Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 Germany’s biggest carmaker is in trouble.

Volkswagen is staring at a potential €11 billion cash shortfall next year — a gap big enough to derail its investment plans and EV transition. Half-year profits are down 33%, and cash flow has turned negative (€1.4 billion). What’s driving the crisis? 🇨🇳 Weak sales in China 🇺🇸 Tariffs from the U.S. ⚙️ Fierce competition from fast-moving Chinese EV makers Now, cuts are hitting everywhere — marketing, sales, and even R&D. The company may be forced to sell assets just to fund new models and technologies. Executives are calling it “particularly fatal” — hitting right as Volkswagen tries to shift from combustion engines to electric. The once-unshakable German auto powerhouse is learning the hard way: 🔋 The EV race isn’t just about innovation — it’s about survival. Source: https://lnkd.in/gC5NC2YH, Bild

Big Move in AI + Mobility!

On Thursday, $NVIDIA dropped a game-changing announcement — it’s partnering with Uber Technologies to push the frontier of autonomous driving. Here’s what’s exciting 👇 🚗 Uber brings massive real-world driving data from millions of trips. 🧠 NVIDIA brings its Cosmos World foundational model — built to power self-driving intelligence. ⚡ Development will run on NVIDIA DGX Cloud, supercharging the entire training pipeline. The market noticed: Uber’s stock jumped after the news, as investors saw this as a strong move to cement Uber’s edge in next-gen transportation tech..

Don't tell your favorite bear, but November is the best month for stocks since 1950

It is the second best month the past 20 years, best month the past decade, and third best in a post-election year. Source: Ryan Detrick, CMT @RyanDetrick

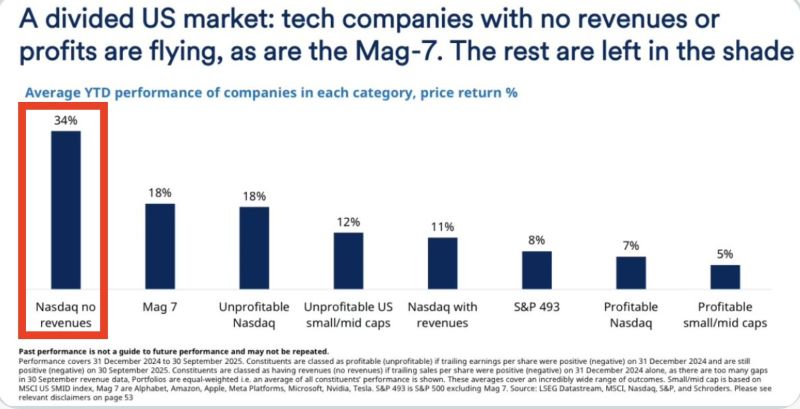

Zero-revenue stocks are up 34% this year, outpacing the Mag 7.

Source: StockMarket.news

Goldman Sachs says its basket of most-shorted stocks is up 16% in October, on pace for its best month on record since 2008, far outpacing the S&P 500’s 0.7% gain.

At the same time, Goldman’s unprofitable tech basket, which includes names like Roku and Peloton, has also surged 16%, the strongest October since 2014. Source: StockMarket.news, Bloomberg

Google and Anthropic are reportedly in talks on cloud deal worth tens of billions

Anthropic is in discussions with Google $GOOGL about a deal that would provide the with additional computing power valued in the high tens of billions of dollars The plan, which has not been finalized, involves Google providing cloud computing services to Anthropic - Bloomberg Google stock is up 3% in after hours on the news Source: Evan

$NFLX announces new logo following earnings

Netflix (NFLX) missed Wall Street third-quarter earnings targets due to an unexpected expense from a dispute with Brazilian tax authorities, though it offered a slightly stronger-than-expected forecast for the rest of the year. Shares fell 4% to $1,186.82 in after-hours trading on Tuesday. Source: John Trades MBA @JPATrades

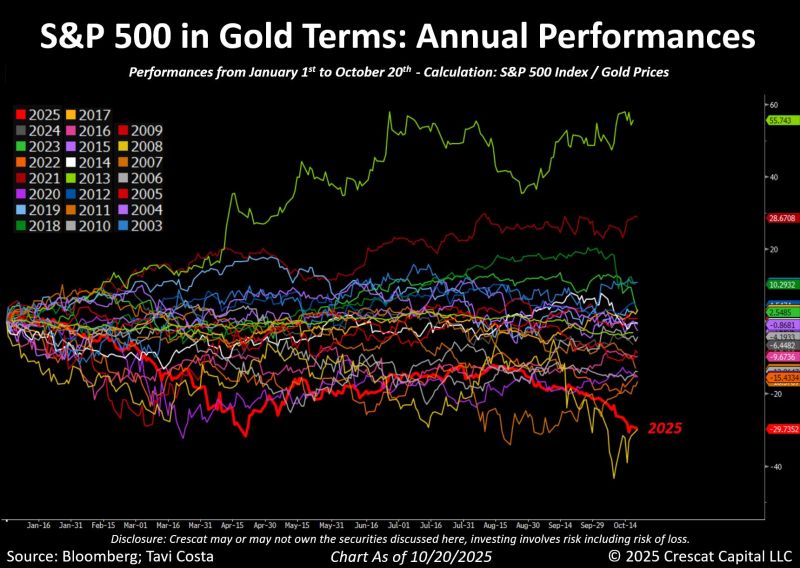

In gold terms, the S&P 500 is down nearly 30% so far this year.

The decline is about to surpass 2008 as the worst year for the index in gold terms in over two decades. Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks