Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

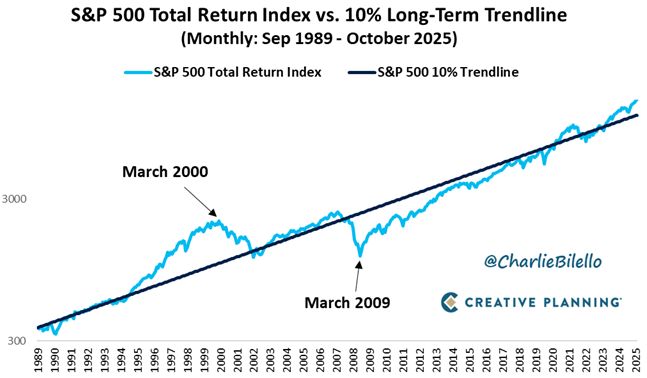

The S&P 500 has gained 10% per year over the long run (including dividends) but that return hasn't come in a straight line.

Changes in investor sentiment have led to huge deviations from the 10% trendline at times, with periods of extreme greed (2000) & extreme fear (2009). $SPX Source: Charlie Bilello

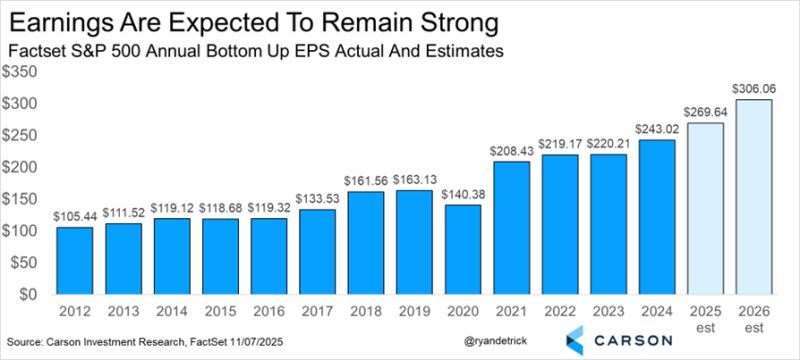

A week ago, S&P 500 Q3 earnings were up 10.7% YoY.

Today is it 13.0%. Earnings continue to drive this bull market. Source: Ryan Detrick, CMT @RyanDetrick Carson

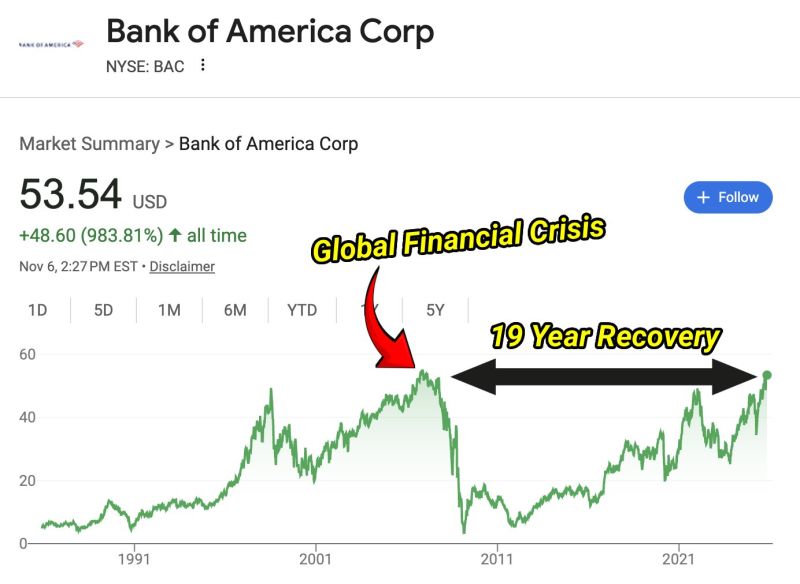

Yesterday was officially the first day Bank of America stock has fully recovered from the Global Financial Crisis.

Source: Dividendology @dividendology

Challenger Job cuts was one of the reasons for the equity market weakness yesterday..

Given the lack of government data, any report gets huge attention... Source: RBC, Bloomberg

Is bitcoin weakness signalling more downside ahead for the Nasdaq?

Source: Bloomberg

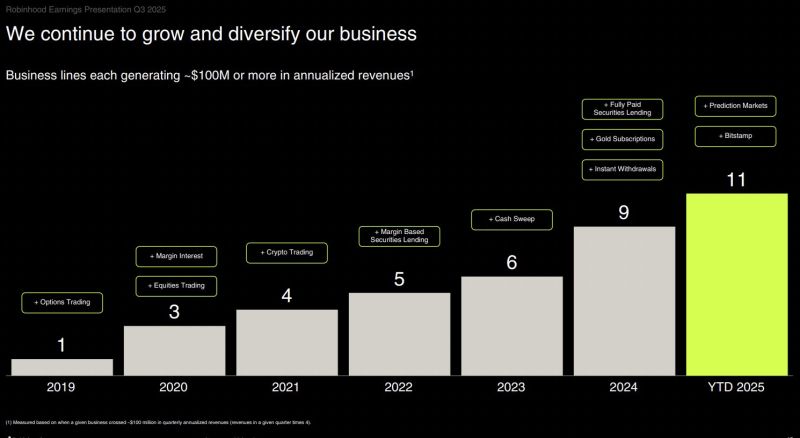

Robinhood $HOOD now has 11 separate business segments generating more than $100 Million of revenue on an annualized basis.

Source: Source: Evan @StockMKTNewz

$SPY S&P 500 is back at multi-month channel support.

Can the bulls pull off another stick save? Source: TrendSpider LLC

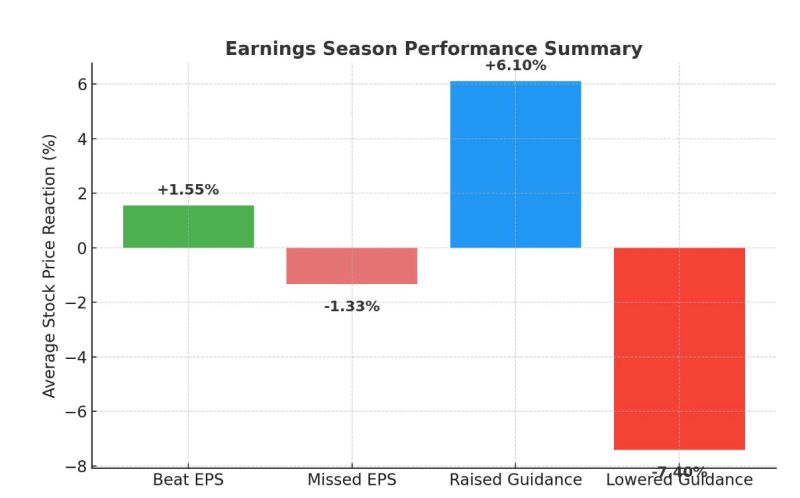

Bespoke on US earnings season thus far:

--Stocks that beat EPS estimates have risen 1.55% while stocks that have missed EPS have fallen 1.33%. --Stocks that have raised guidance (62) have risen 6.1%, while stocks that have lowered (29) have fallen 7.4%. Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks