Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Another day of rotation out of tech

Source: Daily sp500 heat map by Finwiz

Since the April 8 low, the SP500 has rallied by 30%.

This is powered by a 50% surge in Mag7 stocks, while the rest of the S&P 500 members gained 21%. Source: Augur Infinity on X

On this day in 2004: Google went public at a valuation of $23 billion.

Today, it’s worth $2.5 trillion. Source: Jon Erlichman @JonErlichman on X

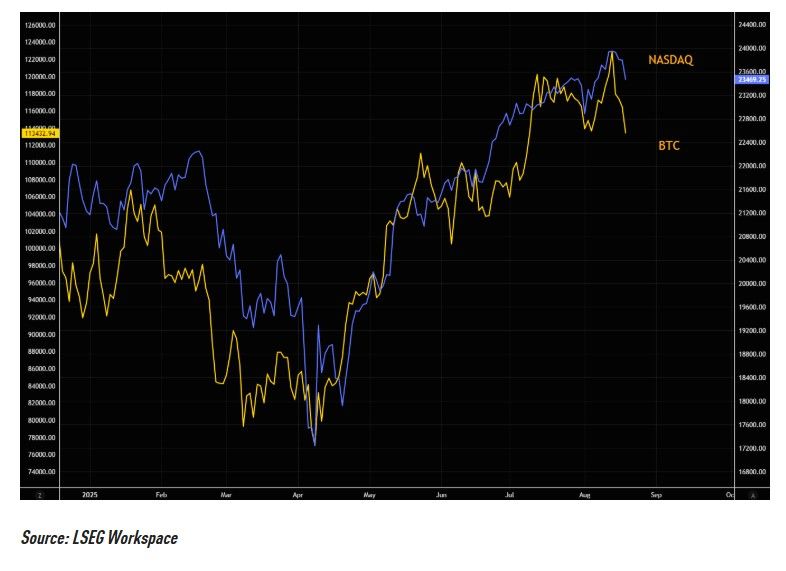

Nasdaq and Bitcoin often trade in the same direction

Source: www.zerohedge.com, LSEG workspace

Stocks and rate-cut expectations have decoupled significantly since the start of the Summer... will they start to move in sync after Jackson Hole ?

Source: zerohedge

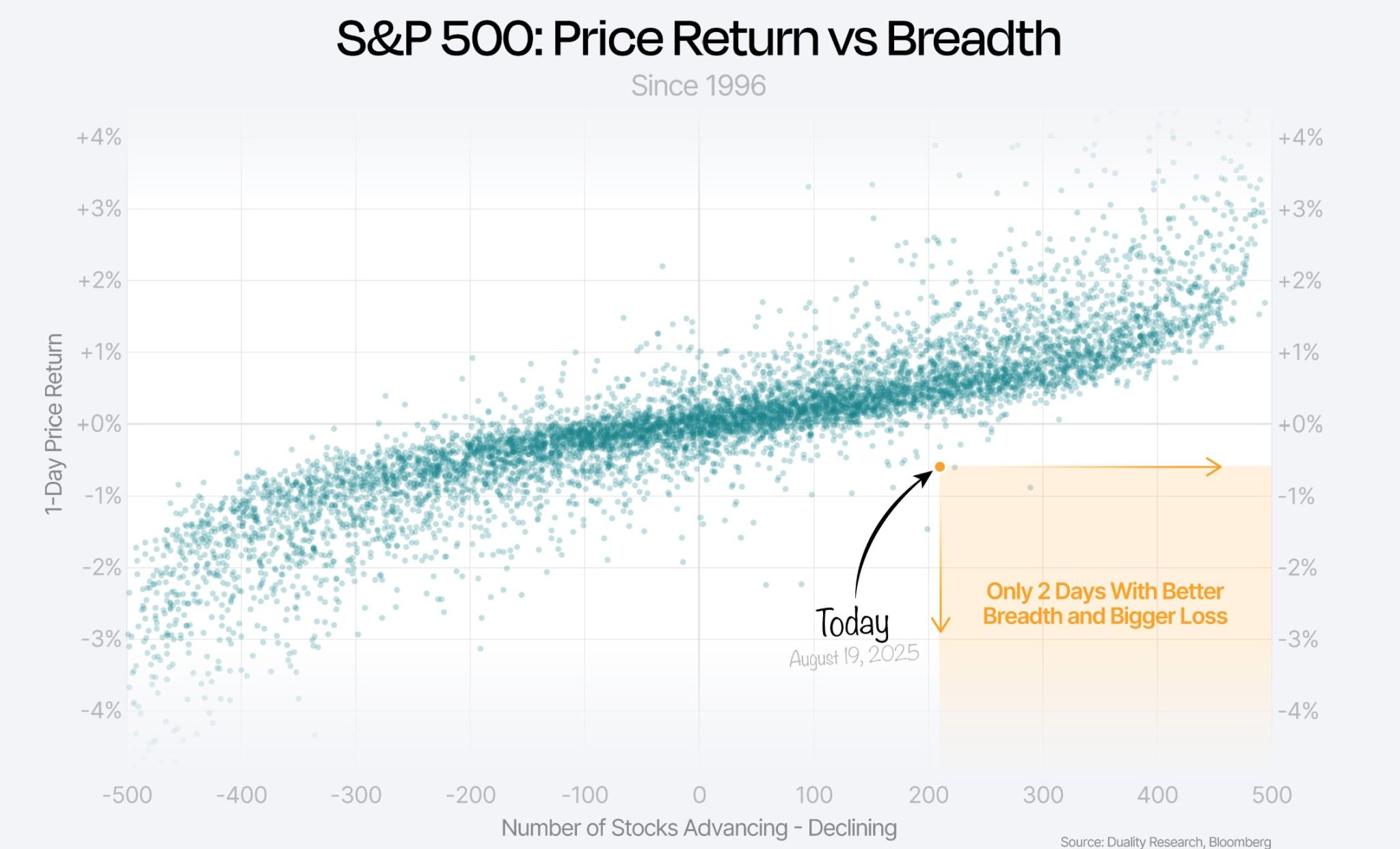

Very interesting session in Wall Street yesterday Since 1996, only two other days have seen stronger S&P 500 breadth paired with a bigger loss.

Source: Duality Researchv@DualityResearch

Investing with intelligence

Our latest research, commentary and market outlooks