Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

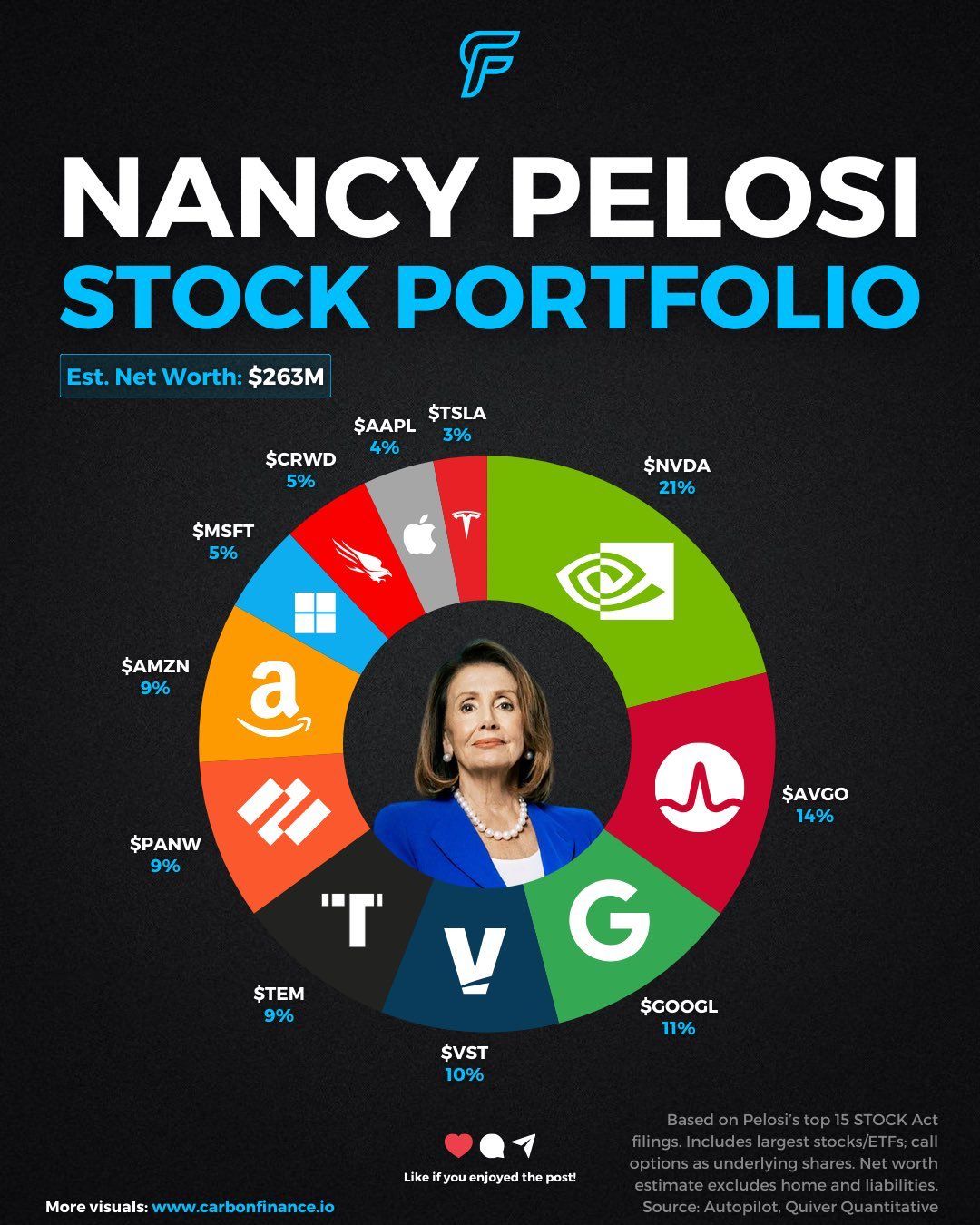

Nancy Pelosi's stock portfolio

Source: Sam Badawi @samsolid57, Carbon Finance

Eye-opening chart, while earnings of Magnificent 7 have had an unprecedented run, earnings of S&P 493 have been more or less stagnant since 2020.

Is the US economy really so strong? Source: Michel A.Arouet, Bloomberg

Shorting the market is not an easy sport...

Below S&P 500 returns following Michael Burry’s stock market warnings... Source: Peter Mallouk

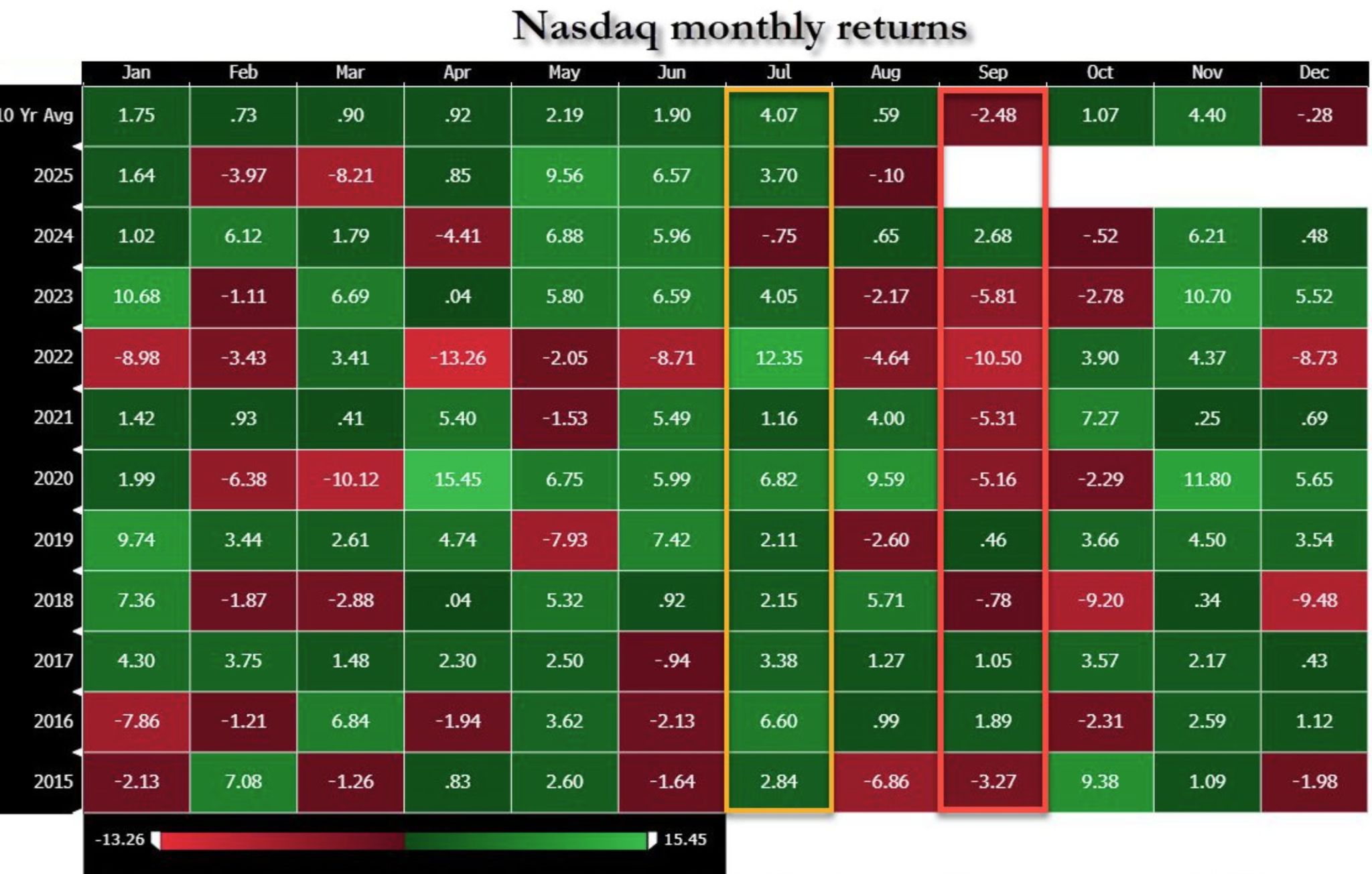

July Nasdaq seasonals were great. September's are not.

Source: zerohedge

Belated "Nixon closing the gold window anniversary" post

SPX priced in gold (blue) v. SPX priced in USD (red) since August 1971 when Nixon closed the gold window. Source: Luke Gromen @LukeGromen

People who bought Palantir last week

(Palantir has officially entered bear market territory). Source: Not Jerome Powell

Investing with intelligence

Our latest research, commentary and market outlooks