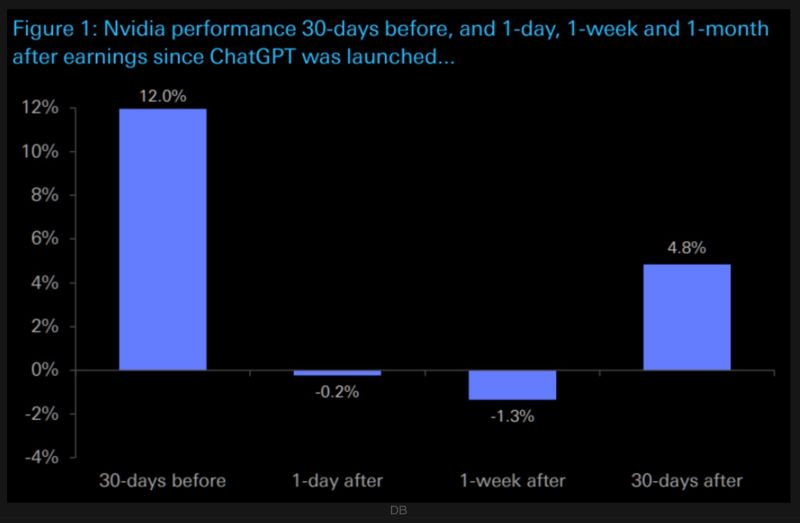

➡️ Over the past eleven releases since ChatGPT launched, NVDA’s massive 10x rally hasn’t come from earnings-day pops:

Day-after and week-after moves have typically lagged, while the month before earnings has usually been the strong stretch. ➡️This quarter breaks that pattern, NVDA is flat heading into results, with recent earnings cycles showing weaker immediate reactions and stronger rallies later in the quarter. Source: The Market Ear, DB

$NVDA NVIDIA Data Center literally off the charts.

Source: App Economy Insights

Is this really sustainable? We will find out more later today

Source: Markets & Mayhem @Mayhem4Markets

Investing with intelligence

Our latest research, commentary and market outlooks