Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

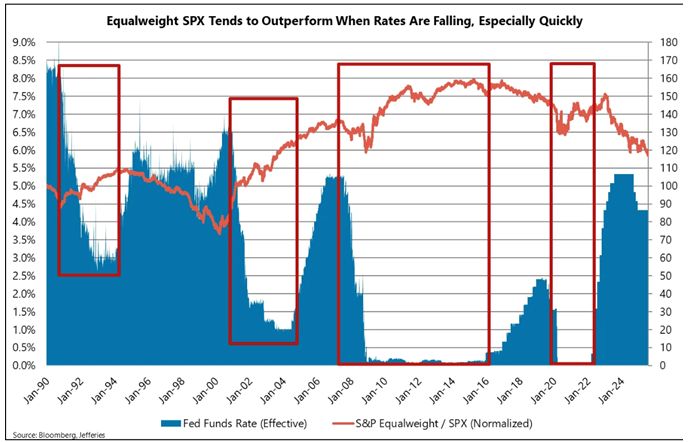

S&P Equal Weight has outperformed S&P Cap Weight during easing cycles

Source: Jefferies thru RBC

Nvidia & Microsoft alone account for almost half of sp500 $SPX returns this year

Source: Tatiana Darie, MLIV, Bloomberg thru Joumanna Bercetche

The S&P 493 – that’s the S&P 500 excl “Magnificent 7” – is expected to deliver just 2-3% net income growth in Q2, Q3, and Q4.

That’s slower than inflation, meaning most of the market is barely growing in real terms. Measured against this, US equities are quite expensive! Source: Strategas thru HolgerZ

US companies announced share repurchases totaling $166 billion last month, the highest dollar value on record for July ...

For the year, announced buybacks stand at $926 billion, which is $108 billion ahead of the previous year-to-date record set in 2022. Source: Bloomberg, Birinyi Associates, RBC

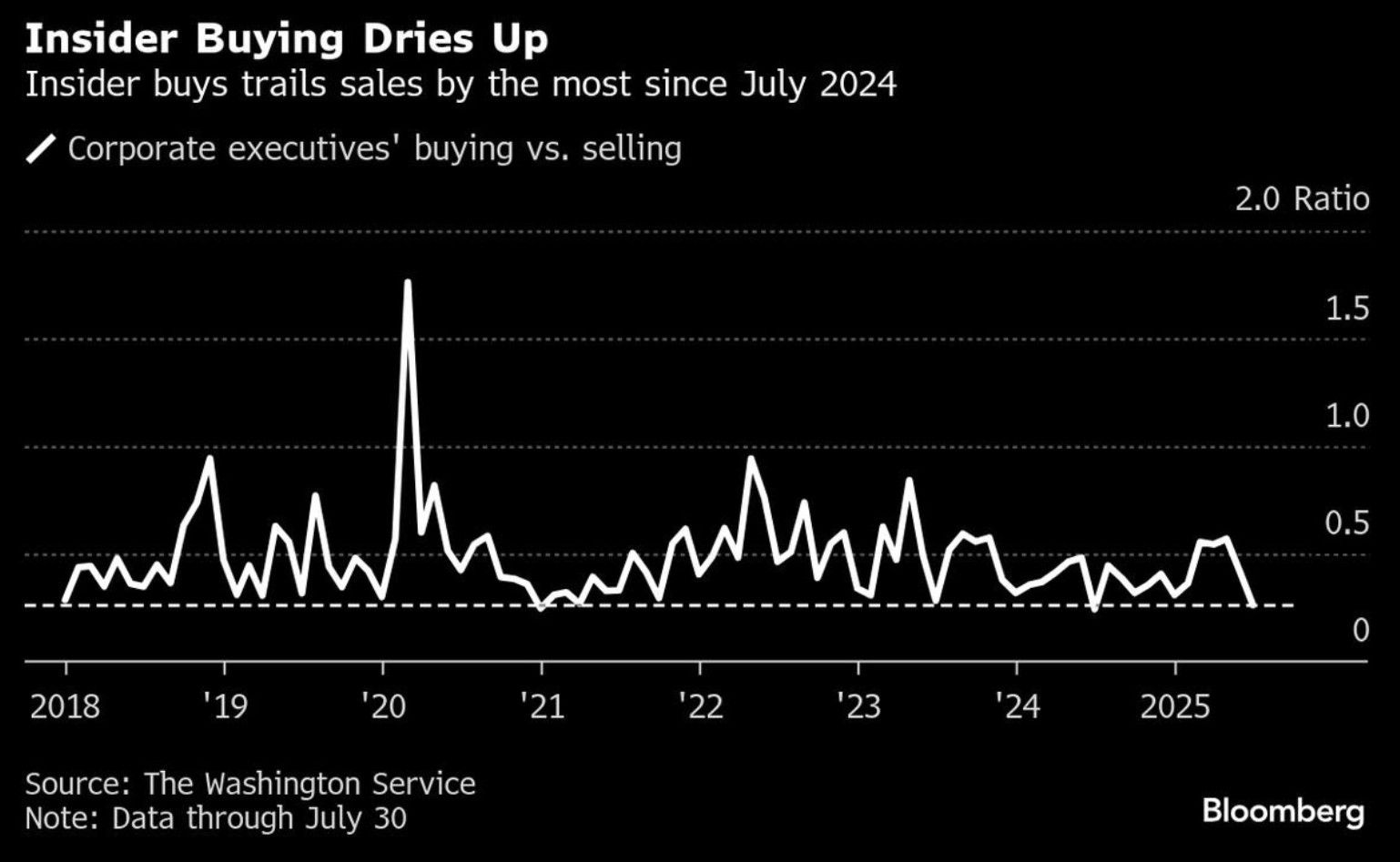

“Insiders at just 151 S&P 500 companies bought their own stocks last month, the fewest since at least 2018, according to data compiled by the Washington Service.”

Source: Kevin Gordon on X, Bloomberg

$PLTR absolutely destroyed their Q2 earnings

Palantir topped Wall Street’s estimates Monday, surpassing $1 billion in quarterly revenue for the first time, and hiking its full-year guidance. Shares rallied more than 5%. • Sales $1.0B vs Est. $939M • EPS $0.16 vs Est. $0.13 • US Commercial: $306M -- up 93% YoY • Customer count up 43% YoY Q3 Outlook • Sales $936M vs Est. $899M • Operating Profit $495M vs Est. $417M FY25 Outlook • Sales $4.14B vs Est. $3.90B • Operating Profit $1.92B vs Est. $1.72B Source: Shay Boloor @StockSavvyShay, CNBC

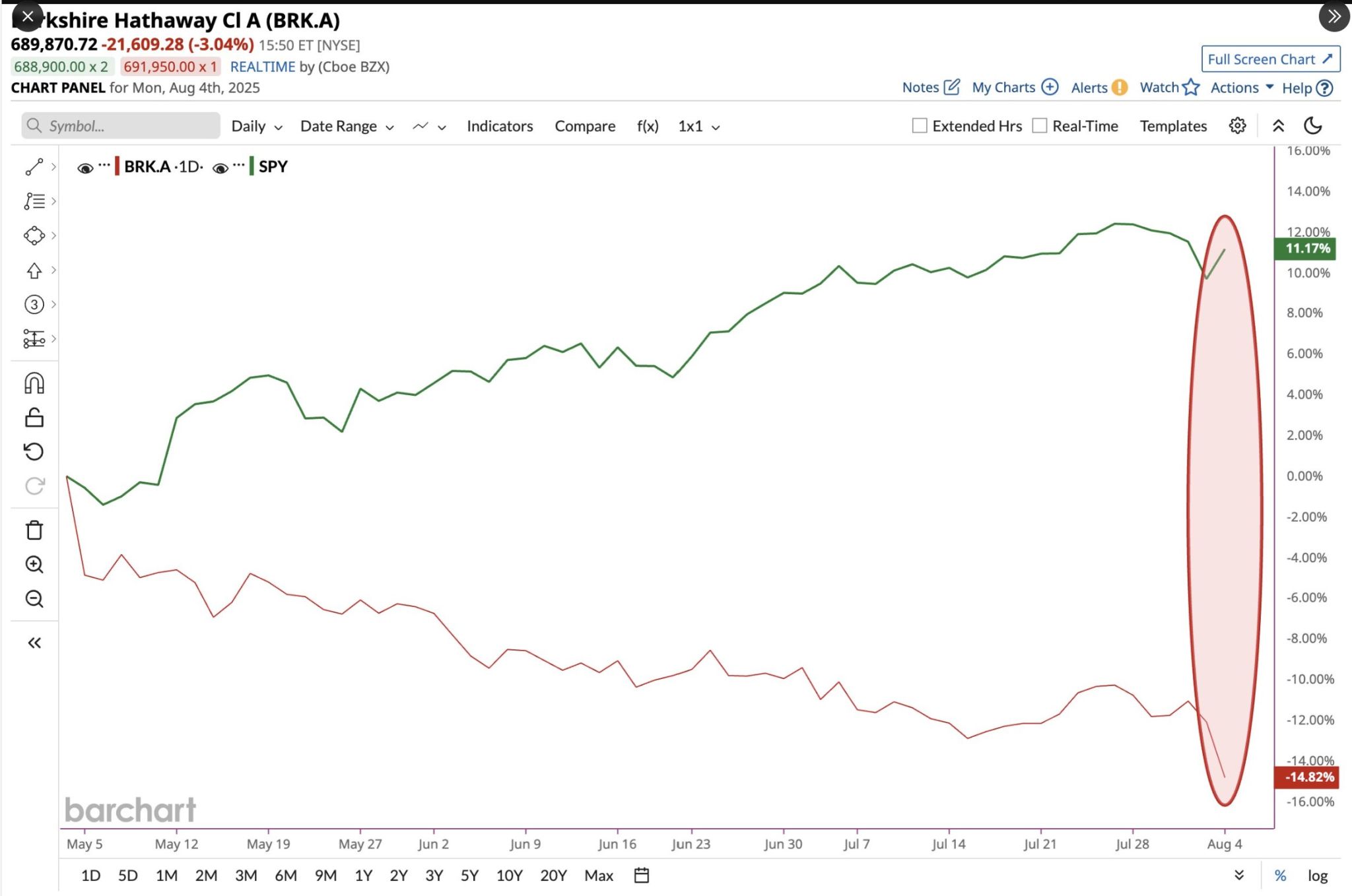

Buffett might have to cancel his retirement!

Berkshire Hathaway $BRK.A is now underperforming the S&P 500 by 26 percentage points since his retirement announcement... Source: Barchart

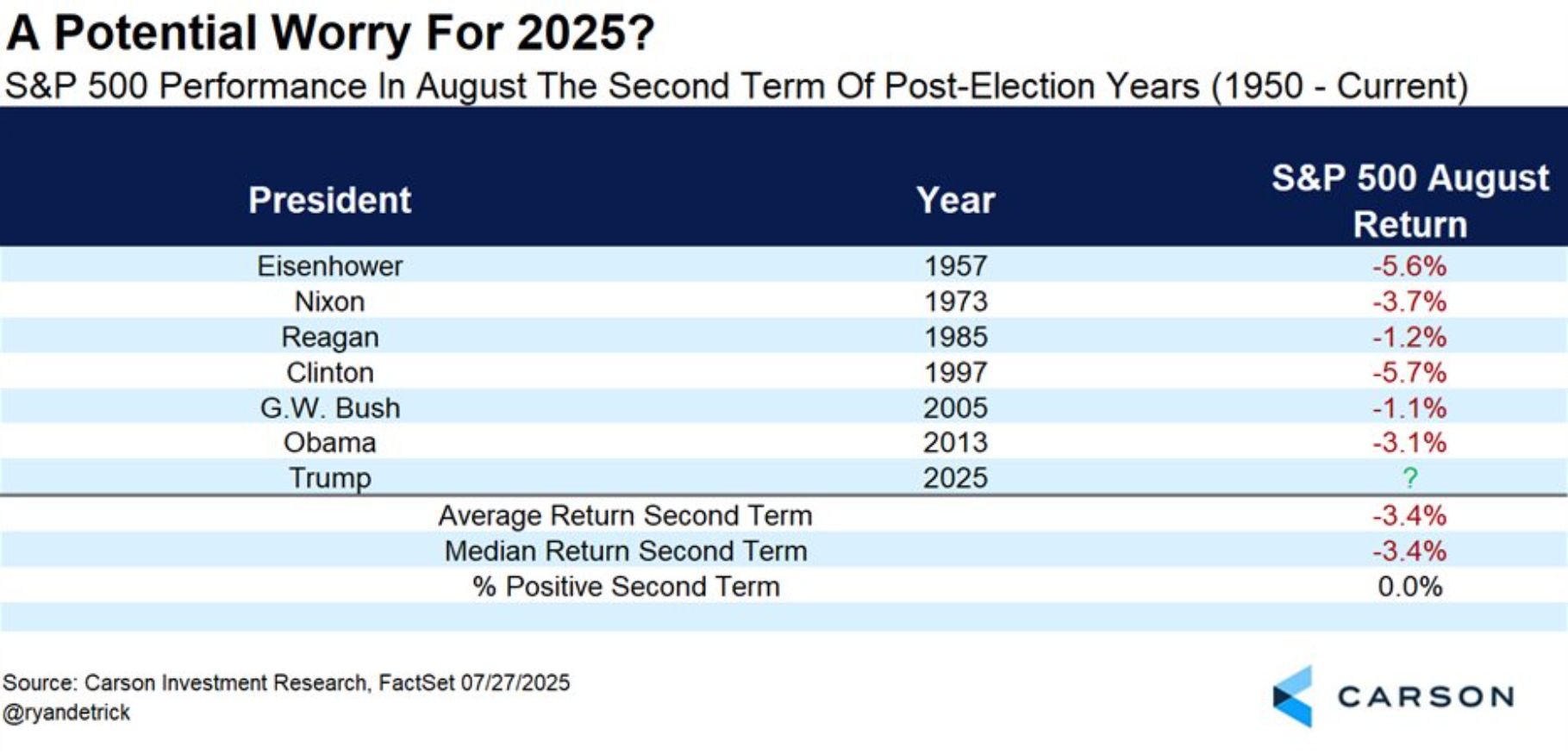

US stocks have never been higher in August under a second term president in a post-election year.

6 for 6 lower. Source: Ryan Detrick, CMT

Investing with intelligence

Our latest research, commentary and market outlooks