Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

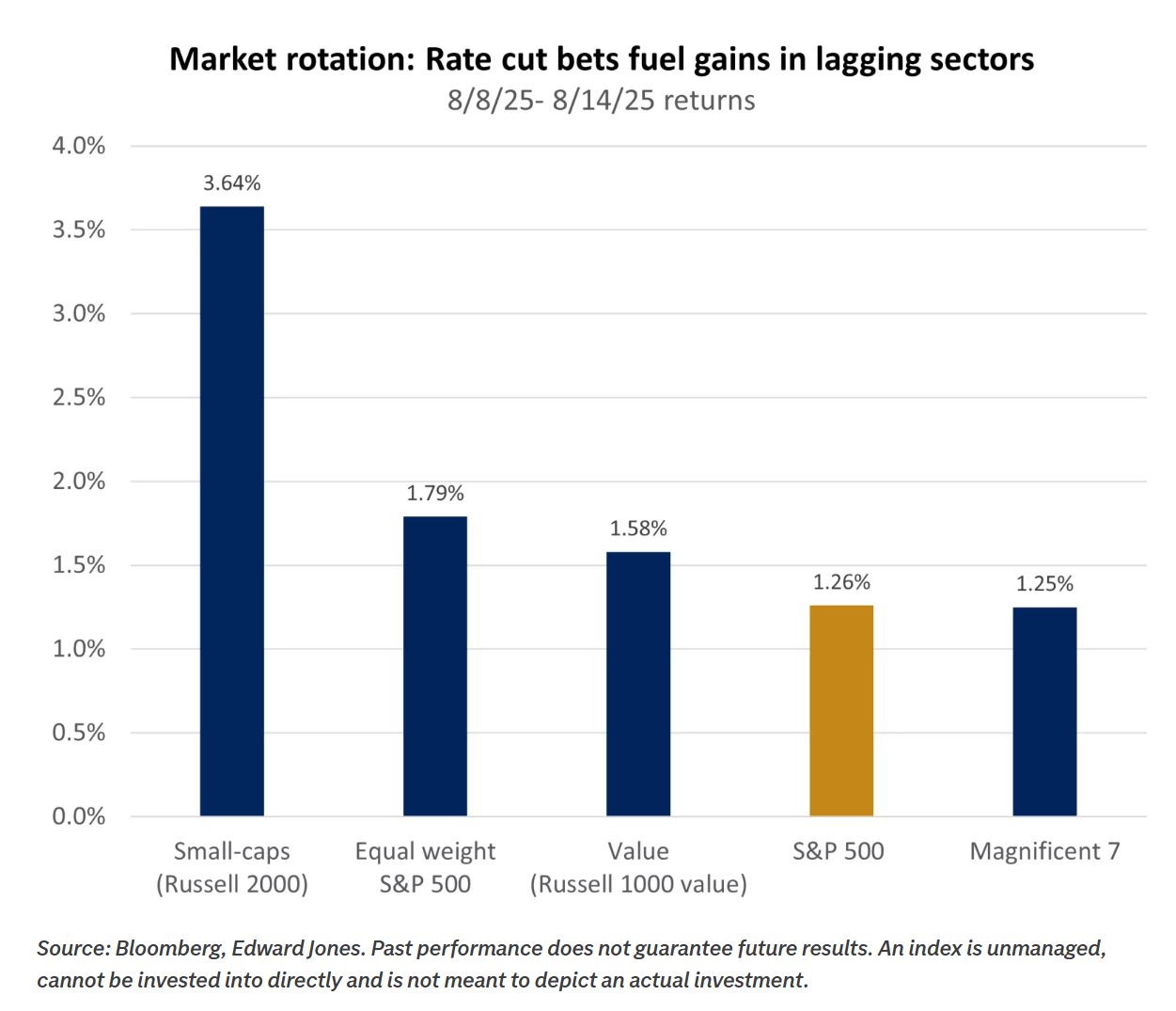

Last week we have see an interesting sector / size /style rotation within us equities.

The chart below - courtesy of Edward Jones - shows weekly returns for various indexes following the CPI release. Lagging segments of the market appeared to receive a boost from rising expectations of rate cuts. Source: Edward Jones

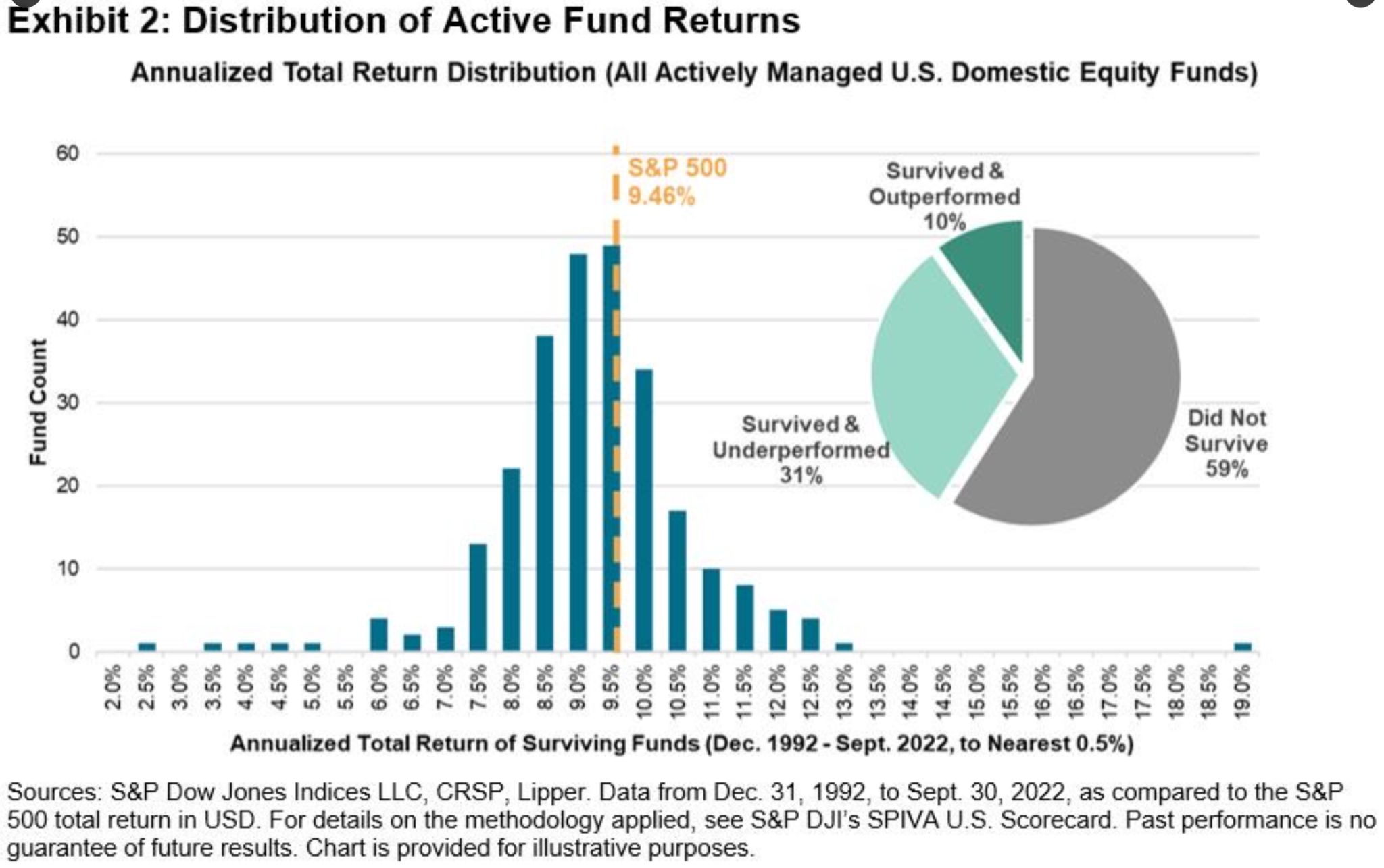

Fund management is a rough business... especially when you try to beat the sp500

Source: Invest in Assets

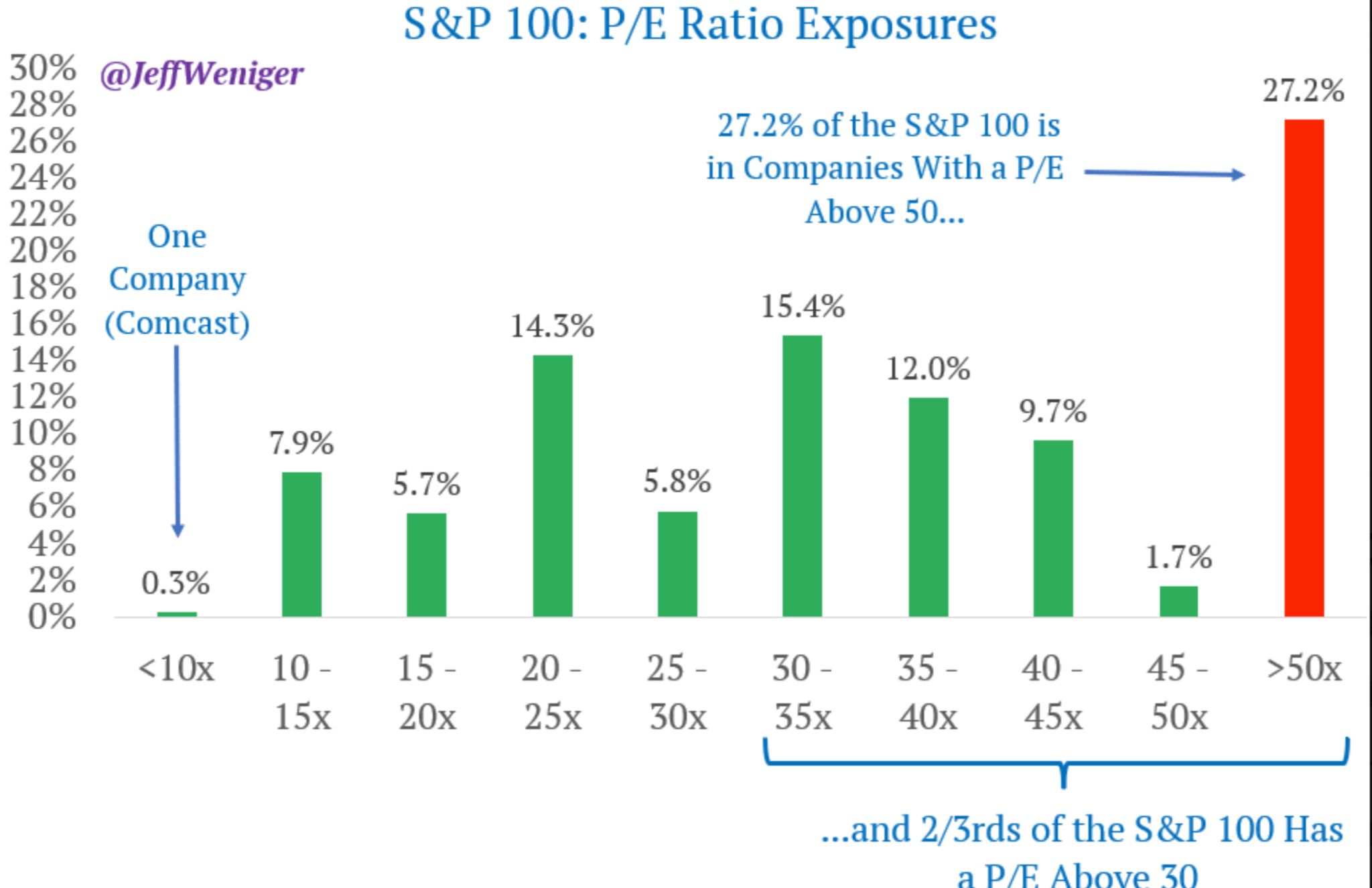

⚠️This has never happened before: The NASDAQ market cap relative to US GDP hit 105%, an all-time high.

The ratio has nearly doubled since the 2022 bear market low and is now ~40 percentage points above the 2000 Dot-Com Bubble. It is also at a record relative to world GDP. Source: Global Markets Investor, econovisuals

The most-hated rally ever ??

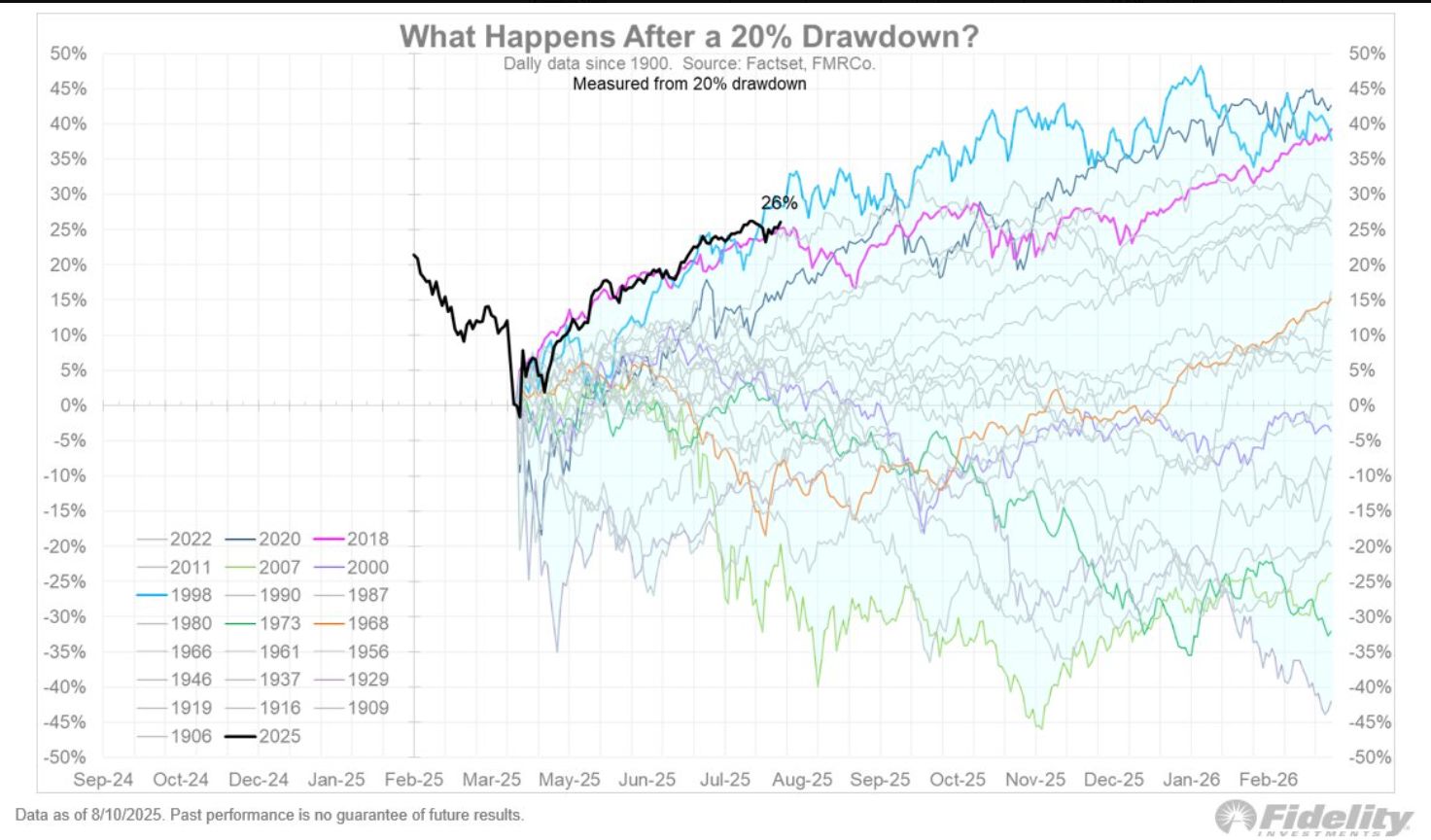

A record 91% of fund managers say U.S. stocks are overvalued (BofA fund manager survey). Meanwhile, the S&P 500 index continues on its V-shaped recovery track and remains in the running for the fastest and strongest recovery ever following a 20% drawdown ‼️ Source: Fidelity

Investing with intelligence

Our latest research, commentary and market outlooks