Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

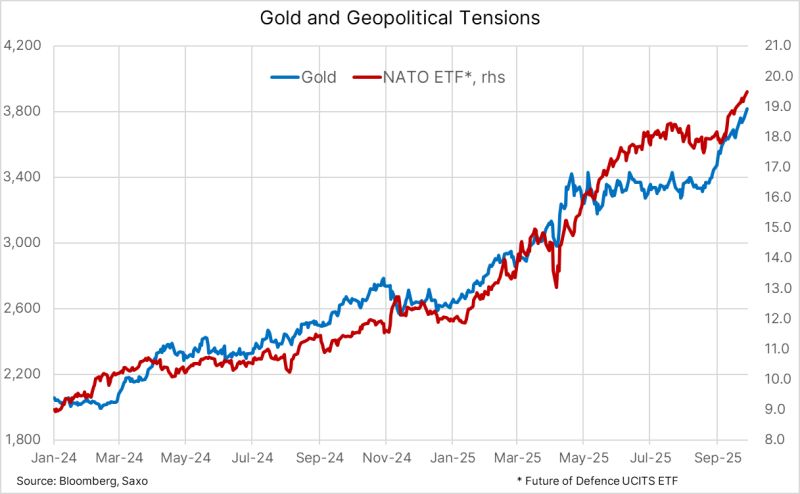

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Robinhood Prediction Markets just crossed 4 billion event contracts traded all-time, with over 2 billion in Q3 alone.

And we’re just getting started. Source: Vlad Tenev @vladtenev on X

Zijin Gold IPO explodes +64.8% on day one China’s biggest gold miner just spun off its global arm in Hong Kong, the largest IPO since May 2025.

Investor demand for gold is going vertical Zijin Gold shares surged over 60% Tuesday as the Chinese miner’s international unit made its trading debut in Hong Kong. The company had raised nearly 25 billion Hong Kong dollars (about $3.2 billion) with shares priced at HKD$71.59 apiece, making it the world’s second-largest initial public offering after battery giant CATL’s listing earlier this year. Zijin Gold’s debut, which was delayed by a day due to the impact of Super Typhoon Ragasa on Hong Kong last week, comes at a time when the yellow metal has been notching record highs amid strong safe-haven demand, expectations of rate cuts, and global economic uncertainty. Source: CNBC, Wall Street Gold on X

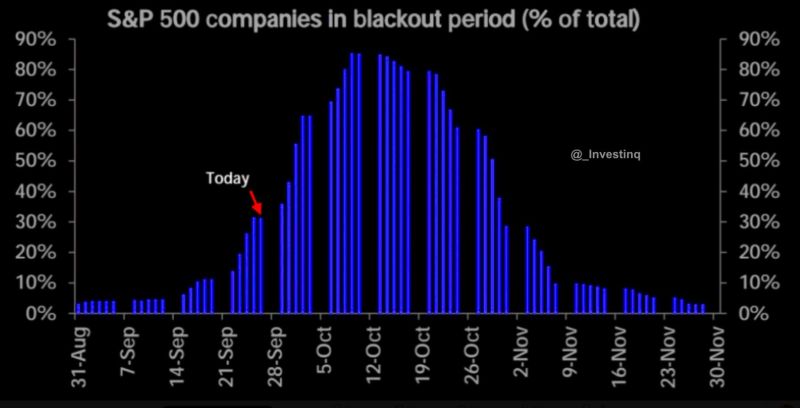

We’ve officially entered buyback blackout season in the US

Roughly one-third of SP500 companies are already restricted from repurchasing shares as of today. That figure will climb rapidly, peaking near 80–85% by mid-October. This matters because buybacks are one of the biggest sources of demand for equities. Source: StockMarket.news

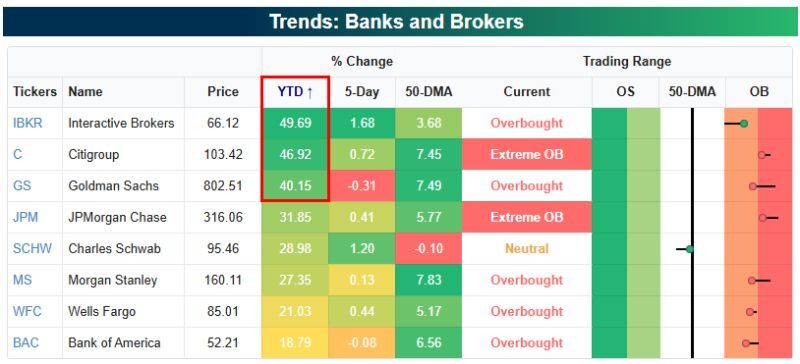

Goldman $GS, Citi $C, and Interactive Brokers $IBKR are all up 40%+ year-do-date.

Source: Bespoke

Apollo just released a report titled: 'The extreme weight of AI in the S&P 500'

Here's the key message: Source: Niko Ludwig @Collateral_com

In case you missed it...

Canada is up 25% in 2025, driven by strength in financials and mining stocks: Source: J-C Parets, Trend Labs

S&P 500 - How does the rally compare to history?

-The 4th strongest rally vs all other bulls (82, 09, 20 were >). -The STRONGEST recovery excluding recessionary cases. At 116 days w/o a 6% pullback, the rally has gone farther than all but two early-stage bulls (1966 & 1957). Source: Warren Pies @WarrenPies, 3Fourteenresearch

Investing with intelligence

Our latest research, commentary and market outlooks