Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

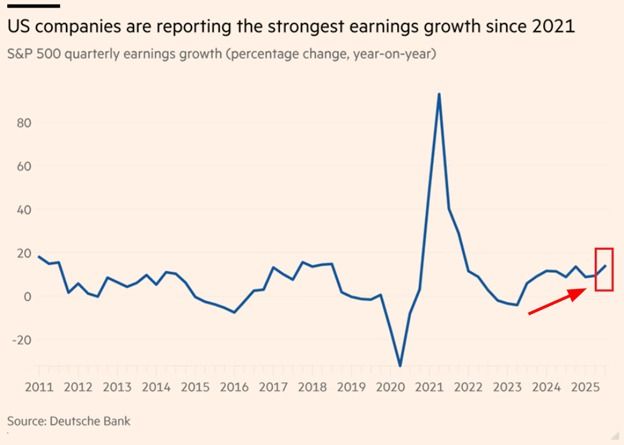

US corporate earnings growth is booming:

S&P 500 quarterly earnings growth is up to +18% YoY in Q3 2025, the highest since Q3 2021. Excluding the post-pandemic recovery, this marks the strongest growth since 2018. This comes as 6 of the 11 S&P 500 sectors reported positive average EPS growth in Q3, a material improvement from just 2 sectors in Q2. Additionally, median profit growth in the Russell 3000 index hit +11% YoY, the highest since Q3 2021 and up from +6% in Q2. Overall, the frequency of earnings beats is now among the highest on record. Earnings momentum is incredibly strong. Source: FT, Global Markets Investor

*SOFTBANK SHARES FELL AS MUCH AS 10% (before recovering somewhat to close at -3.5%)

Maybe liquidating NVDA to invest in its biggest cash-incinerating client wasn't the best idea... Source. zerohedge

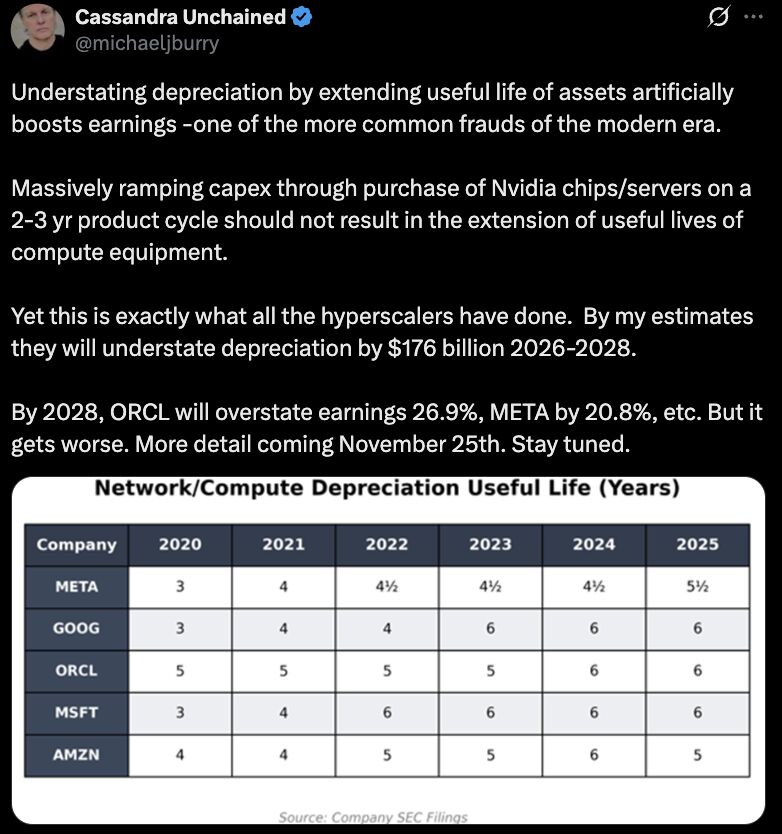

Michael Burry has said that Oracle, $ORCL, and Meta, $META, could overstate earnings by 26.9% and 20.8%.

He adds: "It gets worse." Source: unusual_whales @unusual_whales

🚨 TSMC’s Growth Just Slowed — and the Entire AI Supply Chain Is Watching

Bloomberg reports TSMC’s October sales rose 16.9% — still strong, but slower than the recent surge. Why it matters: TSMC sits at the choke point of advanced chips. When it slows, the ripple hits GPUs, memory, packaging, the whole AI stack. 📉 A slowdown in monthly sales doesn’t always mean weak demand. It can be: - Order timing (customers shifting deliveries) - Yield ramps (new node transitions) - Inventory digestion (buyers catching up) But zoom out… 💰 Cloud giants plan to spend >$400B on AI infrastructure next year — a 21% jump. That money flows straight into NVIDIA GPUs, high-bandwidth memory, advanced packaging, and TSMC’s cutting-edge wafers. 🗣️ NVIDIA’s CEO says demand is “getting stronger month by month” and even met with TSMC’s CEO to ask for more capacity. Translation: supply, not demand, is still the bottleneck. TSMC also builds for AMD, Qualcomm, and Apple — so who gets priority at the fab affects entire product launches. 🎯 The company says capacity is “very tight,” and chip designers are literally chasing slots in Hsinchu. Source: Bloomberg, Rohan Paul @rohanpaul_ai

$AMD is the second best performing position over the last 10 Years in the S&P 500

Source: Charlie Bilello

The best performing stocks in the S&P 500 this year...

Source: Charlie Bilello

Germany, continues to lose ground on global stock markets.

The market value of German equities has dropped to just 2% of total global market capitalisation, as the early-year momentum has completely faded. Source: HolgerZ, Bloomberg

Lot of panic out there, but don't lose faith in November yet.

S&P 500 up 10% YTD heading into November? November higher 13 of the past 14 years. Final two months of the year higher 16 times in a row. Source: Ryan Detrick, CMT @RyanDetrick

Investing with intelligence

Our latest research, commentary and market outlooks