Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"THE MOST IMPORTANT FOMC OF OUR LIFETIME"

$SPY S&P500 is completely flat

Institutional investors are the most bullish since the February peak in stocks and no longer see a trade war as the biggest risk.

According to Bank of America’s September fund manager survey (covering $426bn AUM), risk appetite is back at its highest since Feb 2025, when the S&P 500 last hit an intermediate peak : The trade war narrative is fading. Optimism is rising. Risk is back on. source : BofA

AI is eating the world

The 109 AI stocks in the Goldman Sachs TMT AI Basket are now worth $29.2tn, almost as much as the annual economic output of the US. Source: HolgerZ, Bloomberg

BREAKING: Robinhood announces that they have filed with the SEC to launch Robinhood Ventures Fund I (RVI), a concentrated portfolio of innovative private companies leading their industries.

It looks like Robinhood is going to IPO a fund that allows retail to invest in the best private companies... “For decades, wealthy people and institutions have invested in private companies while retail investors have been unfairly locked out. With Robinhood Ventures, everyday people will be able to invest in opportunities once reserved for the elite,” said Robinhood Chairman and CEO Vlad Tenev. Source: amit @amitisinvesting

Is AI seriously overbought?

$AIQ is the Global X Artificial Intelligence & Technology ETF. It is at the most overbought levels since July 2024...just before markets crashed. Source: TME, LSEG

Seagate is now the top performing stock in the S&P 500 for 2025

The GenAI bull market is expanding. Source: Mac10

Donald Trump has called for US companies to stop reporting quarterly results

He added that a shift to publishing figures twice a year will save them cash and allow executives to focus on their businesses. The US president issued his call in a post on his Truth Social network on Monday, contrasting standard practice in the US with what he depicted as China’s more long-term approach. Most publicly listed US companies are required to file quarterly and annual financial filings with the Securities and Exchange Commission, known respectively as 10-Q and 10-K disclosures. “Subject to SEC Approval, Companies and Corporations should no longer be forced to ‘Report’ on a quarterly basis . . . but rather to Report on a ‘Six (6) Month Basis’,” Trump said. “This will save money, and allow managers to focus on properly running their companies.” Source: FT

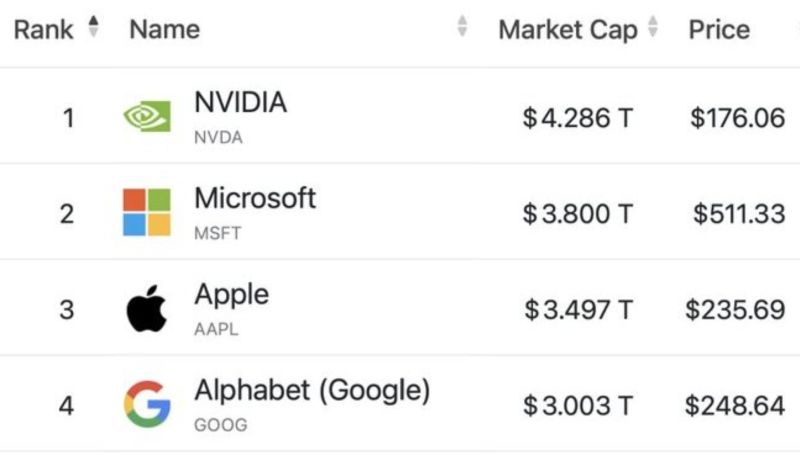

$GOOGL JUST JOINED THE $3T CLUB ALONGSIDE $MSFT, $AAPL & $NVDA

Source: Shay Boloor

Investing with intelligence

Our latest research, commentary and market outlooks