Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

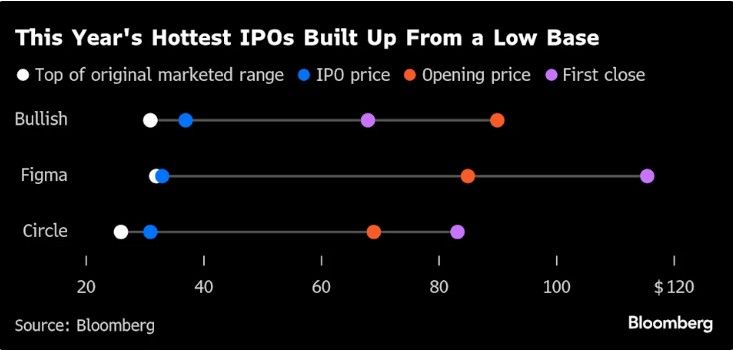

Retail traders are reshaping IPOs

Wall Street is opening the door to individuals via platforms like Robinhood & SoFi. Bullish’s $1.1B IPO: 20% went to retail, stock jumped +143% on debut. Upcoming deals (Gemini Space Station, Figure, Via) are also reserving retail allocations. With retail now 20%+ of US equity trading, IPOs are no longer just for institutions. Source : Bloomberg

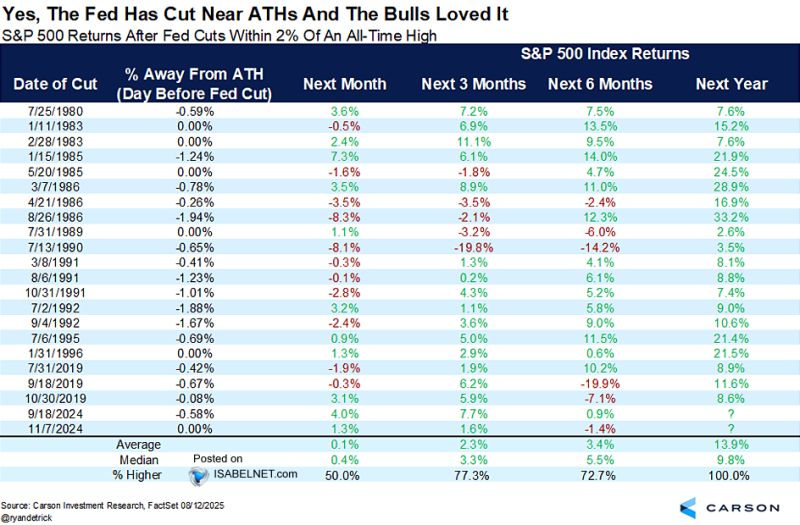

This chart shows how the SP500 has performed since 1980 when the Fed cut rates near all-time highs

On average, the index gained 3.3% over 3 months, 5.5% over 6 months, and 9.8% over the next year with markets higher 100% of the time after 1 year. Since 1980, Fed cuts near highs haven’t stopped bull runs. Source: StockMarket.News, Carson Investment Research

$TLT jumps to highest price since April 📈📈📈 Ready to breakout?

Source: Barchart

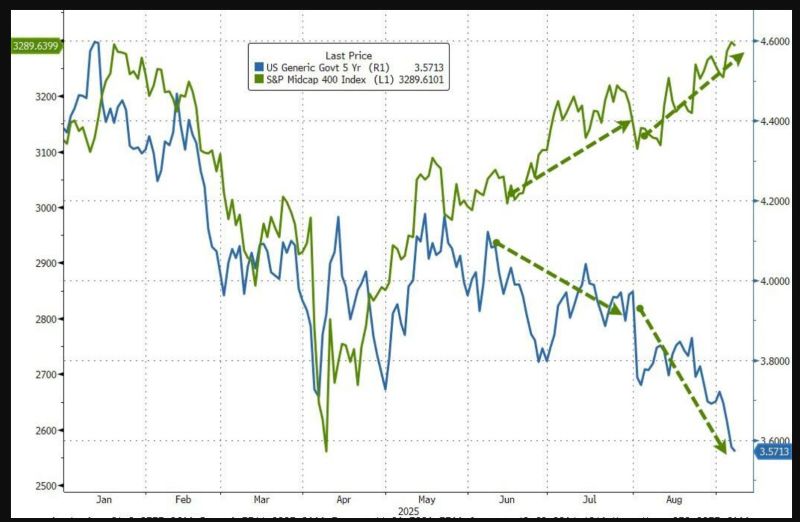

As Fed rate cuts odds increase, stocks and bonds continue to be bid together...

Source: www.zerohedge.com, Bloomberg

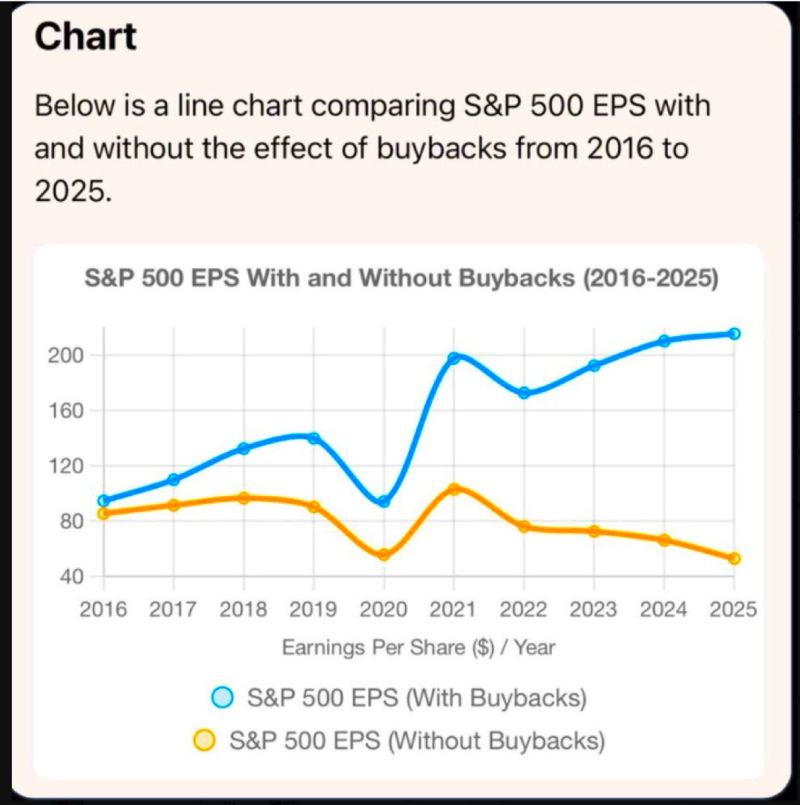

Buybacks are inflating earnings per share

By shrinking share counts, companies make profits look stronger on paper even when most firms show flat or declining growth. The top 10 companies are the only ones delivering real growth. Indexes keep climbing because of them, while the S&P 490 and the broader economy remain weak. This is one of the disconnect driving the market. Source: StockMarket.news

The top 10 US stocks now have a combined market cap of 23 trn USD, bigger than China (16), the EU (13) or Japan (7)

If these 10 were a country, they’d be the world’s largest stock market (ex US). Source: Bergos AG, Econovis, Till Christian Budelmann

‼️Hedge funds are shorting the S&P 500 futures at nearly a RECORD pace

Hedgefunds short exposure to the S&P 500 futures hit $180 BILLION, an all-time high. As a share of open interest, shorts hit ~27%, the highest in 2.5 years, only below March 2023 and September 2022. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks