Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In Germany, the short-lived rally at the start of the year has already fizzled out.

The country is losing ground on the global stage: German stocks now make up just 2.1% of global market capitalization, down from 2.4% only three months ago. Source: Bloomberg, HolgerZ

The S&P 500 Shiller P/E ratio has surpassed 40x for the first time since the 2000 Dot-Com Bubble BURST.

The US stock market has ALMOST NEVER been so expensive. Source: Global Markets Investor

The US Government is reportedly seeking to buy up to a 10% equity stake in Lithium Americas $LAC

+73% after-hours (CNBC) Source: Reuters

Saudi Arabia’s stocks soar after reports that foreign ownership limits will be axed ‼️

The Capital Market Authority (CMA) is moving toward allowing foreigners to own majority stakes in local companies, Bloomberg reported. The Authority is close to approving a major amendment to raise the cap on foreign ownership in listed companies, which currently stands at 49%, the agency quoted CMA board member Abdulaziz Abdulmohsen bin Hassan as saying. He highlighted that the regulator is almost ready for this step and is awaiting approval from the relevant government entities. “It is prepared to move forward,” said the official, without specifying the final ownership cap that will be permitted for foreigners, expecting the decision to come into effect before the end of this year. Allowing foreign ownership to exceed 50% of capital in listed companies will increase the relative weights of Saudi stocks in MSCI indices, which could attract significant capital inflows, as these indices reduce the weight of companies that impose foreign ownership restrictions. Source: Argaam, Reuters

All the Magnificent 7 stocks are now in positive territory for the year!

Source: Bloomberg, HolgerZ

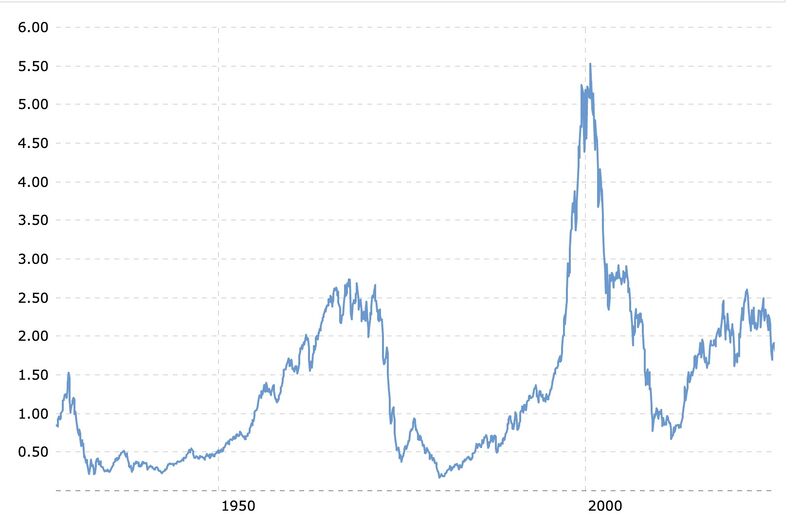

S&P 500 priced in gold...this is what the stock market looks like in real money (looks like a big head and shoulders pattern...)

As highlighted by Quoth the Raven on X, "If we go back to 0.5x, that puts gold at $12,000, or the S&P at 1850 or they meet in middle at $9000/4500 which would be gold 2.5x and S&P -30%ish"

Stocks just saw the largest weekly inflow all year from retail investors

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks