Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Hong Kong’s IPO Comeback

Chinese IPOs in America have collapsed 93% since 2021, raising just $875 million this year vs. $13 billion at the peak. Meanwhile, Hong Kong is reaping the rewards — Chinese listings there surged 164% to $18.4 billion across 56 deals. The turning point came after Beijing’s regulatory crackdown on Didi’s 2021 New York debut — a short-lived listing that ended with a forced delisting. Since then, companies in “strategic industries” face a regulatory maze for U.S. approval. The Nasdaq has raised the bar with a $25 million minimum for Chinese IPOs, while Hong Kong introduced its “Technology Enterprises Channel” to fast-track tech listings. source : cnbc

S&P 500 Shiller P/E (CAPE) ratio exceeded 40x, the highest level since the 2000 Dot-Com Bubble BURST.

At the same time, US households’ equity allocation jumped to ~45%, the highest EVER. This is a few percentage points above the Dot-Com Peak. Source: Global Markets Investor, TopdownChart

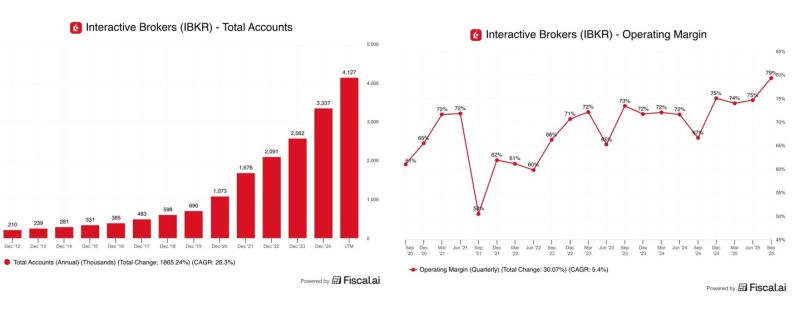

Interactive Brokers might be one of the most under-discussed growth stories of the last decade.

Total accounts are up nearly 20x since 2012. Interactive Brokers reported 79% operating margins for their latest quarter. 79%... Is there any company in the world with higher operating margins? Source: Fiscal.ai (formerly FinChat) @fiscal_ai

Only ~20% of active equity managers have outperformed their benchmarks this year.

Source: Bloomberg, Jefferies

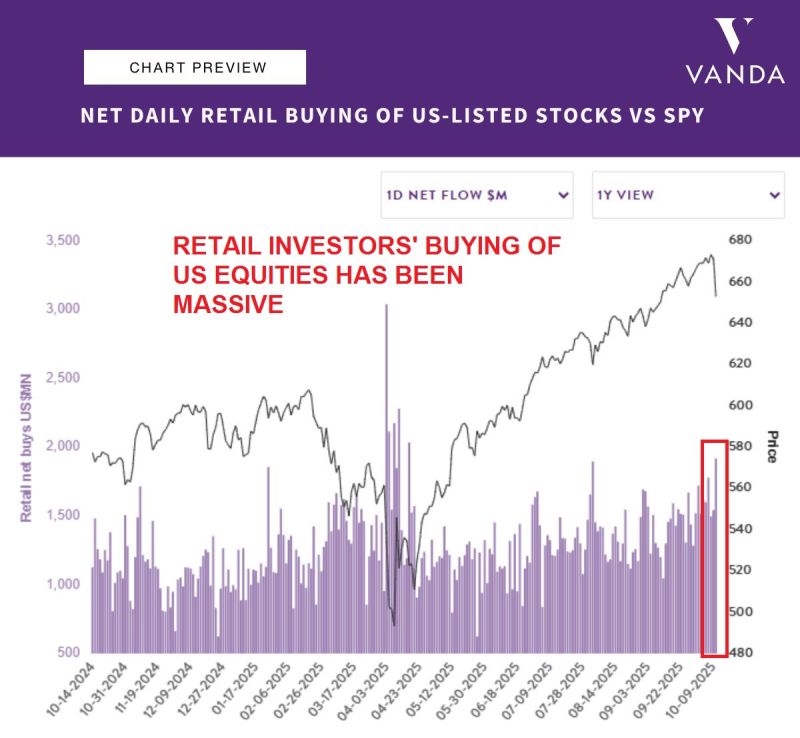

Retail investors bought nearly $2 BILLION of US stocks on Friday, Oct 10, following the market pullback.

This marks the BIGGEST buying day since the April 2025 sell-off and one of the largest on record. Mom-and-pop investors are still buying the dip. Source: Global Markets Investor, Vanda

The performance gap between $QQQ and $BTC is widening again, and this time more dramatically.

Usually BTC and QQQ are mostly correlated until recently. Something has to give. Will QQQ go down to play catchup? Will BTC go up to play catchup? Will it be a blend of both? Source: Heisenberg @Mr_Derivatives

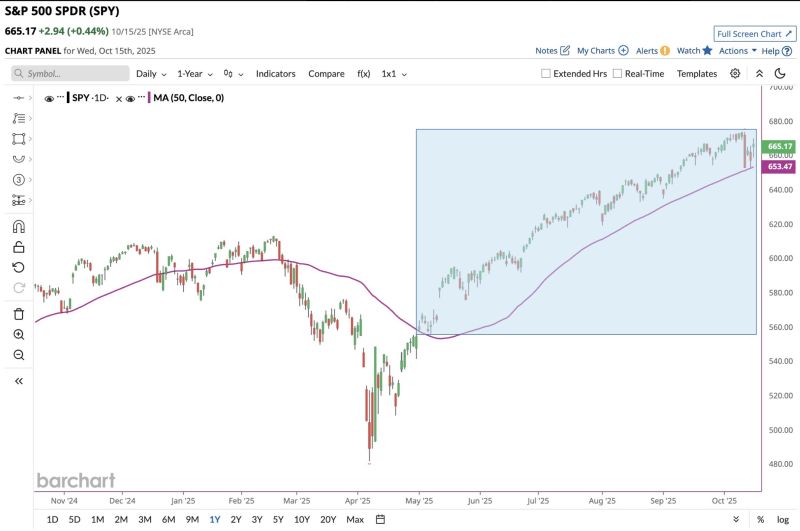

S&P 500 has now closed above its 50-day moving average for 116 consecutive trading days, the 3rd longest streak going back to 1990 (1995 and 2007 were longer)

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks