Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Oracle’s debt-to-equity ratio is ~520%, way above other AI stocks

E.g Amazon is near 50%. Microsoft close to 30%. Google’s even lower. How long can Oracle afford to keep this up? Source: StockMarket.news

The circular AI economy...

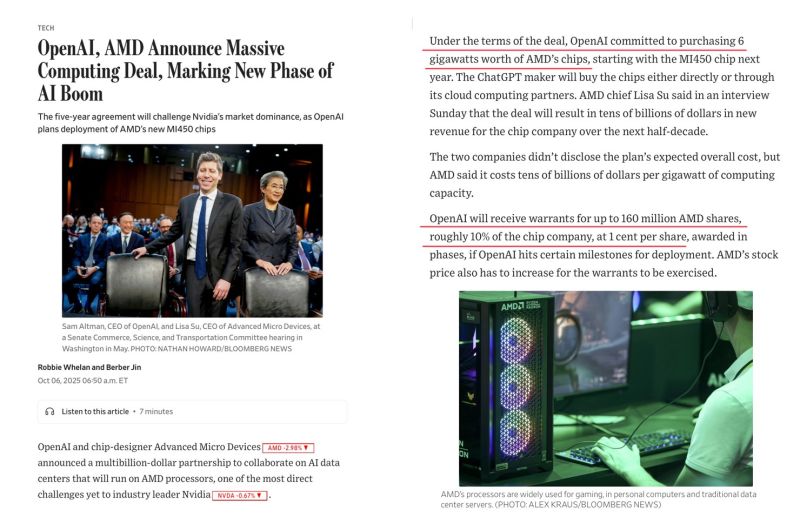

$AMD giving OpenAI 10% of its stock (worth roughly $35bn pre-market) so OpenAI can buy 6 GW of AMD chips over the next few years. Stock up +27%. Source: Wasteland Capital @ecommerceshares

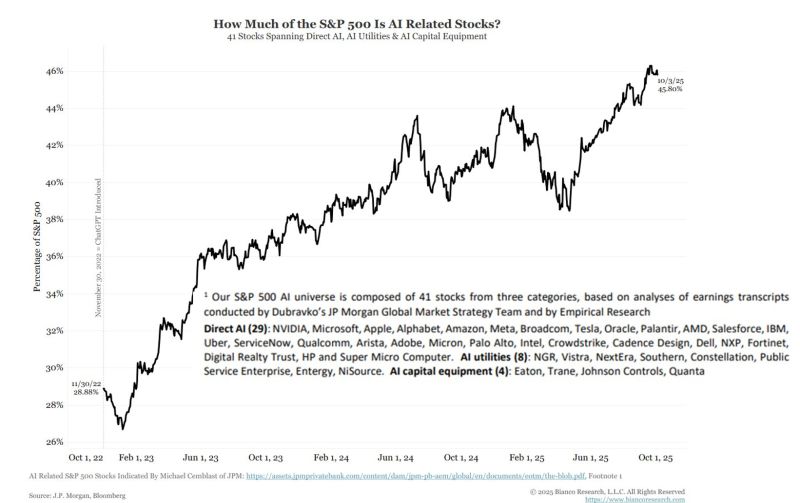

How much of the S&P 500 is AI related stocks?

JP Morgan has identified 41 "AI-Related" stocks. As this chart shows, they are now 45% of the S&P 500. Source: Bianco Research

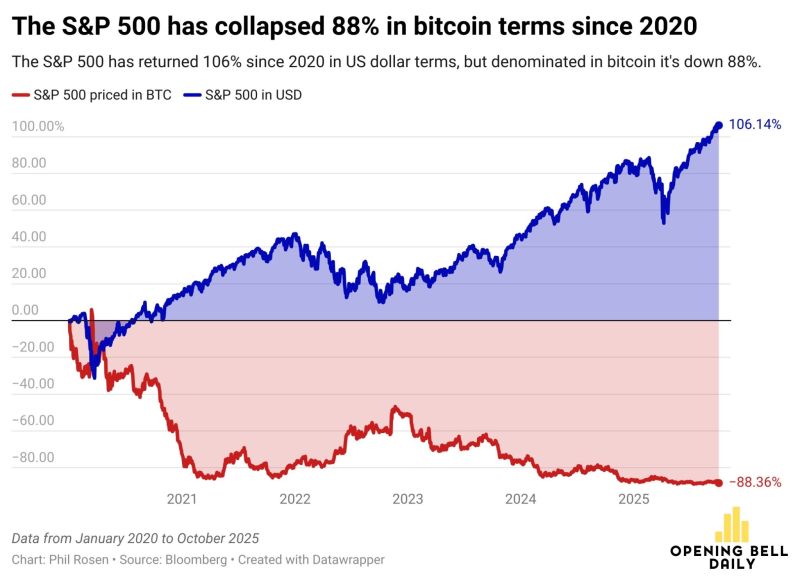

The S&P 500 is up more than 100% since 2020

But the index is actually down 88% when priced in a hard asset like bitcoin. Source: Anthony Pompliano 🌪@APompliano (H/t @philrosenn)

It's liquidity stupid!

Strong M2 growth in China, and to a smaller extent Brazil and India, add to the ongoing expansion of M2 in the United States and in Europe. Our Global M2 proxy continues to point to a broadly supportive liquidity environment for risk assets. The S&P 500 continues to follow the evolution of our Global M2 proxy with an 11-week lag. Bitcoin has desynchronized from our Global M2 proxy since mid-August but bounced up strongly last week. Will it catch up our Global M2 proxy (and rise toward 140k)? NB: liquidity is one risk assets driver among others. Past results do not guarantee future results

It seems that Russell 2000 small & mid caps ETF $IWM is joining the breakout party...

Source: Trend Spider

Foreign holdings of US equities have crossed above $20 trillion, a record high.

30% of the total US stock market is now held by foreign investors, the highest percentage on record with data going back to 1945. Source: Charlie Bilello, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks