Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

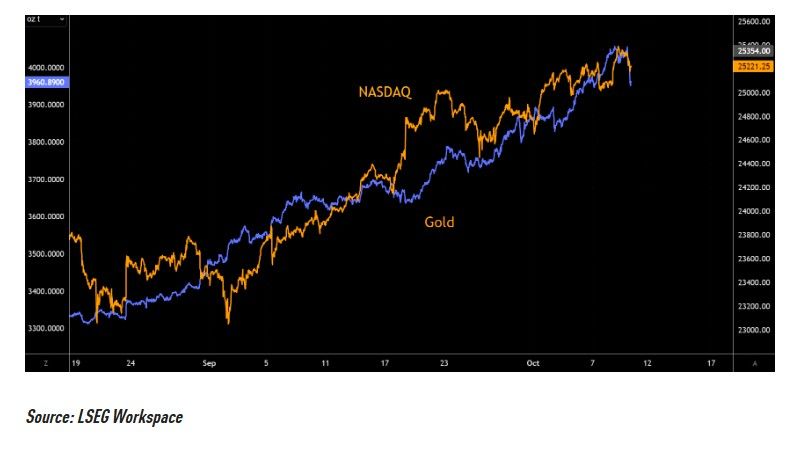

Same same... Below is a 30 min chart of the Nasdaq index and gold since September....

Stocks and gold have moved in close tandem over the past weeks when the last squeeze started. Slightly illogical given the fact gold is, at least partly, a fear hedge. It could be that the same short term money is just chasing momentum, irrespective of "logic". Source: The Market Ear

The S&P500 is now up 71% and has hit 88 all-time highs since Michael Burry said ‘Sell.’

Source: Peter Mallouk

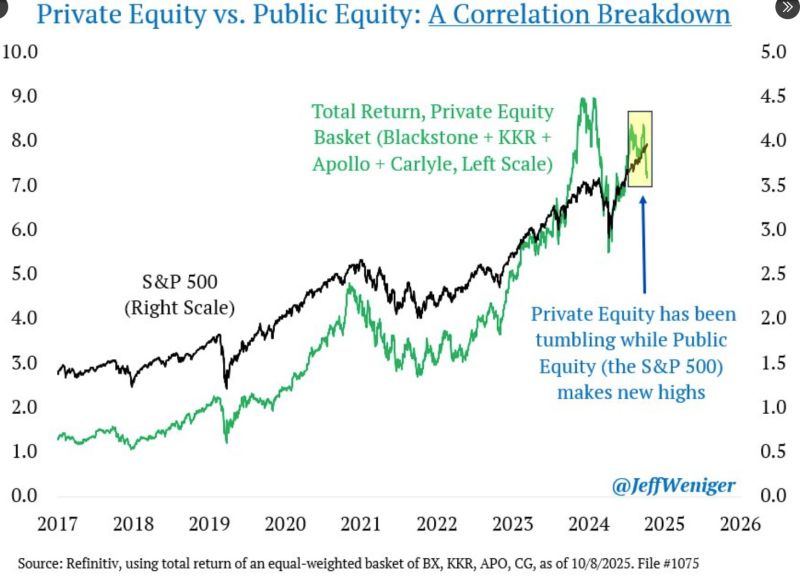

A correlation breakdown:

Private equity stocks (Blackstone, KKR, Apollo, Carlyle) dropped 14.5% in just 3 weeks, while at the same time the S&P 500 just hit another high. What does it mean? Source: Jeff Weniger, Refinitiv

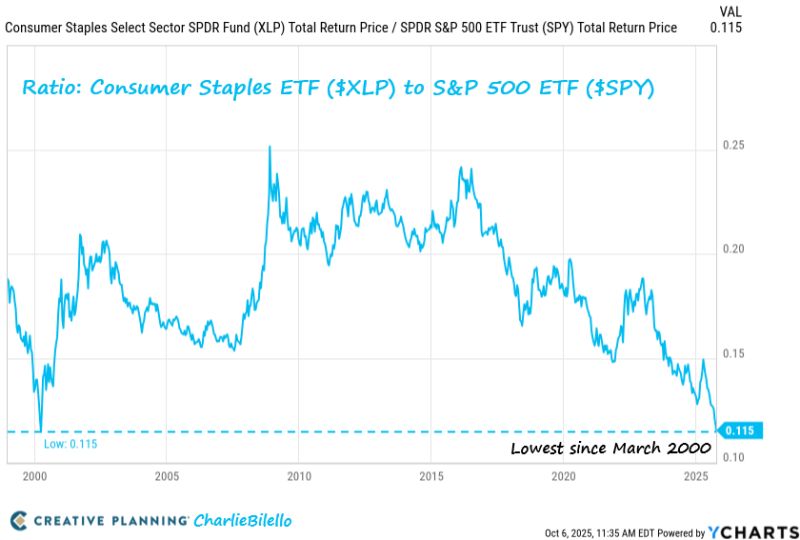

The Ratio of the Defensive Consumer Staples ETF to the S&P 500 has moved down to the lowest level since the dot-com bubble peak in March 2000.

$XLP $SPY Source: Charlie Bilello

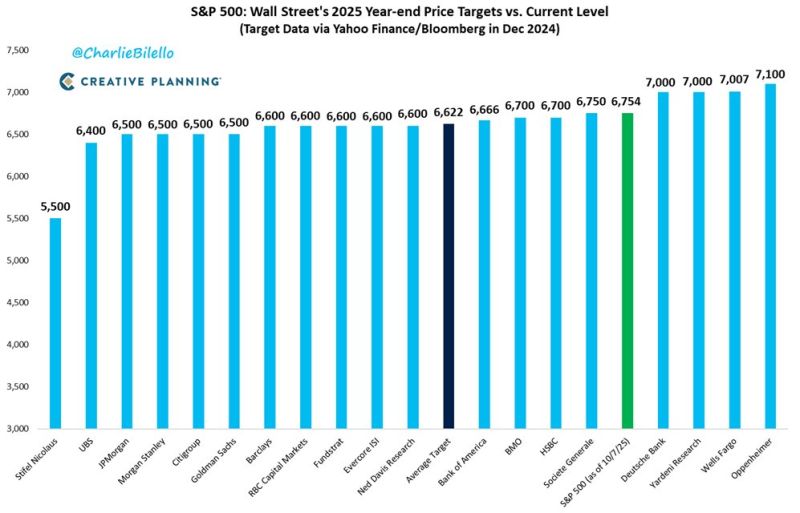

If the S&P 500 gains another 5% from here until December 31, it will exceed every single Wall Street price target for the 3rd consecutive year.

$SPX Source: Charlie Bilello

Oracle $ORCL was the market mover yesterday, down -2.5% and driving Tech stocks, the S&P500 and cryptos lower. So what happened?

A month ago Oracle stock soared after forecasting extraordinary growth: "We signed four multi-billion-dollar contracts with three different customers in Q1," said Oracle CEO, Safra Catz. $455B in contract backlog. Multi-billion-dollar deals. But according to The Information, newly surfaced internal documents paint a very different picture. Oracle’s AI cloud margins are razor-thin around 14 cents of profit for every $1 in Nvidia server rentals. That’s less than most retail businesses, and in some cases, the company’s actually losing money. The data shows margins fluctuating between 10% and 20%, averaging just 16%. And reportedly, Oracle lost nearly $100 million last quarter renting out Blackwell chips, the very product driving its “AI boom.” The first crack in the matrix? Not really. This looks more like margin issue rather than a demand issue. Basically, this is not about Oracle not finding customers for renting their GPUs but customers asking for good deal or they go elsewhere. As a result, Oracle margins have not been that strong. Source: STockMarket.news

Semiconductors SOX's relative performance to the equal-weighted S&P 500 is nearing the highest levels since the dot-com bubble...

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks