Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

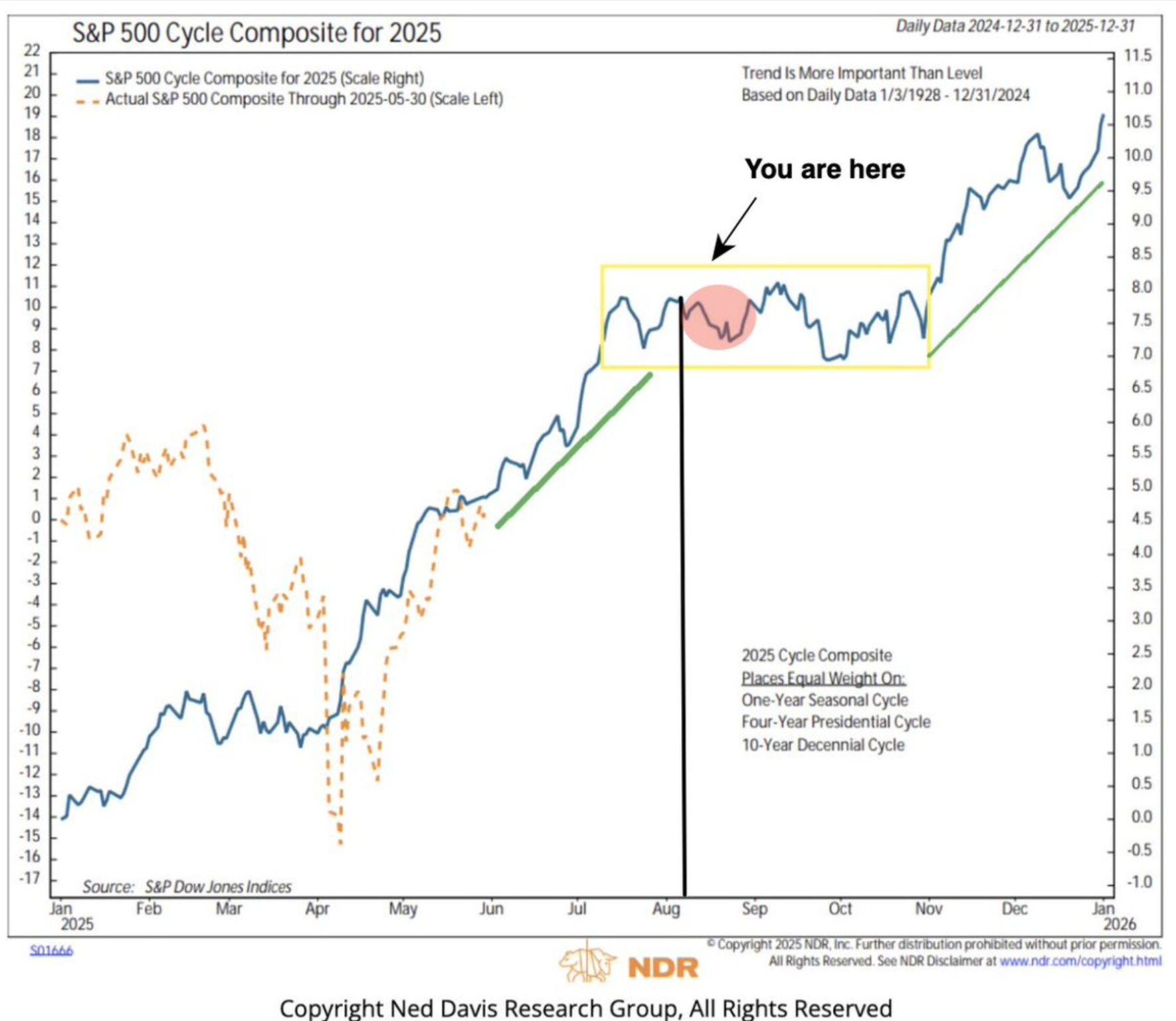

After getting off course in Q1, $SPX has been trending well with the Cycle Composite since.

Will we see a pick up in volatility in the week ahead, in-line with historical cycle? Source: NDR thru Seth Golden

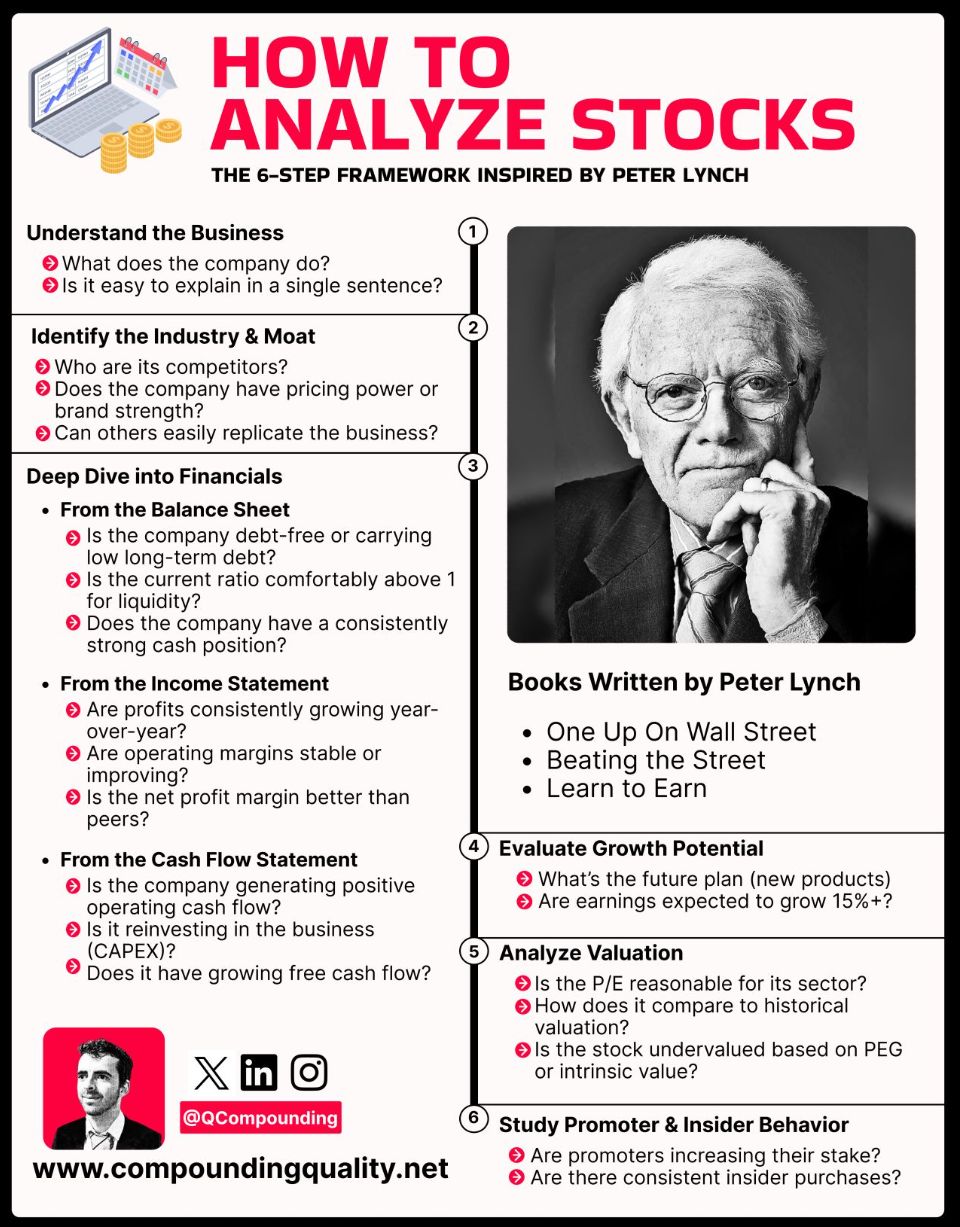

How to analyze stocks

the 6-step framework inspired by Peter Lynch. Source: Compounding Quality

Many investors bet Germany’s “whatever it takes” fiscal stimulus package and an enormous uplift in European defence spending would drive a prolonged upturn in the region’s equity markets.

A BofA survey of fund managers showed allocations to Eurozone stocks leapt to their highest level since 2021 at the beginning of this year. But the outperformance was short lived. Strong earnings from the US mega caps have sent Wall Street stocks powering ahead again, despite Trump’s tariff onslaught and deteriorating US economic data. Weak second-quarter earnings in Europe have supported the growing view that the region’s stock rally is losing momentum. With more than half of the companies in the Stoxx Europe 600 having reported earnings, the index is on track for no earnings growth compared with a year ago, according to Bank of America, sapping optimism over a revival in the region’s equity markets. By contrast, the S&P 500 index’s constituents are on track to post 9 per cent year-on-year average earnings growth, according to BofA, powered largely by strong results from Silicon Valley’s tech giants and Wall Street banks. Source: Financial Times, LSEG

So much for the end of US exceptionalism...

US equity market cap as a percentage of the developed world total rose for a third month to 72.5% at the end of July, while Europe's weight declined to 16.1%. Source: Augur Infinity

Investing with intelligence

Our latest research, commentary and market outlooks