Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Nvidia $NVDA in danger of closing below its 100-day moving average for the first time since May

Source: Barchart

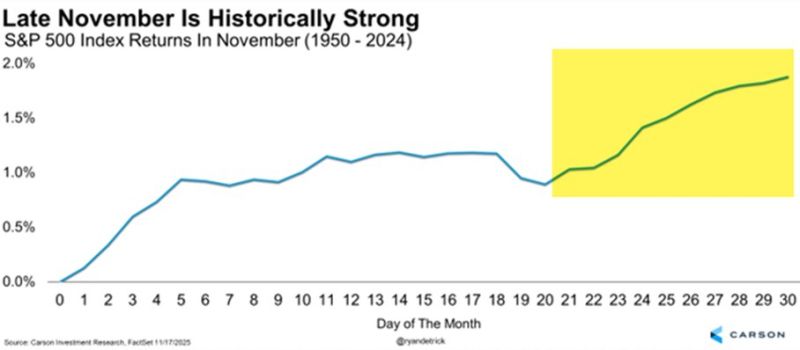

Late November is historically a strong time of the year. Is this year going to be different?

Source: Ryan Detrick, CMT @RyanDetrick

⚠️Retail investors are ALL-IN on US equities:

Individual investors' equity allocation hit 70.5%, near the highest since the 2000 Dot-Com Bubble burst. This is also in line with the 2021 meme stock frenzy peak. Their cash allocation remains historically low at 14.7%. Source: Global Markets Investors

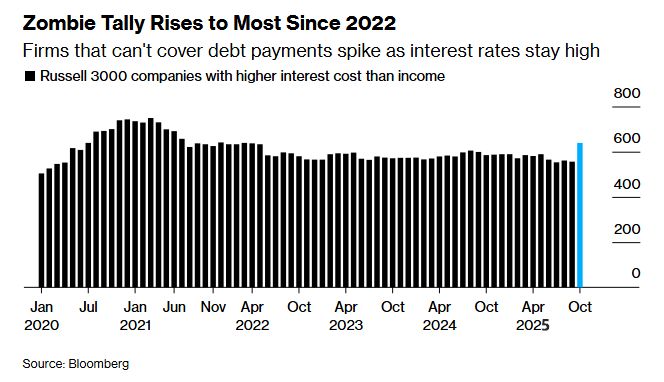

Zombie Companies (businesses unable to cover their debt payments) have reached the highest level in almost 4 years 🚨🚨🚨

Source: Bloomberg

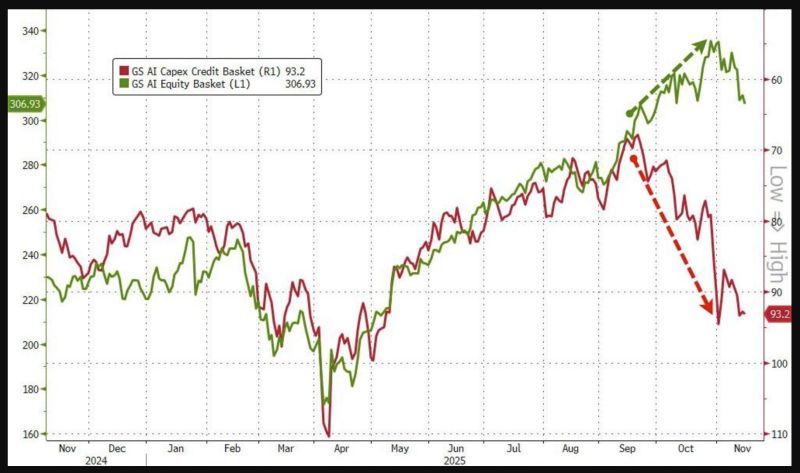

Credit spreads of the hyperscalers (red line - inverted) continue to widen out...and start to put donward pressure on AI equity basket (green line)

Source: Zerohedge

The spread between tech and Bitcoin is stretched to historic extremes.

Either $BTC reclaims ground, or $NQ has unfinished business on the downside. Source: Trend Spider

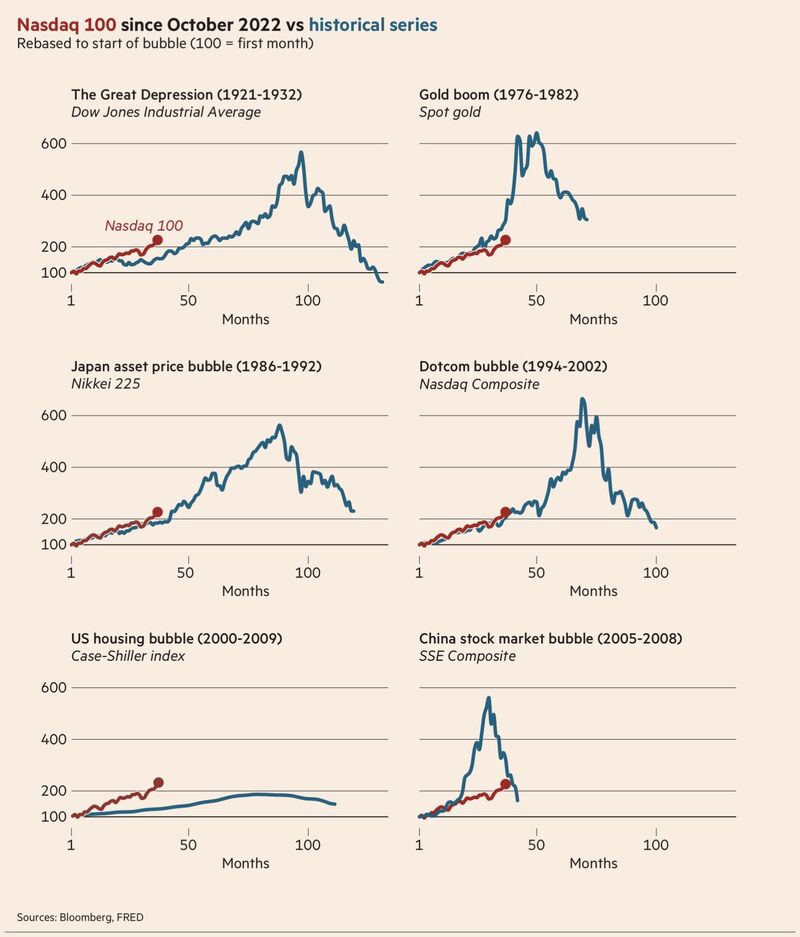

”The AI Bubble” in perspective.

What if the doomsayers are right but they have been, and they continue, miss the last +30% of the ”bubble” for their told-you-so moment? This is indeed what already happened most of this year. Source: Emre Akcakmak, Bloomberg, FT

Billionaire investor Peter Thiel fully exited Nvidia $NVD in Q3, selling all ~537k shares that were nearly 40% of his fund, per his latest 13F.

Thiel Macro has cut US equity holdings from about $212m to $74m and is now basically parked in Tesla, Microsoft and Apple. Source: Wall Street Engine

Investing with intelligence

Our latest research, commentary and market outlooks