Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Mag 7 Stocks now outperforming the S&P 500 by the largest margin in history

Source: Barchart

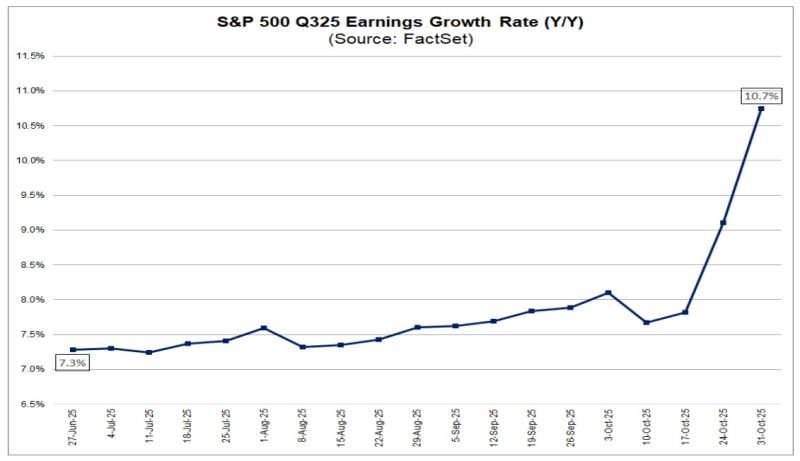

Great chart from @FactSet that shows the vertical move in Q3 earnings.

Source: Ryan Detrick, CMT @RyanDetrick

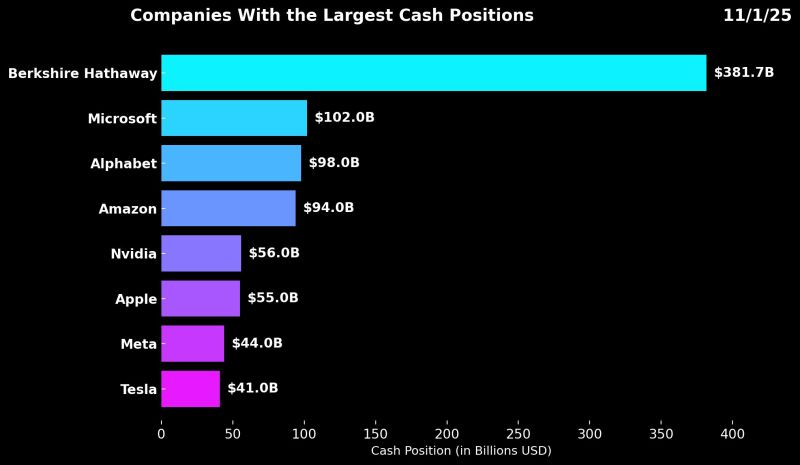

Top Cash Rich Stocks in the Market💰:

- Berkshire Hathaway $BRK.B: $381.7 Billion - Microsoft $MSFT: $102 Billion - Alphabet $GOOGL: $98 Billion - Amazon $AMZN: $94 Billion - Nvidia $NVDA: $56 Billion - Apple $AAPL: $55 Billion - Meta $META: $44 Billion - Tesla $TSLA: $41 Billion Source: Patient Investor @patientinvestt

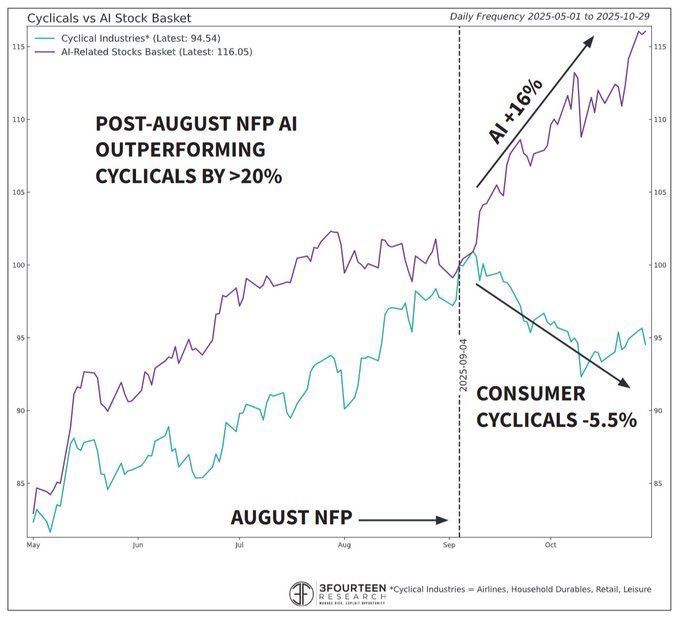

AI mania is the only game in town as the real economy sinks.

Great chart from @WarrenPies highlighting the recent divergence. Source: Bob Elliott @BobEUnlimited

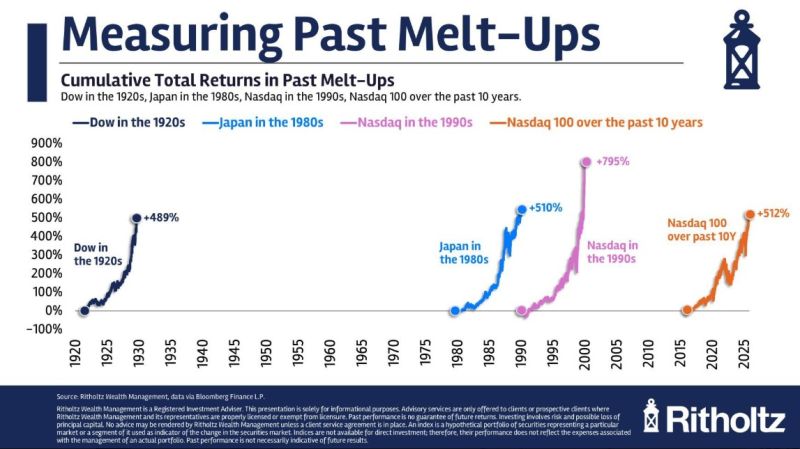

The Melt-Up

"However you measure it, tech stocks are on an all-time heater. This is one of the great bull markets we’ve ever witnessed. So now what? Source: Ritholtz @RitholtzWealth

The total value of the US stock market is now ~245% of the country’s GDP – far above the 100% level that Warren Buffett considers a sign of a market bubble.

Source: HolgerZ, Bloomberg

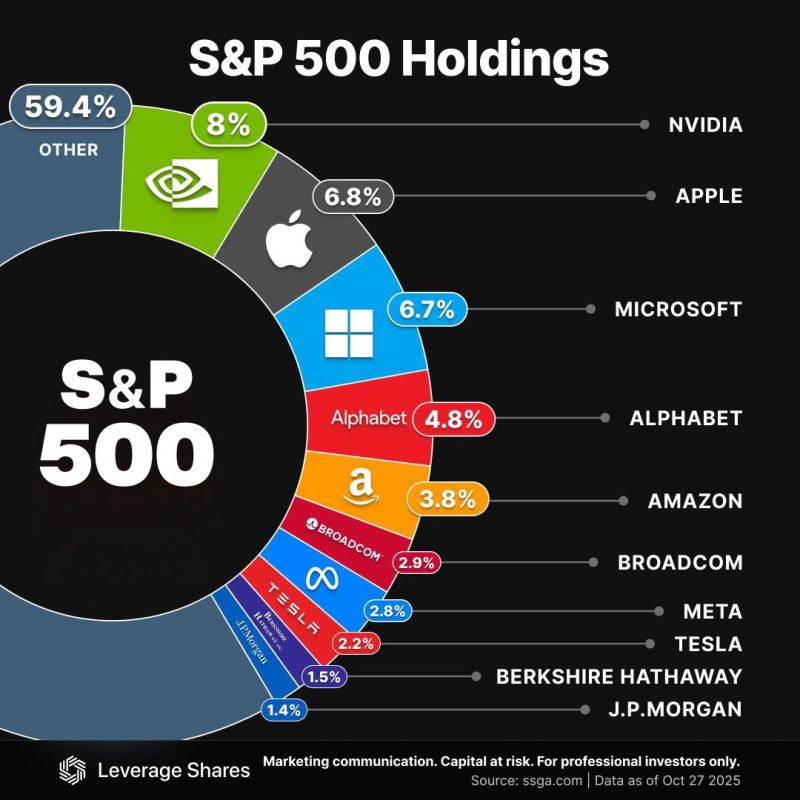

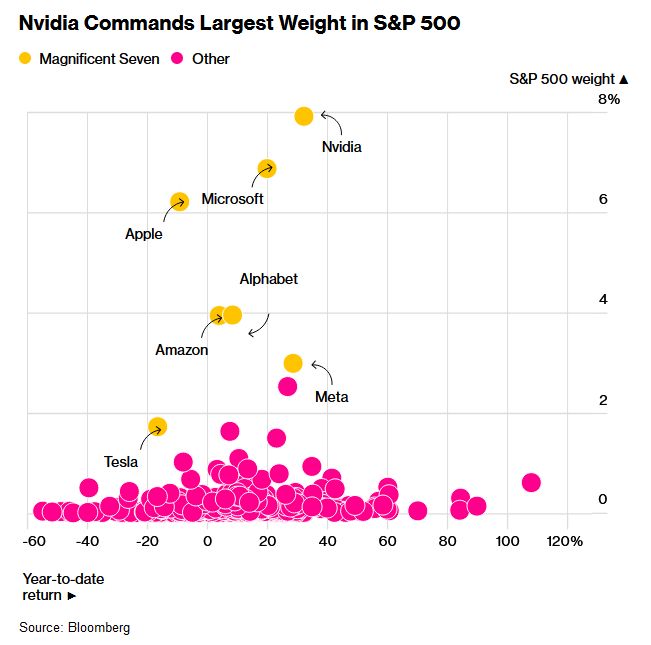

🚨 Such concentration has almost NEVER happened:

NVIDIA accounts for 8% of the S&P 500's market cap, the highest for any company in history. Microsoft’s and Apple’s shares are 6.5% and 6.0%, respectively. The top 10 companies represent a record 40% of the index's total value. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks