Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

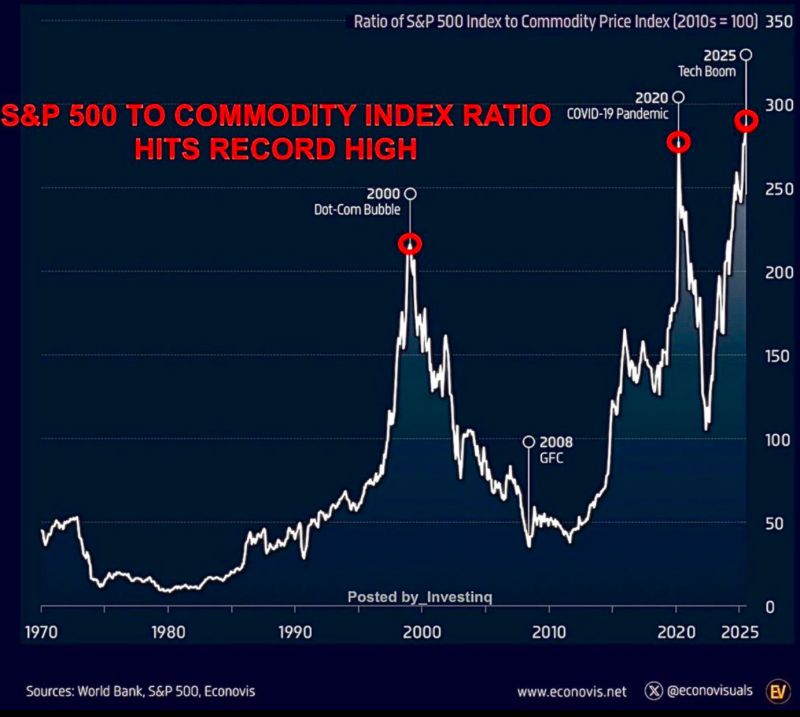

A new all-time-high for sp500 to commodities ratio

Source: Worldbank, Econovis

Analysts are raising their Nvidia $NVDA targets across the board

• JPMorgan: $170 → $215 • Rosenblatt: $200 → $215 • Benchmark: $190 → $220 • BofA Securities: $220 → $235 • Citi: $170 → $215 • Jefferies: $200 → $205 • KeyBanc: $215 → $230 • DA Davidson: $135 → $195 • Trust Securities: $210 → $228 Source: Stocktwits

🚨Hedge funds are dumping US stocks

Hedge funds sold $2.0 billion in single stocks and ETFs last week, bringing the 4-week average of selling to $0.5 billion. Interestingly, retail sold $0.9 billion, the 1st time in 8 weeks. Institutional investors bought $1.6 billion. Source: Global Markets Investors , BofA

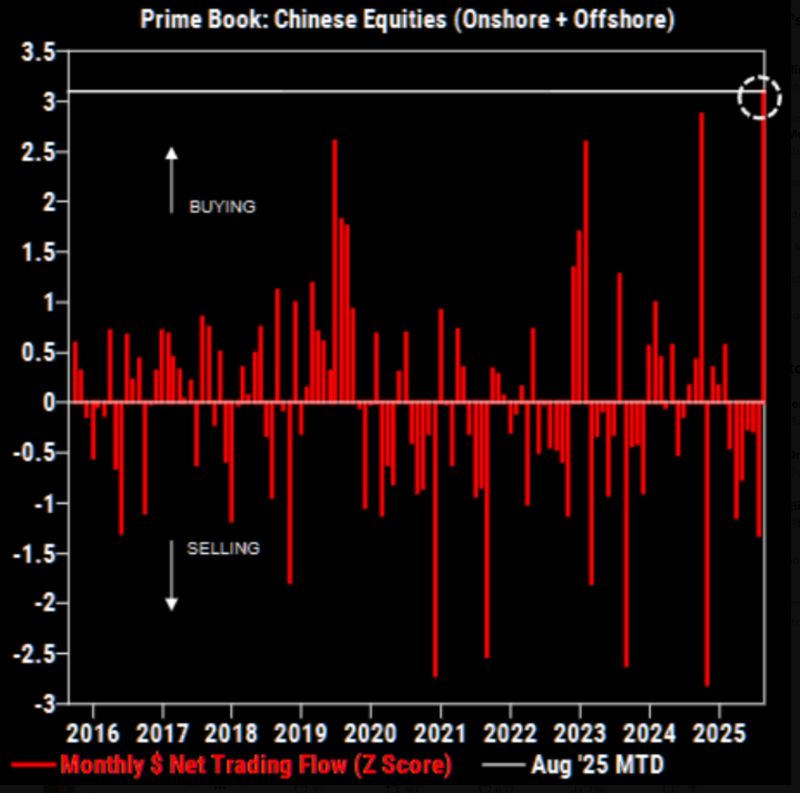

Chinese stocks on track for the largest monthly inflow from Hedge Funds in history

Source: Barchart

The share of 0DTE (zero days to expiry) options volume on the Nasdaq index has climbed to nearly 80%.

For S&P 500 options, the 0DTE share has surpassed 60%. 0DTE market share has doubled in just 3 years. Source: Global Markets Investors, BofA

The 69% decline in the $VIX over the last 20 weeks is the biggest volatility crash in history.

Source: Charlie Bilello

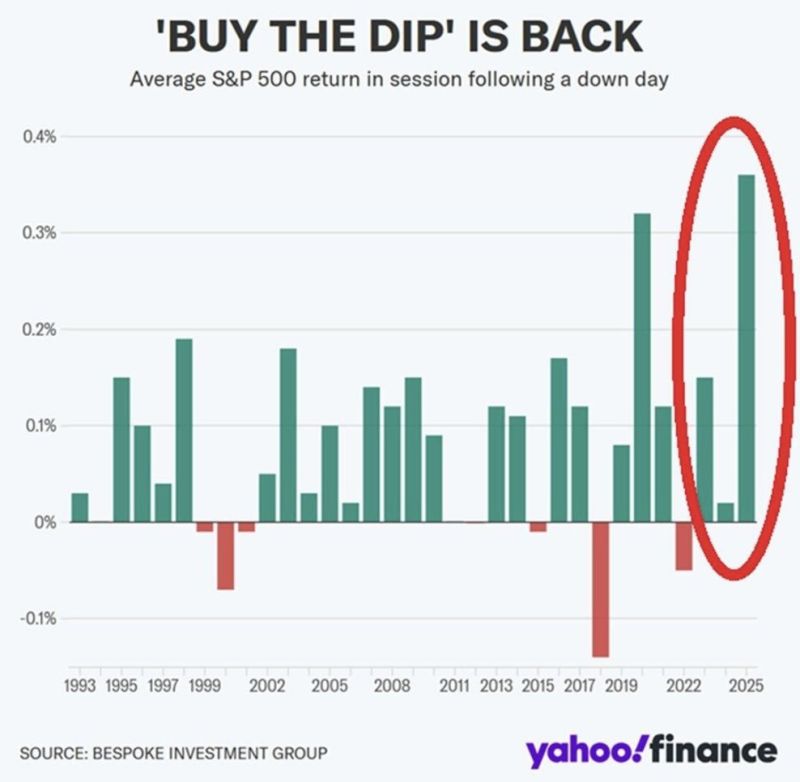

"Buy the Dip" Trading Strategy is having its best return in more than 30 years

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks