Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The S&P500 valuation is higher than historical average for a reason.

Net income margins are in a secular uptrend. "People throw that word around far too easily; a bubble is a relatively rare event, and not something that occurs annually. We see bubbles only once every few decades." https://buff.ly/hPw3gQj by @Ritholtz

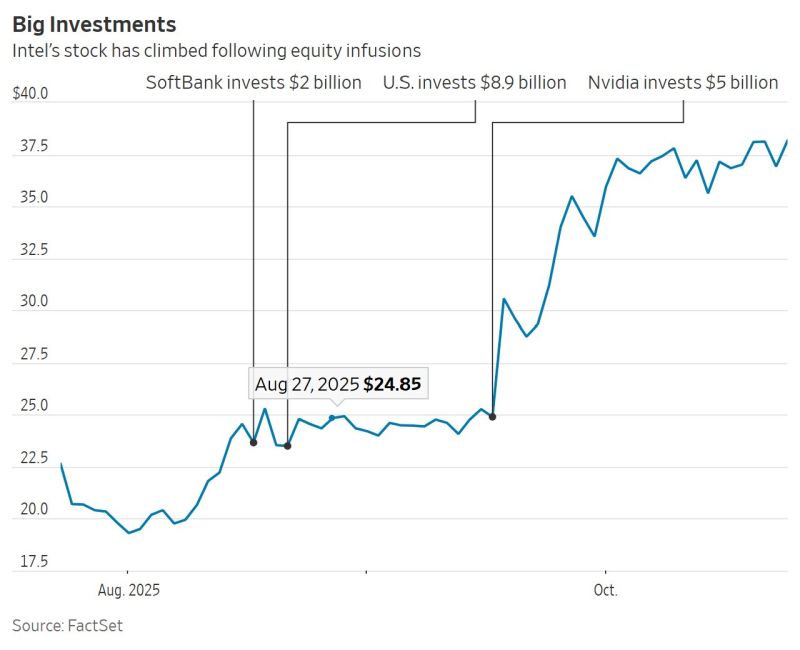

🔥 From “Has-Been” to “Too Important to Fail” 🔥

Intel’s comeback story isn’t just about chips — it’s about industrial strategy. As The Wall Street Journal noted today, “Investors seem to be betting that Intel is too important to fail.” 💡 The U.S. government’s deep involvement — driven by national security priorities — has transformed Intel’s trajectory: 🏛️ Direct support through policy and funding 🤝 Indirect momentum as partners and investors rush back in 💰 New contracts, new capital, and renewed confidence This is what modern industrial policy looks like — when national interest and private innovation align. Intel isn’t just rebuilding a company… it’s reshaping an ecosystem. Source: Mo El Erian, WSJ, Factset

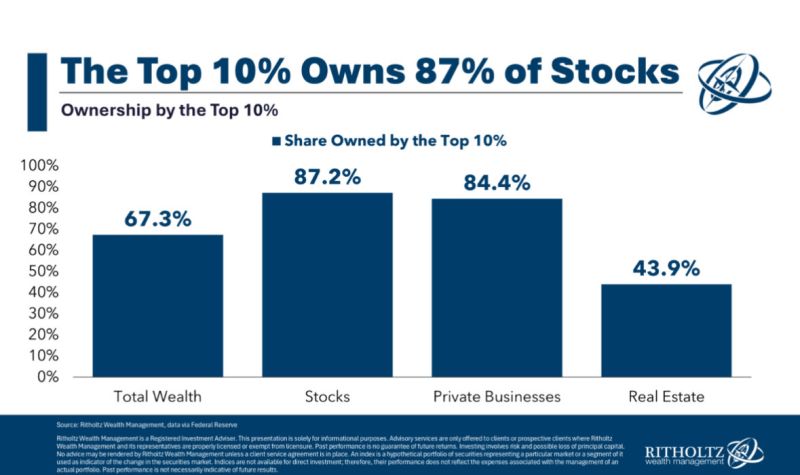

The "K-shaped" economy in one chart...

The top 10% of American households own 87% of all stocks, nearly 85% of all private businesses and 44% of Real Estate Another way of looking at this: The bottom 90% increasingly don’t matter in official economic data Source: Amy Nixon @texasrunnerDFW

Japan just crossed the 50,000 mark — a psychological barrier decades in the making.

Three powerful forces are converging 👇 1️⃣ A predictable, pro-market policy mix PM Sanae Takaichi is doubling down on an Abenomics 2.0 formula — fiscal support, pro-growth industrial policy, and a still-dovish Bank of Japan. Add the Tokyo Stock Exchange’s campaign for better capital efficiency (P/B < 1 firms pushed to fix balance sheets, unwind cross-holdings, boost ROE) — and you get rising multiples, buybacks, and dividends. 2️⃣ Earnings turbocharged by a weak yen A softer yen means every dollar of global revenue converts into fatter yen profits. Exporters and tech suppliers — from semiconductors to automation — are posting margin resilience and beating guidance. Investors see that leverage extending into the AI, EV, and industrial digitization cycles ahead. 3️⃣ Foreign money chasing reform and value Japanese stocks still trade at discounts to U.S. peers but with cleaner balance sheets and credible governance reforms. Global allocators diversifying beyond U.S. mega-caps are pouring in — absorbing dips, fueling breakouts. 🌏 Geopolitics that add, not subtract With U.S.–Japan trade cooperation and easing U.S.–China tensions, Japan benefits from de-risking, not decoupling. New fabs, packaging, and chip equipment demand are landing in Japan — exactly where value accrues. ⚠️ But watch the pressure points A sharp yen rebound could hit exporters. Persistent inflation could force the BOJ’s hand. A slowdown in U.S. tech or China’s imports would hit Japan’s growth engines. 💡 Bottom line: Nikkei 50,000 isn’t just a number — it’s the market voting for Japan’s mix of easy money, corporate reform, and strategic positioning in the global AI and industrial build-out. The story holds as long as the yen stays weak, reforms keep unlocking ROE, and global capex keeps humming. Source: EndGame Macro

In case you missed it... The Shanghai Composite index is about to top 4,000 for the first time in 10 years

Source: David Ingles @DavidInglesTV Bloomberg

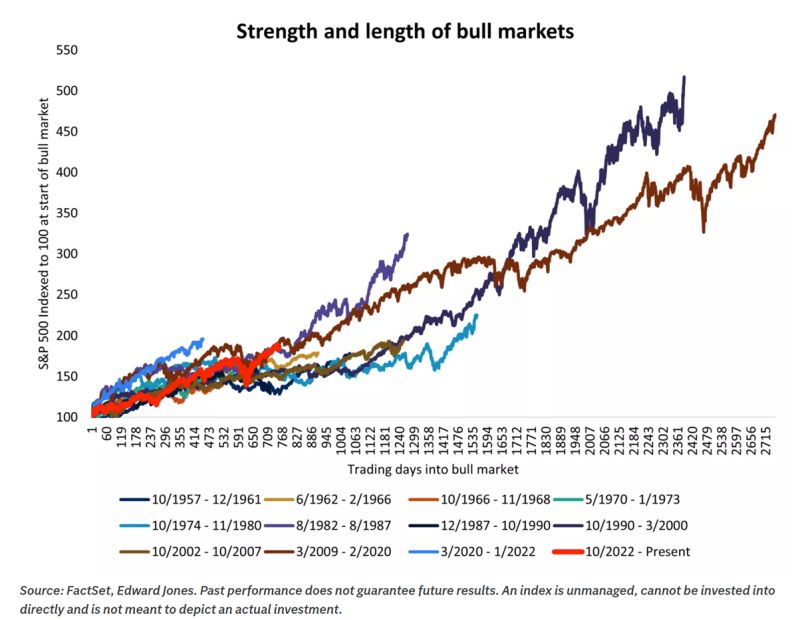

🐂 This Bull Market Isn’t Young… But It’s Far From Done.

It’s not a toddler finding its footing — and it’s not a retiree either. We’re mid-cycle, and that’s where things often get interesting. Yes, history gives us context. But it’s fundamentals — not birthdays — that decide how long a bull market lives. As the saying goes: “Bull markets don’t die of old age. They die from recessions or Fed tightening.” And right now, we see neither on the horizon for 2026. 📈 The takeaway: This run still has legs — just maybe a steadier, more mature stride. Do you think this bull still has room to run? 🐃👇 Source: Edward Jones

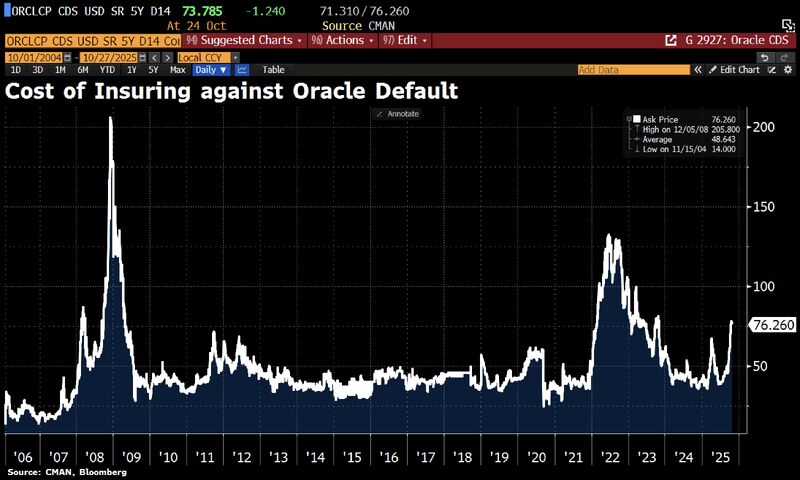

The cost of insuring against an Oracle default has surged following the company’s massive Q3 AI investment announcements – reaching levels not seen outside periods of major macro stress.

According to Goldman, Oracle’s CDS spreads have become a key sentiment indicator for the market’s appetite to finance large-scale AI spending. Source: HolgerZ, Bloomberg

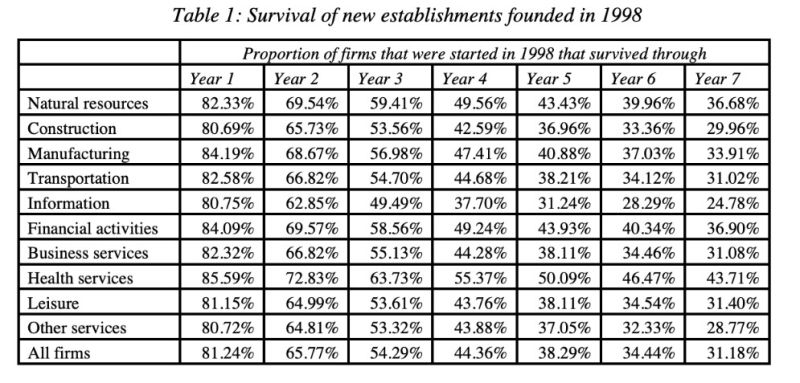

Only 31% of companies started in 1998 were still alive in 2005.

Capitalism is brutal. Source: Brian Feroldi

Investing with intelligence

Our latest research, commentary and market outlooks