Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨The S&P 500 has NEVER been this expensive:

The index Price-to-Sales (P/S) hit 3.6x, WAY above the 2000 Dot-Com Bubble peak of 2.1x. The Price/Book (P/B) ratio hit 5.6x, above the 2000 high of 4.6x. Forward P/E is 26x, the second-highest since the Dot-Com Burst. Source: Global Markets Investor

🚨 BYD’s profits just dropped 33% in Q3 — and it’s a wake-up call for China’s EV giant.

For years, BYD has been the unstoppable force in electric vehicles — outpacing Tesla in global sales and setting records for innovation in battery and autonomous tech. But the latest numbers tell a different story 👇 📉 Q3 profit: RMB 7.8B (~$1.1B) 📉 Down from: RMB 11.6B last year 📉 Below analyst expectations: RMB 9.6B 📈 Still up from Q2: RMB 6.36B So what’s happening? Beijing’s recent crackdown on price wars and supplier payment practices has cooled the once red-hot EV market. The aggressive domestic competition that fueled BYD’s growth is now under scrutiny — and that’s forcing the company to look overseas faster than ever. Earlier this year, BYD’s stock hit record highs after breakthroughs in charging and driverless tech. But since May, shares have fallen more than 30%. 🌍 The takeaway: China’s EV boom is maturing. The next phase of the race won’t be about who can build cheaper — it’ll be about who can go global, profitably. Source: FT

It took Nvidia 6,138 days to reach a $1T market cap.

Then just 597 days to reach $5T. Slow, then fast. $NVDA Source: Morning Brew

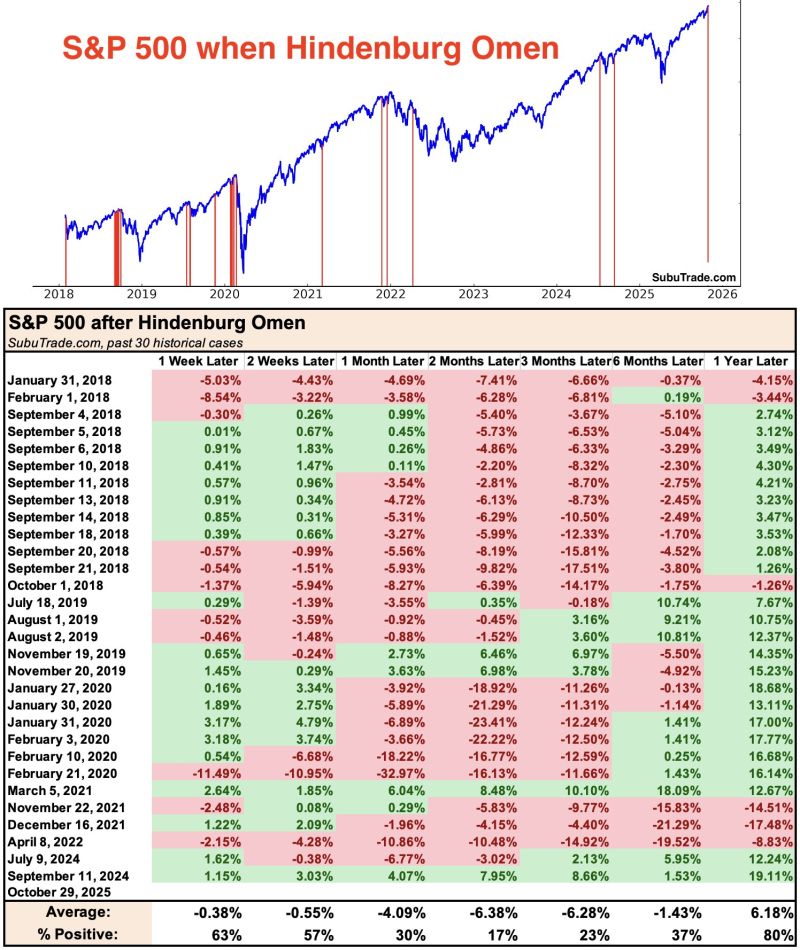

😨 Weak breadth: a Hindenburg Omen was triggered yesterday 🚨

The past 30 times this happened, $SPX fell 83% of the time 2 months later ➡️ What is a Hindenburg Omen ??? The Hindenburg Omen is a technical analysis signal that’s often cited as a warning of a potential stock market crash or major correction. It’s named (dramatically) after the Hindenburg airship disaster, implying that markets might be headed for a similar fiery fate when the signal appears. Here’s what it actually means 👇 ⚙️ The Mechanics The Hindenburg Omen triggers when a specific combination of conditions occur on the New York Stock Exchange (NYSE): 1. A large number of stocks hit new 52-week highs and a large number hit new 52-week lows — on the same day. 2. The number of new highs and new lows both represent more than 2.2% of all issues traded. 3. The NYSE composite index is above its level from 50 trading days ago (i.e., the market is still in an uptrend). 4. Market breadth (the McClellan Oscillator) is negative. 💡 What It Signals - This combo suggests internal conflict in the market — investors are both euphoric (driving some stocks to new highs) and fearful (dumping others to new lows). - That kind of divergence often happens before major turning points — when optimism and fear coexist uneasily. ⚠️ The Catch - It’s not a guaranteed crash predictor. - Historically, it’s produced lots of false alarms, but most major market crashes (like 2008) were preceded by one. So, think of it as a “storm warning” — not a crash forecast. When it flashes, investors tend to watch liquidity, breadth, and credit spreads much more closely. Source: Subu Trade: h/t @McClellanOsc

I would prefer to see better participation on the upside for the Nasdaq 100 $QQQ to extend its bull market.

Things have been improving lately but the negative divergence between price action and market breadth (% of Nasdaq 100 stocks above their 50-day MA) is not the best set-up. We remain long Tech though. Source: Trend Spider

S&P Global Ratings has issued a credit rating to Michael Saylor’s Strategy, the first time for any Bitcoin treasury company 👀

Source: Bitcoin Magazine

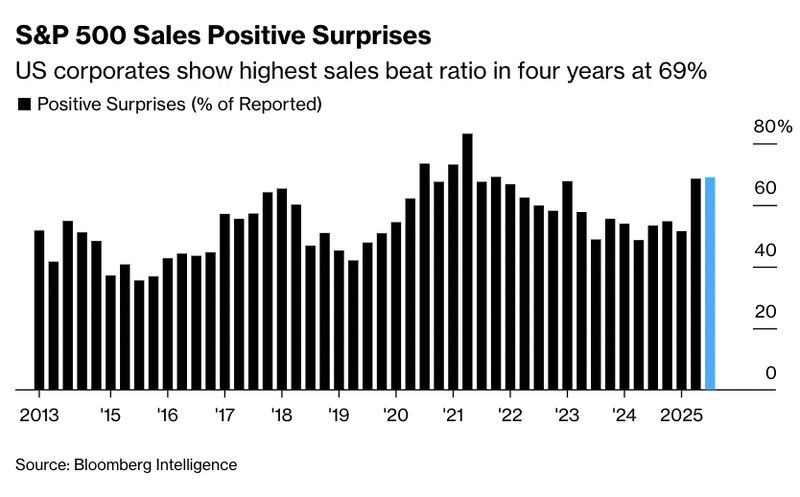

69% of S&P 500 index members that have reported their Q3 numbers so far have beat sales expectations,

It is the highest beat ratio in 4 years Source: Bloomberg

Not yet halfway through this earnings season.

But guide cuts are looking pretty good thus far. Let see if this number improves or worsens this week as 25% of S&P 500 market cap reports earnings Source: RBC, GS

Investing with intelligence

Our latest research, commentary and market outlooks