Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Breaking news

Tesla’s board has proposed a new pay package for chief executive Elon Musk worth $1tn over the next decade if he is able to hit a series of formidable targets. Musk will receive no salary or bonus under the plan unveiled on Friday, but would collect shares in instalments unlocked by increases in Tesla’s market value, combined with milestones including a huge increase in earnings and selling millions of cars, robotaxis and AI-powered robots. “Retaining and incentivising Elon is fundamental to Tesla . . . becoming the most valuable company in history,” chair Robyn Denholm said in a letter to investors. The package is “designed to align extraordinary long-term shareholder value with incentives that will drive peak performance from our visionary leader”. The board stressed that Musk’s incentives were aligned with investors’ interests and he will receive nothing if Tesla’s growth stalls. However, the sheer scale of the deal is likely to revive a fierce debate over the earnings of the world’s richest man. Source: FT

American Eagle $AEO shares just had their best day in history (+37.9%)

What a chart! And thank you Sydney Sweeney...📈📈 Source: Barchart

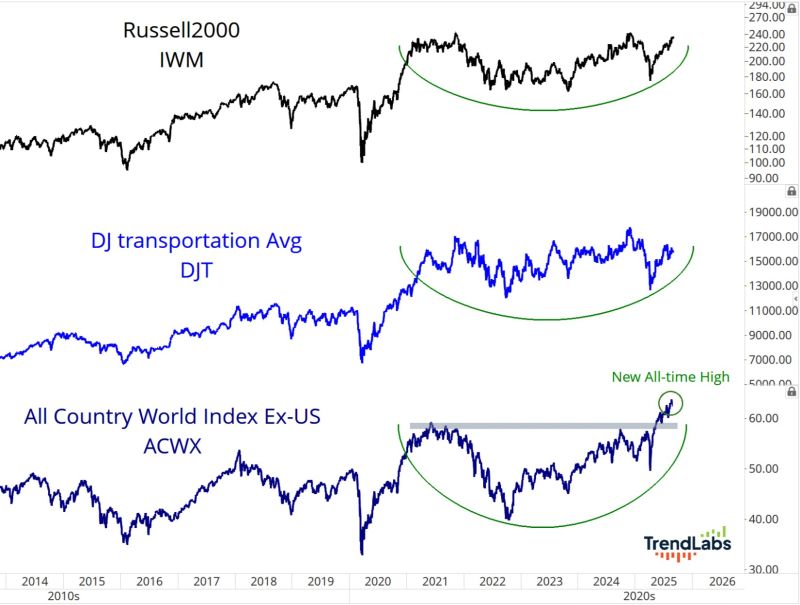

I keep being told about all these tops people are seeing all over the market

I just see a lot of bottoms. Here are a few... Source: J.C. Parets

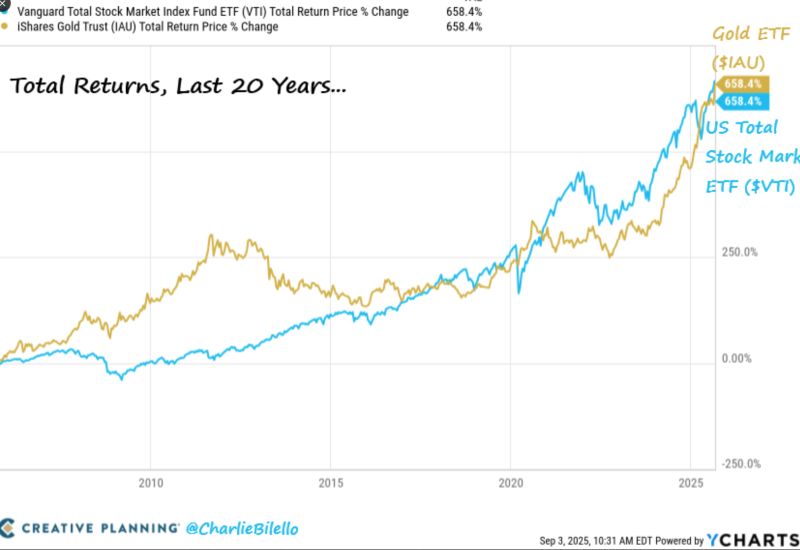

Total Returns over Last 20 Years:

US Stock Market $VTI: +658.4% / Gold $IAU: +658.4%, Source: Charlie Bilello

In the AI race between Alphabet $GOOGL and Microsoft $MSFT, Alphabet is once again clearly ahead

Since the launch of ChatGPT, Alphabet stock has risen nearly 128%, while Microsoft's share price has only increased 98%. Source: HolgerZ, Bloomberg

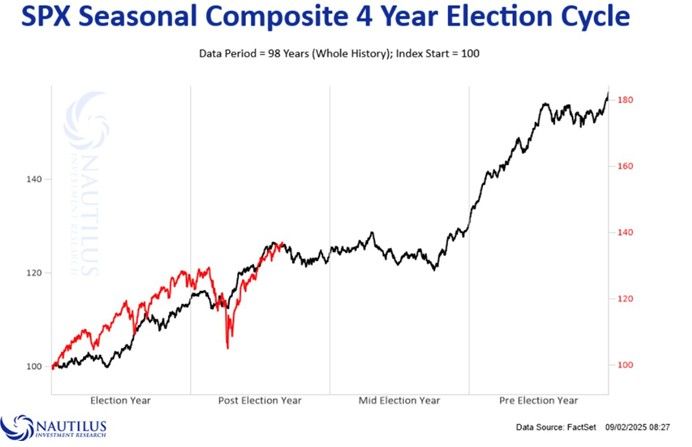

Lots of talks about seasonality these days...

If you believe in election cycle, we are in for a stretch of sideways at best. Source: Nautilus thru RBC

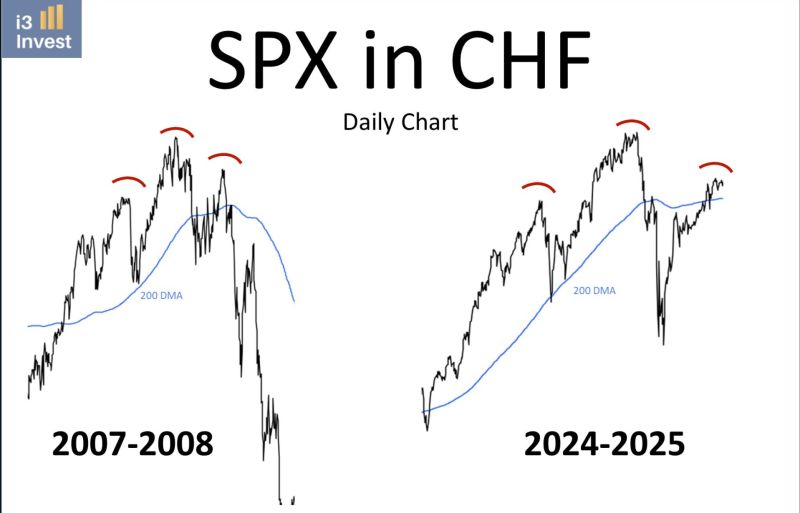

Something to be worried about

The chart of the S&P 500 expressed in a strong currency (Swiss franc) does not look the same as in Dollars. Source: i3 invest

Google can keep its popular Chrome browser, a federal judge has ruled

Alphabet $GOOGLE shares are up 8% AFTER-MARKET. Source: Brew markets, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks