Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

It's a race to the first major fib extension.

Who's tagging it first? $SPY | $QQQ

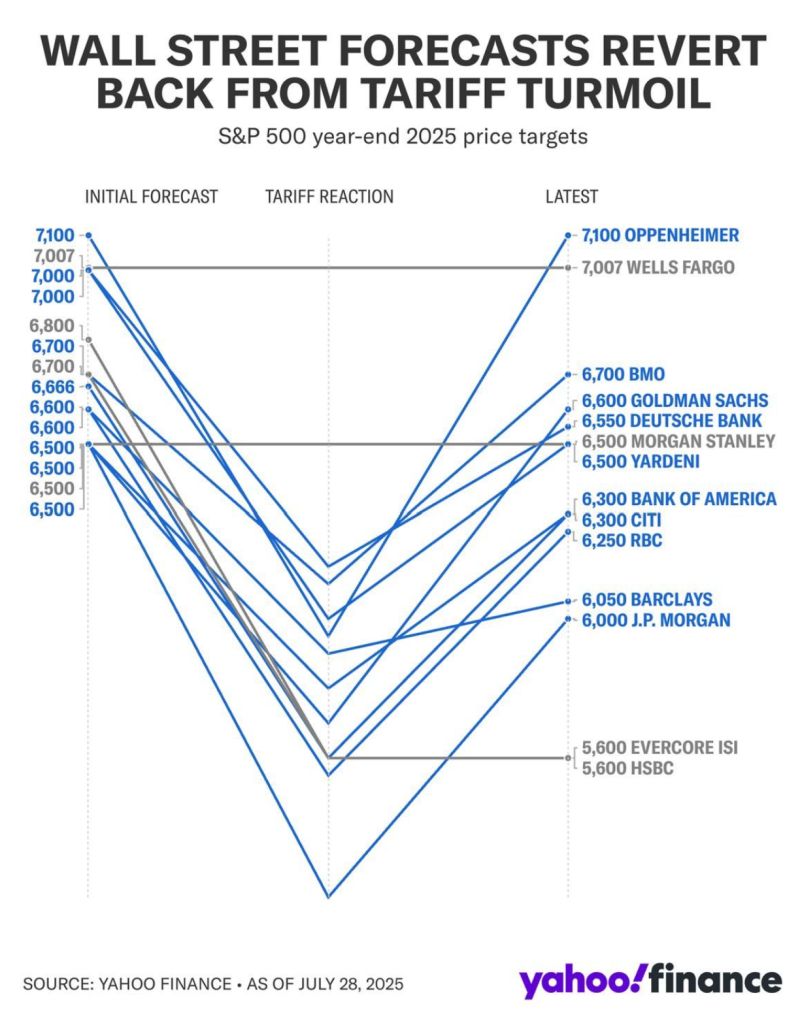

THIS IS WHY YOU NEVER FOLLOW WALL STREET PRICE TARGETS BLINDLY

Source: Gurgavin, Yahoo Finance

Retail investors are winning big this year – meme stocks are back.

The Goldman Sachs Meme Stock Index, which tracks some of the market’s most shorted names, is up 39% – a full 30 percentage points ahead of the S&P 500. Even the Goldman Sachs Retail Favorites Index, packed with stocks popular among small investors, has outperformed the broader market. Source: Bloomberg, HolgerZ

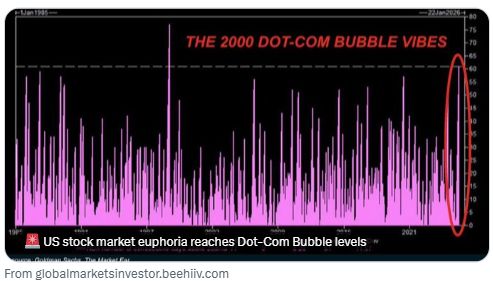

Us equities markets very EXTREMELY expensive: The Shiller P/E ratio on the S&P 500 is now at 38.8x, the highest since the 2000 Dot-Com Bubble burst.

The Shiller P/E ratio is higher than it has been 96% of the time in history. Source: Global Markets

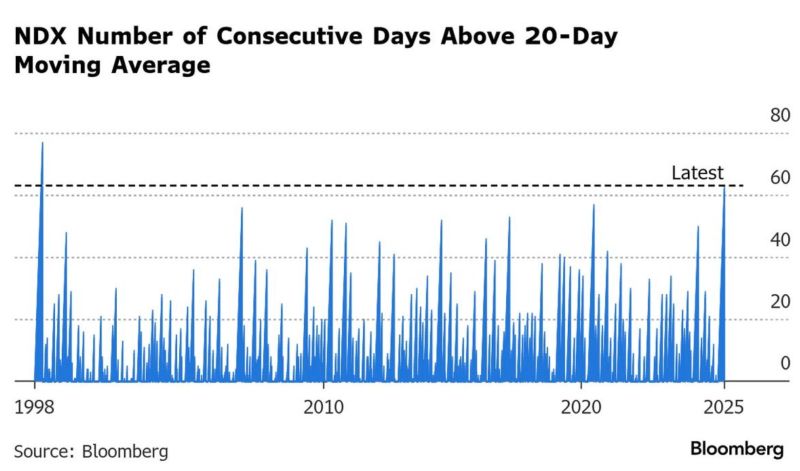

Nasdaq posted its 63rd consecutive day above its 20-day moving average, the longest streak since the dot com bubble.

Source: zerohedge, Bloomberg

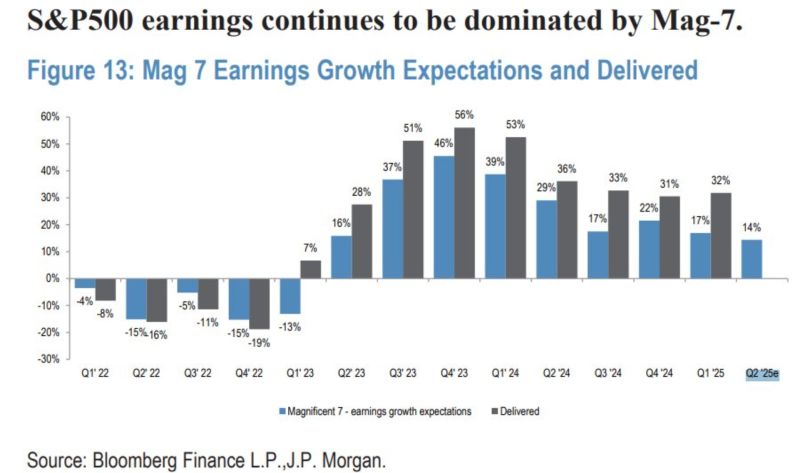

The Mag 7 has consistently blown the doors off EPS estimates

Mag 7 EPS growth is expected to hit 14% this quarter Source: Mike Zaccardi, CFA, CMT, MBA, JP Morgan, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks